Chapter 5 : The Job Order Cost Accounting System

Learning Objectives

After studying this chapter, you should be able to:

1. Explain how to design a job order cost accounting system (JOCAS).

2. Illustrate the cost flows and prepare journal entries for a normal JOCAS.

3. Demonstrate how to account for scrap, reworked units, and spoilage in a normal JOCAS.

4. Describe how an integrated computer-based information system (ICBIS) can support a JOCAS.

5. Discuss how costs are estimated for construction projects and how work item software is used.

6. Prepare a list of attributes needed in a relational database to prepare job cost reports in an REA environment.

INTRODUCTION

A job is an individual product, a small and unique batch of products, a project, a case, or a client. Its distinguishing characteristic is that materials and labor can be directly traced to it, along with the basis for applying over-head. The basic purpose of a job order cost accounting system (JOCAS) is to provide information about the cost of a job.

But a world-class JOCAS is much more than that. It is designed and used to provide vital information to management for planning and estimating, monitoring and controlling daily shop floor operations, and evaluating performance. After demonstrating how to design and implement a JOCAS, this chapter explores how the system can aid management in ways other than just costing products or services.

DESIGNING THE JOB ORDER COST ACCOUNTING SYSTEM

LEARNING OBJECTIVE 1

Explain how to design a job order cost accounting system (JOCAS).

A traditional JOCAS has three main informational inputs:

• Materials requisitions

• Time tickets

• Information on the volume of the predetermined overhead rate's basis (machine hours, direct labor hours or cost, and so forth)

Notice that the third informational input means that this will be a normal JOCAS, not an actual or standard cost system. Designing a standard JOCAS will be discussed in Chapter 8.

The key record that details the costs of each job is the job cost sheet. A job cost sheet (also called a job order cost record) is used to accumulate and summarize all direct materials, direct labor, and applied overhead costs for each job order. The only difference between the basic CAS in Chapter 4 and a JOCAS is in the subsidiary ledger accounts of WIP. Instead of having one subsidiary ledger account for the cost of the product (“WIP-Product Cost”), each job has its own subsidiary account.

Setting Up the WIP General Ledger and Subsidiary Accounts

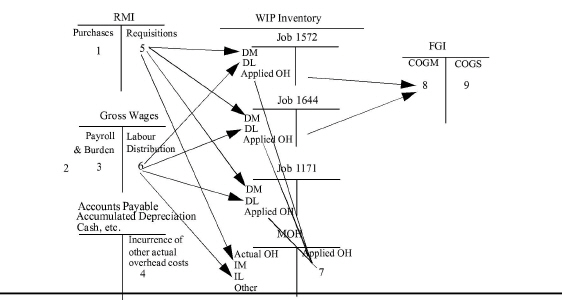

Exhibit 5-1 illustrates the WIP inventory subsidiary ledger system for a JOCAS. The WIP general ledger account remains a control account, as in any basic CAS. Because it is the control account for all production costs, its balance equals the sum of all actual manufacturing costs incurred. These costs are subtotaled by jobs and overhead. In other words, each job and overhead are accounted for as separate WIP subsidiary ledger accounts. The sum of their ending balances equals the balance in WIP.

In Exhibit 5-1, each job performed by the Earnest and Oldham accounting firm represents one of their clients. Manufacturers and construction companies maintain the same kind of accounts. In manufacturing firms, individual products or small batches of unique products are treated as jobs. In construction companies, projects such as an office building, mini-mall, house, or bridge are jobs. For the accounting firm, job 1572 is an audit of Clarksdale's financial accounting system. Job 1644 is an activity-based overhead allocation system for Mercy Hospital (covered in detail in Chapter 10). Job 1711 is the implementation of an ICBIS and EDI for Taylor Manufacturing.

|

The WIP inventory subsidiary ledger accounts are periodically reconciled to the WIP inventory control account in the general ledger. This reconciliation provides an internal control feature for the JOCAS by helping to ensure the proper recording of costs.

Setting Up and Using Job Cost Sheets

As Exhibit 5-2 illustrates, each job order is assigned a unique job number to keep track of jobs and their costs as they progress toward completion. The top portion of the job cost sheet used at Milacron Company includes a job order number, contract price, customer name and address, description of job, and schedule. The rest of the record contains cost data. The bottom of the record summarizes the total manufacturing costs assigned to the job, marketing and administrative expenses directly traceable to the job, its contract price, and profit (or loss).

The job cost sheet for job 897 shows a contract price of $18,000 for the manufacture of five 24-inch sluice valves for Deephole Mining. Direct materials and direct labor costs are assigned to the job as work is performed. Data about direct materials are gathered from materials requisitions. Data on direct labor costs are obtained from time tickets. Overhead costs are applied to the job using a POR based on machine hours. The management accountant at Milacron also includes applicable marketing and administrative costs associated with each job. These costs are not charged to WIP because they are not costs of making the job. They are costs of selling it and all aspects of its administration. Marketing and administrative costs are treated as expenses for financial and tax reporting. To help in identifying which nonmanufacturing costs are directly traceable to jobs, modern CASs include subsidiary ledger systems by job for related engineering, research and development, purchasing, marketing, and administrative activities.

|

Exhibit 5 -2 Job Cost Sheet for Milacron Company's Job Number 897 |

||||||

|

Milacron Company |

|

|

Job Order Number |

897 |

||

|

1200 Industrial Drive |

|

|

Contract Price |

$ 18,000.00 |

||

|

Reno, NV 89557 |

|

|

|

|

|

|

|

For: |

Deephole Mining |

|

Date ordered: |

02/05/x5 |

||

|

Product: |

24-inch Sluice valves |

|

Date promised: |

02/26/x5 |

||

|

Specification: |

Beveled flanges |

|

Date started: |

02/06/x5 |

||

|

Quantity: |

5 |

|

|

Date completed: |

02/23/x5 |

|

|

|

|

Direct Materials |

|

|

||

|

Date |

|

Requisition Number |

|

Cost |

|

Total |

|

02/06 |

|

612 |

|

$ 3,450.00 |

|

|

|

02/15 |

|

643 |

|

1,200.00 |

|

|

|

02/18 |

|

651 |

|

400.00 |

|

|

|

|

|

|

|

|

|

$ 5,050.00 |

|

|

|

|

Direct Labour |

|

|

|

|

Date |

|

Hours |

|

Cost |

|

Total |

|

02/06 |

|

10 |

|

$ 100.00 |

|

|

|

02/13 |

|

60 |

|

600.00 |

|

|

|

02/18 |

|

40 |

|

400.00 |

|

|

|

02/23 |

|

30 |

|

300.00 |

|

|

|

|

|

140 |

|

|

|

$ 1,400 |

|

|

|

|

Applied Overhead |

|

|

|

|

Date |

|

For |

|

Cost |

|

Total |

|

02/23 |

|

$ 12.00 x 500 machine hours |

|

$ 6,000.00 |

|

$ 6,000.00 |

|

Direct Materials |

$ 5,050.00 |

Contract price |

|

$ 18,000 |

||

|

Direct Labour |

1,400 |

Manufacturing cost |

$ 12,450.00 |

|

||

|

Applied Overhead |

6,000 |

Marketing cost |

1,400 |

|

||

|

Total Manufacturing cost |

$ 12,450.00 |

Administrative cost |

800 |

<14,650,00 |

||

|

|

|

|

Profit |

|

$ 3,350,00 |

|

|

Unit Cost |

($ 12,450/5) = |

$ 2,490.00/unit |

|

|

|

|

The job cost sheet serves as the source record for the WIP subsidiary ledger accounts. In many manual JOCASs, it is the subsidiary ledger sheet. In computerized JOCASs, it is the report, or status screen display, from a job file or record in the database.

When a job is completed, costs posted to the job cost sheet are totalled to determine the total manufactured cost of the job (the cost of goods manufactured). This amount is used to credit the appropriate WIP subsidiary ledger account and to debit finished goods inventory when the job is completed and leaves the factory. If the job's product is directly shipped or sold to the customer upon completion, there is no FGI, and the debit is directly to COGS.

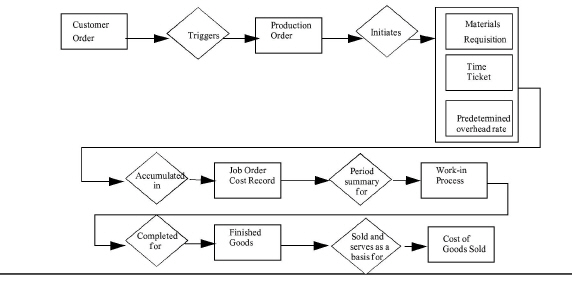

How Do Data Flow in a JOCAS?

The flow of the inputs, documents, and records is summarized in Exhibit 5-3. This flow diagram provides a visual summary of the overall operations in a normal JOCAS. In a manual JOCAS, completed job cost sheets are transferred to a FGI subsidiary ledger file and then, when sold, to a permanent COGS file for long-term storage. These job cost sheets are useful for planning and control purposes as well as for bidding on future jobs. If a particular job was very profitable, management may decide to pursue similar jobs in the future. If a job was unprofitable, the job cost sheet may provide the reasons why. In some instances, management may decide to produce some products that have not yet been ordered. If these products are not sold fairly quickly, management may decide to reduce prices or offer discounts. Having ready access to cost records for such products provides management with guidance as to how much prices can be reduced and still make a profit.

|

JOURNAL ENTRIES FOR A NORMAL JOCAS

LEARNING OBJECTIVE 2

Illustrate the cost flows and prepare journal entries for a normal JOCAS.

Thus far, the discussion has established the general outline of a JOCAS. This section describes the flow of production costs through the JOCAS and shows the journal entries that account for these costs. The following presentation records a single month's activity (May) for Oilwell Compressors, Inc., a company that manufactures a variety of air compressors and oil pumps used in producing and refining crude oil. The journal entries will be presented in order of the cost elements (DM, DL, and OH) instead of in journal entry number order to facilitate linking topics to Chapter 4.

On May 1, there was one unfinished production job, job 11, which was started in April. During April, $71,000 was charged to job 11 for direct materials ($50,000), direct labor ($20,000), and applied overhead ($1,000). This is labelled as its beginning balance in the exhibits that follow.

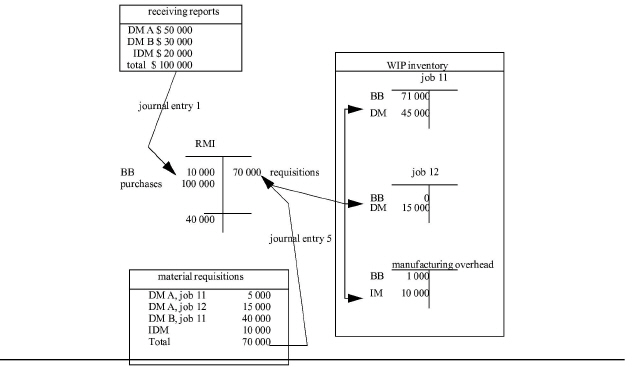

Accounting for Materials Costs

The beginning balance in RMI is $10,000. During May, Oilwell Compressors, Inc., purchased $100,000 of materials, including $80,000 for direct materials and $20,000 for indirect materials. The purchase is recorded as in any basic CAS (journal entry 1 for the basic CAS in Exhibit 4-4 in Chapter 4):

|

JOURNAL ENTRY 1: Purchase of Raw Materials |

|

|

|

Raw Materials Inventory |

$100,000 |

|

|

Accounts Payable |

|

$100,000 |

During May, the factory floor requisitioned $70,000 in raw materials from the storeroom for use in production. Direct materials equaled $60,000 and indirect materials, $10,000. In a basic CAS, the requisition of materials to production is recorded in journal entry 5:

|

BASIC CAS JOURNAL ENTRY 5: Requisition of Raw Materials |

||

|

WIP-Product Cost (DM) |

$60,000 |

|

|

WIP-Manufacturing Overhead (IM) |

$10,000 |

|

|

Raw Materials Inventory |

|

$70,000 |

The breakdown of direct materials by job from the material requisitions is presented in Exhibit 5-4. In a JOCAS, the “WIP-Product Cost” subsidiary account is replaced with individual subsidiary accounts for each job. This changes journal entry 5 to:

|

JOCAS JOURNAL ENTRY 5: Requisition of Raw Materials |

||

|

WIP-Job 11 (DM) |

$45,000 |

|

|

WIP-Job 12 (DM) |

$15,000 |

|

|

WIP-Manufacturing Overhead (IM) |

$10,000 |

|

|

Raw Materials Inventory |

|

$70,000 |

In Exhibit 5-4

|

, $10,000 of raw materials issued to production was not directly traceable to any specific job and was charged to overhead as indirect materials. These costs remain in the overhead account until applied to the individual job cost sheets by use of a POR. At the end of May, $40,000 of raw materials remained in RMI and is reported as a current asset on Oilwell Compressors' May 31 balance sheet.

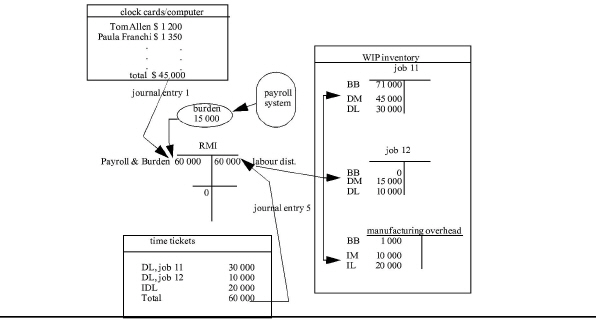

Accounting for Labor Costs

As work is performed, time tickets are generated daily. These tickets are used to trace labor costs directly to specific jobs (assume $40,000) and to identify indirect labor costs going to the overhead subsidiary account ($20,000). In a basic CAS, the labor distribution journal entry is:

|

BASIC CAS JOURNAL ENTRY 6: Distributing Gross Wages |

|

|

|

WIP-Product Cost (DL) |

$40,000 |

|

|

WIP-Manufacturing Overhead (IL) |

$20,000 |

|

|

Gross Wages |

|

$60,000 |

The amount charged to WIP-Product Cost represents the direct labor costs of specific jobs. The JOCASs’ payroll system provides a summary of the direct labor by job for journal entry 6. Using the Exhibit 5-5 information, the labor distribution journal entry becomes:

|

JOCAS JOURNAL ENTRY 6: Distributing Gross Wages |

||

|

WIP-Job 11 (DL) |

$30,000 |

|

|

WIP-Job 12 (DL) |

$10,000 |

|

|

WIP-Manufacturing Overhead (IL) |

$20,000 |

|

|

Gross Wages |

|

$60,000 |

|

The labor costs charged to the overhead subsidiary account represent the indirect labor costs for May. Such costs include janitorial work, security guards, and maintenance. As in the case of indirect materials, the indirect labor costs charged to overhead will remain there until applied to the jobs through the use of a POR. Finally notice that, like material purchases (journal entry 1), the “purchase” of labor-related costs (journal entry 2 for payroll and journal entry 3 for the employer's burden) is the same as in any basic CAS.

Accounting for Actual Overhead Costs

As actual overhead costs are incurred, they are charged to WIP-Manufacturing Overhead in the same way as in any basic CAS. To illustrate, assume Oilwell Compressors incurred two cash overhead costs during the month of May, rent on the factory building of $10,000 and factory utilities of $2,000. Oilwell Compressors also recognized $25,000 in depreciation on factory equipment, $17,000 in accrued property taxes on factory buildings, and $6,000 of prepaid insurance expired on factory buildings and equipment.

In both a basic CAS and a JOCAS, journal entry 4 records these items as follows:

|

JOURNAL ENTRY 4: Incurring Other Overhead Costs |

||

|

WIP-Manufacturing Overhead (Rent) |

$10,000 |

|

|

WIP-Manufacturing Overhead (Utilities) |

$ 2,000 |

|

|

WIP-Manufacturing Overhead (Depreciation) |

$25,000 |

|

|

WIP-Manufacturing Overhead (Taxes) |

$17,000 |

|

|

WIP-Manufacturing Overhead (Insurance) |

$ 6,000 |

|

|

Cash |

|

$12,000 |

|

Accumulated Depreciation-Equipment |

|

$25,000 |

|

Property Taxes Payable |

|

$17,000 |

|

Prepaid Insurance |

|

$ 6,000 |

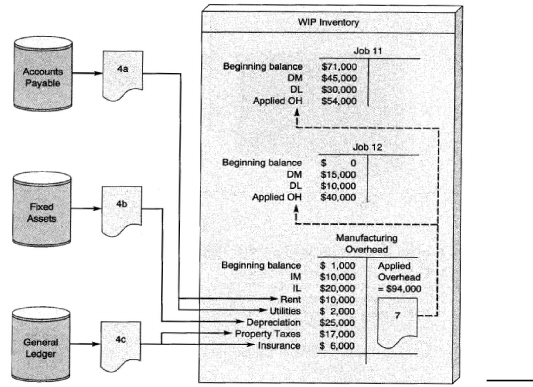

All actual overhead costs are recorded directly into the overhead account as they are incurred throughout the period. Thus, there are really a series of different journal entries, originating from different databases, at different times throughout May. This is illustrated in Exhibit 5-6.

Accounting for Applied Overhead

At the beginning of the year, Oilwell Compressors budgeted a POR of $10 per machine hour. During May, 5,400 machine hours (Mhr) were worked on job 11, and 4,000 Mhr were worked on job 12. Therefore, $54,000 ($10/Mhr X 5,400 Mhr) of overhead is applied to job 11 and $40,000 ($10/Mhr X 4,000 Mhr) to job 12. Journal entry 7 records the applied overhead of $94,000 ($54,000 + $40,000) transferred from the overhead account to the jobs:

|

JOCAS JOURNAL ENTRY 7: Applying Overhead |

|

|

|

|

|

WIP-Job 11 (Applied OH) |

|

$54,000 |

|

|

|

WIP-Job 12 (Applied OH) |

|

$40,000 |

|

|

|

WIP-Manufacturing Overhead |

|

|

|

$94,000 |

|

Compare this to the basic CAS overhead application journal entry: |

||||

|

BASIC CAS JOURNAL ENTRY 7: Applying Overhead |

||

|

WIP-Product Cost (Applied OH) WIP-Manufacturing Overhead |

$94,000 |

$94,000 |

As Exhibit 5-6 shows, overhead is applied to each job's subsidiary account, rather than to the single subsidiary account for all products created in the basic CAS of Chapter 4. Before preceding any farther, review usage journal entries (JEs 5-7). These are the only journal entries that have changed from the basic CAS presented in Chapter 4. But the only change is that the subsidiary account titled “Product Cost” is replaced by subsidiary accounts for each job. The journal entries recording the acquisition of manufacturing cost elements have not changed.

|

The last issue to consider in overhead application is when to make journal entry 7. In this illustration, Oilwell Compressors uses a machine hour basis for its POR. Usually, the information on machine hours worked per job is accumulated throughout the month, and a summary month end adjusting journal entry is made to apply overhead. This information can be summarized and a journal entry made at any time, though, including in real-time, based on bar code scanning, for an ICBIS JOCAS. If a job is completed before the end of the posting period (e.g., the month), journal entry 7 should be made upon job completion. For example, assume job 11 was completed on May 20. Then the overhead application journal entry would be prepared at that time when the management accountant obtains the machine usage information.

With a different application base this journal entry may be made at another time. What if the POR basis is direct labor hours or cost? If the factory workers are paid weekly, then journal entry 7 can be prepared along with the labor-related journal entries (journal entry 2 for the paycheques and journal entry 3 for the employer's burden).

Accounting for Cost of Goods Manufactured and Sold

Oilwell Compressors, Inc., completed job 11 during May. Job 12 was still in process. The cost flows and ending WIP subsidiary account balances for May are shown in Exhibit 5-7. The total costs charged to job 11 are as follows:

|

Beginning balance, May 1 |

$ 71,000 |

|

Direct materials added in May |

45,000 |

|

Direct labor added in May |

30,000 |

|

Applied overhead in May |

54,000 |

|

Total costs incurred on job 11 |

$200,000 |

Journal entry 8 transfers job 11 costs from the factory to finished goods:

|

:JOURNAL ENTRY 8: Cost of Goods Manufactured and Transferred to Finished Goods |

||

|

Finished Goods Inventory-Job 11 |

$200,000 |

|

|

WIP-Job 11 |

|

$200,000 |

When job 11 is sold, journal entry 9 records the removal of this job from FGI:

|

JOURNAL ENTRY 9: Cost of Goods Sold |

|

|

|

Cost of Goods Sold-Job 11 |

$200,000 |

|

|

Finished Goods Inventory-Job 11 |

|

$200,000 |

Notice that in both journal entries, FGI and COGS have subsidiary accounts to track which jobs have been completed and sold. Not all JOCASs track transfers to finished goods and sales by job. Consider a machining shop that makes batches of screws, bolts, nails, and the like. When transferred to FGI and when sold, all size 4 screws may be stored together in a bin, regardless of whether they were produced in May as job 11 or in July as job 45. Tracking FGI and COGS by job may not be possible in this situation.

|

Exhibit 5 -7 Completed Job Cost Flows and Ending Work-In-Process Balances |

|||||

|

|

WIP Inventory |

|

|

|

|

|

|

Job 11 |

|

FGI |

||

|

Beginning balance DM DL Applied OH |

$71,000 $45,000 $30,000 $54,0000 |

Completed &Transferred = $200,000 |

|

COGM = $200,000 |

COGS |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Job 12 |

|

|

|

|

|

Beginning balance DM DL Applied OH |

$ 0 $15,000 $10,000 $40,000 |

|

|

|

|

|

|

$65,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing Overhead |

|

|

|

|

|

Beginning balance |

$ 1,000 |

|

|

|

|

|

IM |

$10,000 |

|

|

|

|

|

IL |

$20,000 |

|

|

|

|

|

Rent |

$10,000 |

|

|

|

|

|

Utilities |

$ 2,000 |

|

|

|

|

|

Depreciation |

$25,000 |

|

|

|

|

|

Property Taxes |

$17,000 |

Applied Overhead = $94,000 |

|

|

|

|

Insurance |

$ 6,000 |

|

|

|

|

|

|

|

$3,000 |

|

|

|

Accounting for Nonmanufacturing Costs

In addition to incurring property taxes, rent, utilities, supervisor salaries, insurance, and so forth, as part of the operations of its plant, Oilwell Compressors also incurred similar costs generated by administrative and sales office activities. The costs of these nonmanufacturing activities are not charged to overhead, however, because they are not related to the manufacture of products. Only the costs of making a product go into WIP. These nonmanufacturing costs are expenses reported on the income statement.1

Because these administrative and sales costs go directly into expense accounts, they have no effect on the costing of Oilwell's production for May, even though they may be directly traceable to the jobs. A growing number of management accountants believe that all costs of the enterprise should be assigned to the product, including administrative, sales, distribution, and research and development costs. As in the earlier example of the job cost sheet (Exhibit 5-2), administrative and selling costs are added to manufacturing costs to determine the total costs to make, sell, and deliver the job.

|

Exhibit 5 -8 JOCAS Journal Entries for Oilwell Compressors, Inc. |

||

|

SPREADSHEET PROGRAM TO RECORD WELL COMPRESSORS, INC.JOURNAL ENTRIES For May 1993 |

||

|

General Ledger Account Titles |

dr's |

cr's |

|

PURCHASE (ACQUISITION) OF RAW MATERIALS: |

|

|

|

1: Raw Materials Inventory |

$100,000 |

|

|

Accounts Payable' |

|

$100,000 |

|

PREPARING (RECORDING) PAYCHECKS: 2: Gross Wages |

$45,000 |

|

|

FICA Payable |

|

? |

|

FIT Payable |

|

? |

|

Wages Payable |

|

? |

|

EMPLOYER'S PAYROLL TAXES & BENEFITS (BURDEN): 3: Gross Wages |

$15,000 |

|

|

FICA Payable |

|

? |

|

FUTA Payable SUTA Payable |

|

? |

|

OTHER OVERHEAD COSTS INCURRED: 4: WIP-Manufacturing OH (Rent) |

$10,000 |

|

|

WIP-Manufacturing OH (Utilities) |

$2,000 |

|

|

WIP-Manufacturing OH (Depreciation) |

$25,000 |

|

|

WIP-Manufacturing OH (Property Taxes) |

$17,000 |

|

|

WIP-Manufacturing OH (Insurance) |

$6,000 |

|

|

Cash |

|

$12,000 |

|

Accumulated Depreciation |

|

$25,000 |

|

Accrued Property Taxes Payable |

|

$17,000 |

|

Prepaid Insurance |

|

$6,000 |

|

REQUISITION OF RAW MATERIALS INTO THE FACTORY: 5: WIP-Job 11 (DM) |

$45,000 |

|

|

WIP-Job 12 (DM) |

$15,000 |

|

|

WIP-Manufacturing OH (IM) |

$10,000 |

|

|

Raw Materials Inventory |

|

$70,000 |

|

DISTRIBUTING GROSS WAGES TO JOBS: 6: WIP-Job 11 (DL) |

$30,000 |

|

|

WIP-Job 12 (DL) |

$10,000 |

|

|

WIP-Manufacturing OH (IL) |

$20,000 |

|

|

Gross Wages |

|

$60,000 |

|

OVERHEAD ALLOCATION TO JOBS: 7: WIP-Job 11 (Applied OH) |

$54,000 |

|

|

WIP-Job 12 (Applied OH) |

$40,000 |

|

|

WIP-Manufacturing OH |

|

$94,000 |

|

JOBS COMPLETED: 8: Finished Goods Inventory-Job 11 |

$200,000 |

|

|

WIP-Job 11 |

|

$200,000 |

|

JOBS SOLD (INVENTORY RELIEF JOURNAL ENTRY ONLY): 9: Cost of Goods Sold-Job 11 |

$200,000 |

|

|

Finished Goods Inventory-Job-11 |

|

$200,000 |

SPREADSHEET APPLICATIONS IN The JOCAS

Spreadsheet software has two common uses in JOCASs. As for any basic CAS, spreadsheet programs can be created for journal entries. The May journal entries for Oilwell Compressors, Inc., are presented in Exhibit 5-8. These should be compared with the basic CAS journal entries in Exhibit 4-4 and Demonstration Problem 1 in Chapter 4. Again, verify that the only journal entries that are different are the usage journal entries (JEs 5-7).

A second common application of spreadsheet software is in creating WIP summary reports showing the costs incurred on each job. The report program designed by Oilwell Compressors' management accountant is linked to the journal entry program. It is illustrated in Exhibit 5-9. The beginning and ending balances in the report can be verified by comparing them to the T-account balances shown in Exhibit 5-7.

|

Exhibit 5 -9 Oilwell Compressors, Inc. Job Cost Report for May |

|||||

|

|

OILWELL COMPRESSORS, INC. WIP INVENTORY AND JOB COSTS SUMMARY For the Month of May 1993 |

|

|||

|

|

COSTS |

JOB 11 |

JOB 12 |

MFG OH |

TOTALS |

|

Direct Materials: Beginning Balance |

$50,000 |

$0 |

|

$50,000 |

|

|

Direct Materials: Added |

45,000 |

15,000 |

|

60,000 |

|

|

Subtotal |

$95,000 |

$15,000 |

|

$110,000 |

|

|

Direct Labor: Beginning Balance |

20,000 |

0 |

|

20,000 |

|

|

Direct Labor: Added |

30,000 |

10,000 |

|

40,000 |

|

|

Subtotal |

$50,000 |

$10,000 |

|

$60,000 |

|

|

Applied OH-Beginning Balance |

1,000 |

0 |

|

1,000 |

|

|

Applied OH-Added |

54,000 |

40,000 |

<$94,000> |

0 |

|

|

Subtotal |

$55,000 |

$40,000 |

|

$95,000 |

|

|

Overhead-Beginning Balance |

|

|

1,000 |

|

|

|

Indirect Materials |

|

|

10,000 |

|

|

|

Indirect Labor |

|

|

20,000 |

|

|

|

Rent |

|

|

10,000 |

|

|

|

Utilities |

|

|

2,000 |

|

|

|

Depreciation |

|

|

25,000 |

|

|

|

Property Taxes |

|

|

17,000 |

|

|

|

Insurance |

|

|

6,000 |

|

|

|

Actual OH-Added |

|

|

91,000 |

|

|

|

TOTAL JOB COSTS: |

$200,000 |

$65,000 |

<$3,000> |

$262,000 |

|

|

Less: Completed Jobs |

<200,000> |

|

|

<200,000> |

|

|

WIP INVENTORY BALANCE |

$0 |

565,000 |

<$3,000> |

$62,000 |

|

|

|

|

|

|

|

|

|

Note: Individual columns add (sum) across into the Totals column. The totals for each cost element ($110,000, $60,000, and $95,000) are not meant to add down into the Total Job Costs ($262,000). This is why each cost element's total is double-underlined. |

|||||

SCRAP AND JOCAS

LEARNING OBJECTIVE 3

Demonstrate how to account for scrap, reworked units, and spoilage in a normal JOCAS.

Scrap refers to fragments of material removed during the production or construction process. Metal fragments, odd pieces of lumber, cloth remnants, and meat trimmings are examples of scrap. Scrap is sometimes collected, inventoried, and either reused or sold to scrap dealers.

When the quantity and value of scrap are relatively high, it should be stored in a designated place (such as RMI) under the supervision of a storekeeper. A typical entry removes the market value less any disposal costs (the net realizable value or NRV) from the job's cost in WIP:

|

SCRAP METHOD 1: Inventory at NRV |

||

|

RMI-Scrap Material WIP-Job 102 |

debit |

credit |

When the scrap is sold, the entry would be:

|

SCRAP METHOD 1: Sale of Scrap |

||

|

Cash (or accounts receivable) RMI-Scrap Material |

debit |

credit |

To minimize accounting for scrap, often no entry is made until the scrap is actually sold. At that time, the entry would be:

|

SCRAP METHOD 2: Only Records Sale |

|

|

|

Cash (or accounts receivable) Scrap Sales |

debit |

credit |

The second method is expedient and reasonable when scrap value is small. The amount accumulated in the scrap sales account may be closed directly to income summary and included on the income statement as other income. It is also advantageous because the cost of scrap remains in the job's cost. Those who support this method argue that since the job causes the scrap (i.e., without the job, there would be no scrap), this scrap should be budgeted as part of the cost of the job. JIT proponents argue that scrap is a nonvalue-added cost and that the production process should be changed to eliminate it. By including scrap in the cost of every job where it is created, management will be better aware of its costs. If scrap is taken out of the job's cost, as in the first method, set up in inventory, and then resold, management may not be motivated to eliminate it (or so the argument goes).

Proponents of the first method argue that if the scrap can be resold, its net realizable value should be removed from the cost of the job. Leaving it there overstates the job's cost and understates its profitability. Besides, they argue, the reasons for scrap are long run: as yet, there are no suppliers available who can deliver materials cut to size (so that there is no scrap from material use), or changing the direct technology cost elements (machines that cause scrap through cutting operations and the like) is not currently feasible. Whether scrap is included or excluded from the job's cost will not change management's motivation to eliminate it.

Obviously, the management accountant is faced with a choice in accounting methods for scrap. As long as the amounts of scrap are relatively small, accounting entries are not a major consideration. However, many manufacturers are discovering that scrap is a growing and serious problem. In dealing with scrap accounting, the management accountant should remember that what is important is an effective scrap performance measurement system that keeps scrap to a minimum, eliminates it entirely, or converts it to a profitable product. Timely scrap reports and performance measurements are the key to reducing scrap and managing its costs.

REWORKED UNITS AND the TRADITIONAL JOCAS

Reworked units are defective products that are fixed so that they can be sold as acceptable finished units through regular marketing channels. Rework should be done only if incremental revenue is expected to exceed incremental costs. Otherwise, if possible, the defective units should be sold as irregulars without the reworking.

• Defective units occur for several reasons including:

• Low-quality raw materials

• Faulty and poorly maintained machinery

• Poor workmanship

• Inadequate training and poor supervision

• Outdated methods and processes

World-class manufacturers work diligently to eliminate these problems, so the modern management accountant needs to provide information on rework costs within the CAS.

Traditional Accounting for Normal Rework

In traditional manufacturing firms, management expects some level of rework within all the jobs. If rework is common to all the jobs, each job should bear a fair share of the rework costs. However, solely due to random fluctuations, some jobs will incur more or less rework than others. Consequently, rework costs should not be directly charged to the jobs, but should instead be included in budgeted overhead and the POR. By allocating rework to all jobs through the POR, these costs will be more equitably spread across all production.

For example, assume that a clothing manufacturer receives an order for 1,000 men's suits. The POR includes a budgeted amount for reworking defective units. One hundred suits are defective and reworked at a total cost of $280 for direct materials, $790 for direct labor, and 100 machine hours of overhead applied at $4 per machine hour. The following entry records the rework:

|

Journal Entry For Normal Rework |

|

|

|

WIP-Manufacturing Overhead (Rework) |

$1,470 |

|

|

RMI |

|

$280 |

|

Gross Wages |

|

$790 |

|

WIP-Manufacturing Overhead |

|

$400 |

Note that all the source documents (material requisitions, time tickets, machine hour reports) must identify the cost elements used on rework. If the source documents do not clearly identify that this is rework, the costs could easily be charged into the job.

It may seem strange that overhead is both debited and credited. In effect, the CAS is applying overhead to itself. This occurs because the POR includes an allowance for rework, and it creates credits in the overhead account when used to apply overhead to jobs. Then, when rework is done, its actual costs have to be debited to overhead where the credits are, so that the debits and credits are matched in the same account. This creates yet another problem, however. Unquestionably, the rework used overhead, so some overhead should be included in its cost. But how much? $4 per machine hour? The $4/Mhr POR includes an allowance for spreading rework over all good suits made in the various jobs worked on during the year. Should these reworked suits be charged with even more rework cost through the POR? Probably not. In other words, the POR should be reduced by the amount of rework cost included in it when it is used to apply overhead to reworked suits! This means that two PORs are needed, one for normal work and one for rework.

This accounting method also creates another, potentially more serious problem. When rework is included in the overhead budget and not in the cost of the jobs, it may effectively be “buried” with all the other overhead items (indirect materials and labor, rent, utilities, depreciation, insurance, taxes, janitorial services, repairs and maintenance, and so forth). The WCM advocate argues that rework, like scrap, is a nonvalue-added activity that should be identified, “brought out into the open,” and analyzed, so that it can be prevented in the future. Is an accounting method available that will do this and also be simple to implement and explain? Some modern management accountants believe so. Because this method treats rework and spoilage in the same way, it is discussed later in the section dealing with spoilage.

Traditional Accounting for Reworked Units for a Special Job or Unusual Conditions

The same clothing manufacturer receives a special order for 1,000 suits, with the agreement that any rework costs are chargeable to the job and billable to the customer. During production, 100 suits need to be reworked. In requisitioning additional materials, workers charge them to the job, as is done with any direct materials in journal entry 5. Workers charge their direct labor time to the job, and overhead is applied to it based on the total machine hours worked.

The problem, though, is that the POR of $4/Mhr has to be reduced by the amount included in it for rework. Since this rework is not debited to overhead, the regular amount of applied overhead representing normal rework should not be credited from the overhead account and charged to this job. The rework costs are already included in the job's cost. Thus, this method includes rework costs directly in the job's cost. It is used when the customer agrees to pay for the rework costs, or when the rework is a result of special circumstances unique to the job. In other words, this method is used for rework costs that are not considered common to all jobs or expected because of the condition of the equipment, raw materials, and/or work force.

SPOILAGE AND the TRADITIONAL JOCAS

Spoilage refers to a rejected job or specific units within a job. A spoiled job or unit is so defective that it is not reworked to bring it up to specifications. In a JOCAS, the treatment of spoilage is basically the same as for rework.

Preparing a Spoilage Report

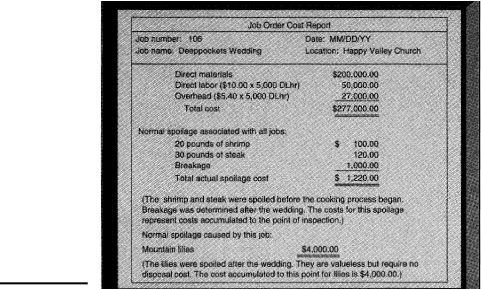

Exhibit 5-10 illustrates a spoilage report, which is prepared when defective products are removed from production. For cost management purposes, spoilage reports should be prepared and reported daily. In highly automated environments, these spoilage reports are made continuously.

Normal Spoilage Attributable to All Jobs

Normal spoilage, like normal rework, is expected under present conditions. Since this spoilage is expected on all jobs, the budgeted overhead includes an amount for normal spoilage, just as it does for normal rework. The POR spreads normal spoilage costs over all jobs through the overhead application journal entry. This means that, as with normal rework costs, when normal spoilage occurs, the costs of these products have to be debited to overhead.

Based on the Insights & Applications on the next page, the following entry is made to account for the actual normal spoilage cost incurred on these two jobs:

|

SPOILAGE JOURNAL ENTRY: Normal Loss |

||

|

WIP-Manufacturing Overhead (Spoilage) |

$1,286 |

|

|

WIP-Job 101 |

|

$ 66 |

|

WIP-Job 106 |

|

$1,220 |

|

|

||

|

INSIGHTS & APPLICATIONS Problems at Majordomo Catering Majordomo is a catering company that provides food and service for weddings, banquets, parties, and special events. Each catered affair represents a separate job. |

Regardless of the job, there is always some spoilage. In calculating the POR for the forthcoming period, Majordomo's management accountant includes an allowance for normal spoilage. One of Majordomo's catering jobs is for a political rally (job 101). Its job cost sheet is displayed in Exhibit 5-11. Majordomo also catered a fancy wedding that called for mountain lilies to be flown from Hawaii to Lubbock, Texas. The job cost sheet for this job (job 106) is presented in Exhibit 5-12. |

Normal Spoilage Caused by a Specific Job

If spoilage is not expected but is occasionally experienced on specific jobs, its estimated cost should not be included in calculating the POR. Why? In this case, the spoilage is caused by the extraordinary specifications of a particular job instead of being associated with standard conditions and specifications that affect all jobs. Chances are, this type of spoilage cannot be estimated at the beginning of the year. Majordomo, for example, does not know exactly what kinds of catering jobs it will have and, thus, the peculiar spoilage that might be associated with any one job. For the wedding (job 106), the total cost of the mountain lilies was $4,000. This normal spoilage cost, which is solely attributable to the wedding, remains with this job's cost. It is treated as just another direct material cost element.

|

Spoilage Report |

|

|||||

|

Number Date |

|

|||||

|

Part number: |

Part name: |

|

||||

|

Quantity spoiled: |

Last completed operation number: |

|

||||

|

Description of defect: |

|

|||||

|

Cause of defect Operator Vendor Material Machine Other |

|

|

|

Operation number responsible for defect: |

||

|

|

|

|

|

Inspector's signature: |

||

|

|

|

|

|

|

|

|

|

|

Direct materials |

Direct labor |

|

Overhead |

||

|

Unit standard cost |

|

|

|

|

||

|

Total standard cost |

|

|

|

|

||

|

|

|

|

Accounting for Abnormal Spoilage in Traditional JOCASs

Abnormal spoilage is the amount of spoilage in excess of the expected level of spoilage. Abnormal spoilage should be written off as a loss (expense) of the time period. For example, Majordomo catered a banquet (job 310) that incurred normal spoilage expected of all jobs of $2,000 and abnormal spoilage of $10,000 due to faulty refrigeration. The entry for this situation is:

|

SPOILAGE JOURNAL ENTRY: Abnormal Loss |

||

|

WIP-Manufacturing Overhead (Spoilage) |

$ 2,000 |

|

|

Loss from Abnormal Spoilage |

$10,000 |

|

|

WIP-Job 310 |

|

$12,000 |

ACCOUNTING FOR REWORK AND SPOILAGE IN WORLD-CLASS JOCASs

To summarize the traditional CAS accounting for rework and spoilage:

If rework and spoilage are “normal” occurrences, expected across all jobs due to the condition of the production process and the nature of the products, these costs should be budgeted for and included in the POR. When these costs occur, they should be debited to overhead. When overhead is applied to the jobs, the POR puts these costs back into the jobs, spreading the costs evenly throughout the year to all jobs.

If unique rework and spoilage are attributable to a specific job, and not to the general operating conditions of the enterprise, these costs should remain within the job. If the company budgets for normal rework and spoilage, including them in the POR, then these amounts must be removed from the POR when overhead is applied to the rework and the job.

Abnormal, unexpected spoilage costs should not be charged to the job. These costs should be written off (debited) to a loss account.

• WCM managers ask, “Why bury the costs of rework and spoilage in overhead or in a completely separate, isolated expense account?” These are nonvalue-added costs that need to be measured, and their activities need to be identified in accordance with the Japanese philosophy that a defect is a gem to be understood so it can be prevented in the future. The JOCAS, then, should specifically measure, identify, and report the cost of all rework and spoilage.

|

Thus, modern job cost reports for WCMs are expanded to include budget and cost variance information about the job. This is illustrated in the last two sections of the chapter (see Exhibits 5-15 and 5-22). If all rework and spoilage costs are left within the job's cost, the job cost report can specifically identify them, and their causes, for management's attention. Further, through the use of an ICBIS, this information can be immediately available for daily operations control.

What are the accounting effects of leaving rework and spoilage costs within the job? First, the job cost report has to include budget and variance information to help measure the significance of these costs. For example, in a traditional CAS, normal rework and spoilage have to be budgeted for anyway. Rather than putting them in overhead, though, why not just budget for them within the jobs directly? If a job results in abnormal rework or spoilage, it will not have been budgeted for and will show up as a cost overrun (unfavorable cost variance) on the job cost report. If normal rework and spoilage costs are not included in overhead, the special journal entries described above do not have to be made. This actually simplifies the CAS and at the same time provides better information for management control.

Secondly, there is a potential effect on net income. When normal rework and spoilage are included in overhead and the POR, job costs are "smoothed." All jobs are charged equally, regardless of random fluctuations between them (some have more or less rework and spoilage than others). Smoothing job costs smooths COGS and net income. But, if all rework and spoilage are left in individual jobs, this smoothing effect will not happen. Net income will be subject to the random fluctuations between jobs. In other words, instead of moving the fluctuations to overhead, they remain in the jobs and affect net income when the jobs are sold.

Traditional CAS theory argues that it is more important to smooth earnings because this gives a truer picture of the firm's profitability. Attaching these costs to specific jobs is not appropriate because the costs were caused by overall operating conditions, not by the individual jobs. The WCM management accountant counters this argument by pointing out that if the fluctuations are truly random and normal across all jobs, then the effect of not smoothing cannot be significant. The fluctuations will, for the most part, be relatively small (these costs will be fairly even across jobs). When a fluctuation is significant because a job results in an unusually high rework or spoilage cost, this job should be singled out for special attention. Only by keeping these nonvalue-added costs within the jobs will management be able to identify and eliminate them.

What about abnormal rework and spoilage? Under traditional CAS methods, these are expensed against net income in the time period they occur (within the month). If these costs remain in the job, and the job is sold, they will still "hit the income statement," not as an expense, but as a cost of the job (COGS). The net income effect is the same. But what if the job was not finished this month? The traditional approach would still expense these costs this month. The WCM approach would keep the costs in the job until it is completed and sold, thus matching the revenues from the job against all of its costs.

What's the "bottom line"? With increasing global competition, the WCM firm needs information on all nonvalue-added costs. The firm must measure these costs, identify the jobs where they were created, and ascertain the underlying causes. Whether these costs are added to every job through a POR, or specifically budgeted for within each job, they end up in the job's cost. Is it better to identify these costs through an overhead cost analysis or through a job cost analysis? Scrap, rework, and spoilage have become extremely serious problems for many traditional manufacturers. The modern management accountant must address the issue of how best to account for these costs in designing a world-class JOCAS.

INSTALLING AN ICBIS FOR A JOCAS

LEARNING OBJECTIVE 4

Describe how an integrated computer-based information system (ICBIS) can support a JOCAS.

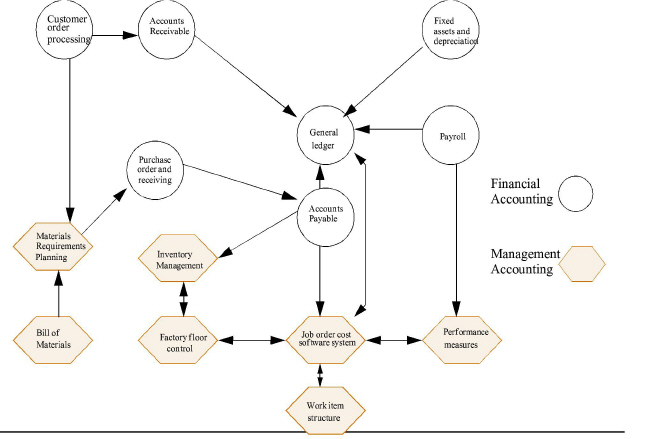

Many companies now apply computer technology to support their JOCASs. For example, the Insights & Applications feature on the following page introduces how Viking Boat Company uses an ICBIS to support its JOCAS.

Necessary Features of JOCAS Software

Different software packages have different features and are customized for different situations. The key to acquiring the best software is to match the needs of the enterprise with the capabilities of the software package. The following list of common features can serve as a guide for comparing the capabilities of different software packages:

• User-friendly. The software package should provide online help, menus, and tutorials. The system should be simple enough that it will not overwhelm the average user.

|

INSIGHTS & APPLICATIONS Viking Boat Company’s New ICBIS The Viking Boat Company is located in West Palm Beach, Florida. Viking takes in about 100 boat construction jobs per month. Some are huge projects, lasting up to six months and producing revenue up to $500,000. Viking also has a large service area that performs a substantial number of repair jobs. Both of these areas, construction and service, fit into the categories for a JOCAS. |

Viking’s management accountant has acquired a JOCAS software package that will track, bill, and charge costs to construction and repair jobs. It is integrated into the financial accounting software, as shown in Exhibit5-13. The advantage of this ICBIS is that transactions entered into one module simultaneously update a specific job as well as other accounting files. For example, when employee time tickets are entered into the payroll module, the hours spent on each job are automatically posted to the job cost sheet. The worker's paycheck is also calculated and prepared. In another example, when a part is taken from materials inventory, the cost is charged to the job cost sheet and WIP, and RMI is automatically reduced. |

Internal controls. The package should have internal controls, such as input, processing, output, and database controls.

• Flexibility. The software should permit each job to be set up according to the work ordered by the customer.

• Break down by work areas. The software should have the ability to break down a job into departments, workcenters, or cells to measure work performed and costs for each work area.

• Integration. The software should be easily integrated with other accounting tasks. For example: integration with payroll for entering labor costs and determining labor performance; integration with inventory for entering material costs and updating quantity on hand; integration with accounts payable and with purchasing for ordering materials and other items; integration with accounts receivable for producing customer invoices and recording receipts; and integration with the general ledger for preparing journals and monthly financial statements.

• WIP reporting. WIP reports keep management abreast of progress on various jobs and also can show at a very early date when costs (such as scrap, rework, and spoilage) are getting out of control.

• Pre-billing data. Management should be provided with a pre-billing worksheet to review before customer invoices are prepared and mailed.

• Job scheduling. This feature produces information including start and due dates, percent completion, and a list of open and closed jobs.

• Job profitability. This feature computes costs incurred and profit margin for each job.

• New job estimating. This feature provides cost information that aids management in bidding for new jobs.

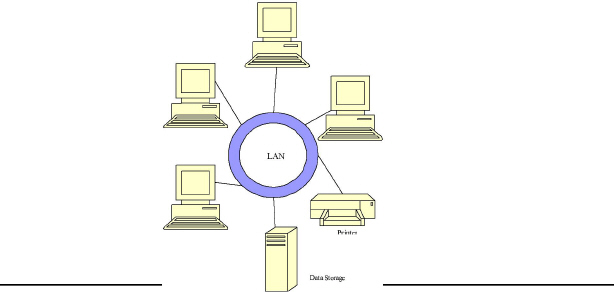

The Technology Platform for Viking's ICBIS

The network backbone and computer hardware platform for Viking's ICBIS are presented in Exhibit 5-14. The network transmission medium is fiber optic and the fiber distributed data interface (FDDI) standard supported by the American National Standards Institute (ANSI). Fiber optic's main advantage to Viking is its resistance to electrical interference from production equipment and lightning from thunderstorms, which are prevalent in Florida.

|

A computerized JOCAS is more than simply a historical record of what happens at Viking. It is a major tool in the whole management process. Moreover, it increases the efficiency and effectiveness of operations.

|

Exhibit 5 -15 |

|||||||

|

|

|

Closed Job Order Report |

|

|

|

||

|

Job Order Number: |

147F |

|

Work Centre |

|

4 |

|

|

|

Customer: |

|

Water Sports |

|

Quantity Ordered: |

28’ Neptune Ski Pkg. |

||

|

Contract Number: |

19743M |

|

Date Ordered: |

9/1/X5 |

|||

|

Contract Price: |

$ 30 000.00 |

|

Date Promised: |

10/12/X5 |

|||

|

|

|

|

|

Date Started: |

9/3/X5 |

||

|

|

|

|

|

Date Completed: |

10/13/X5 |

||

|

Cost Inputs |

|

Estimated ($) |

Actual ($) |

|

Under/<Over> |

||

|

Materials |

|

|

|

|

|

|

|

|

Purchased Parts |

6 500.00 |

|

7 000.00 |

|

<500.00> |

|

|

|

Manufactured Stock |

3 000.00 |

|

3 000.00 |

|

0.00 |

|

|

|

Total |

9 500.00 |

|

10 000.00 |

|

<500.00> |

|

|

|

|

|

|

|

|

|

|

|

|

Direct Labour |

|

|

|

|

|

|

|

|

Production |

2 600.00 |

|

2 500.00 |

|

100.00 |

|

|

|

Setup |

200.00 |

|

500.00 |

|

<300.00> |

|

|

|

Rework |

400.00 |

|

1 000.00 |

|

<600.00> |

|

|

|

total |

3 200.00 |

|

4 000.00 |

|

<800.00> |

|

|

|

|

|

|

|

|

|

|

|

|

Applied Overhead |

|

|

|

|

|

|

|

|

Fixed |

4 200.00 |

|

4 000.00 |

|

200.00 |

|

|

|

Variable |

1 600.00 |

|

2 000.00 |

|

<400.00> |

|

|

|

Total |

5 800.00 |

|

6 000.00 |

|

<200.00> |

|

|

|

|

|

|

|

|

|

|

|

|

Total Manufacturing Costs |

18 500.00 |

|

20 000.00 |

|

<1 500.00> |

|

|

|

|

|

|

|

|

|

|

|

|

Memo: |

Contract Price |

|

$ 30 000.00 |

|

|

|

|

|

|

Cost charged to job |

$ 20 000.00 |

|

|

|

|

|

|

|

Administrative Cost |

2 000.00 |

|

|

|

|

|

|

|

Selling Cost |

3 000.00 |

|

|

|

|

|

|

|

Total cost to make and sell |

|

<25 000.00> |

|

|

|

|

|

|

|

Profit |

|

$ 5 000.00 |

|

|

|

The above Insights & Applications describes how Viking's new JOCAS software system aids management.

|

INSIGHTS & APPLICATIONS Viking Boat Company's New JOCAS as a Management Tool John Silver, CEO of Viking said, “One of the advantages of our new computerized system is that it gives me work-in-progress on all jobs, both construction and service, any time I want this information. I can see exactly what we have in a job; that is, in materials, labor, overhead, and any subcontracted work, by simply entering job numbers via my workstation. I also like the job order reports that I get upon completion of a job. (See Exhibit 5-15 for an example of the job 147F report.) I use these reports to help analyze performance, to bid on future jobs, and to determine product line profitability.” Teri Crusoe, marketing manager, said, “We have also improved customer relations. We're customer-oriented, and we have fewer billing disputes. We can send interim bills on major jobs so the customer knows how work is progressing. We also disclose a lot more detail in the bills to explain precisely what was done.” Marcy Gulliver, financial accountant, said, “On the productivity side, it has streamlined the work flow in our office by cutting the time we spend on billing almost in half. We also get customer revenues much faster, which has almost eliminated our need to obtain short-term loans. Moreover, the integration feature eliminates all the manual entries we used to make for each account. This feature not only increases productivity but reduces data-entry errors.” Homer Dreyfus, yard foreman, said, “I really like the system's flexibility in specifying the precise work the customer wants. I meet with the customer and enter the instructions in detail via my workstation. |

The tasks are grouped to departments, such as yard, electrical, mechanical, paint shop, and so forth. The exact assignment is keyed into the system. When the customer receives a bill, he sees what he told me to do and exactly what he is being charged for. Another feature I like is the graphics that give me performance and utilization information at a glance. I particularly like the trend of performance measures, such as labor utilization, machine utilization, and units rejected. I can use this information to analyze performance over one or more jobs, which might otherwise be obscured by the complexities of various job orders.” Sylvia Torrence, service and repair foreman, said, “The new system simplifies service work and repair jobs. We are able to assign the right parts to the right customer. This used to be a nightmare. Now, we know exactly what parts were used on each job. Since there is a tie to inventory, we can tell if we have the parts on hand before we start a job. We can track a job from the time a customer walks in the door until she leaves with a paid receipt. The work to be performed is entered on the keyboard, and a job cost sheet is set up and printed. Then, a mechanic takes the proper copy and begins the job. Parts are charged to the job cost sheet by the inventory clerk, and labor is entered from the mechanic's time clock tickets. We used to spend hours totaling up the parts and labor for each job. Now, we can hand the customer a computer-generated bill as soon as the job is completed.” |

Attributes needed for a Job Cost Report

Assuming you are in a company with a relational database driven accounting system, [and the accountants in the company actually realize it] what attributes do you need to add to the basic database tables in order to produce the Job Cost reports? Using the generic REA template in Exhibit 5-22 to work on your answer. Include both the attribute and the table it would be from.

|

SUMMARY OF LEARNING OBJECTIVES

The major goals of this chapter were to enable you to achieve five learning objectives:

Learning objective 1. Explain how to design a job order cost accounting system (JOCAS).

A JOCAS has three main informational inputs:

• Materials requisitions

• Time tickets

• Information on the volume of the predetermined overhead rate's basis

Costs accumulated from these inputs are charged to the job, project, or case by posting costs to its job cost sheet. Direct materials are assigned to each job through materials requisitions. Direct labor is traced

through time tickets. Overhead is applied to each job using a POR.

Job cost sheets serve as WIP subsidiary ledger accounts. Completed job cost records for jobs not yet delivered to customers are transferred to FGI subsidiary ledger accounts. When jobs are sold, the appropriate costs are transferred from the finished goods account to the cost of goods sold account. Corresponding FGI subsidiary ledger accounts are closed. Completed job cost sheets are maintained in a database for management analysis and to serve as a guide for bidding on future jobs.

Learning objective 2. Illustrate the cost flows and prepare journal entries for a normal JOCAS.

The cost flows and journal entries are identical to those for any basic CAS, presented in Chapter 4, except that the three journal entries for cost element usage debit specific jobs rather than the WIP subsidiary account called “Product Cost.” The “Product Cost” subsidiary account is replaced by separate subsidiary accounts for each job. Thus, when journal entries 5-7 record the usage of direct materials, direct labor, and applied overhead, the debits are to individual job cost sheets.

To review the cost flows, first cost elements are purchased. When raw materials, factory labor, and indirect manufacturing costs are obtained, their costs are debited (charged) to temporary holding accounts in the JOCAS (journal entries 1-4). These are RMI, gross wages, and overhead, respectively.

When raw materials and factory labor are used in the production process, their costs are removed (credited) from their holding accounts and charged (debited) to the jobs and overhead account as described above (journal entries 5-6). In a normal JOCAS, overhead is applied using a POR in journal entry 7. The journal entry is made when the job is completed, or more frequently, depending on how long it takes to complete the job and the basis used for the POR.

When jobs are completed and all their costs accumulated in their subsidiary WIP accounts, the jobs are transferred to FGI and, when sold, to COGS. Journal entries 8 and 9, recording COGM and COGS, may show subsidiary ledger accounts by job for FGI and COGS. This depends on whether individual jobs are tracked through FGI and sold separately. The journal entry formats are illustrated in Demonstration Problem 1.

Learning objective 3. Demonstrate how to account for scrap, reworked units, and spoilage in a normal JOCAS.

Scrap and spoilage reports should be given to management in a timely fashion. Scrap also should be returned to the storeroom to be held for sale or for reuse. Typically, scrap is not assigned any cost. When it is sold, the proceeds are recorded as miscellaneous income. Sometimes, the net realizable value (NRV) is significant. In that case, the scrap is inventoried, with the NRV credited from the job's cost. Then, when the scrap is sold, no miscellaneous income is recognized.

When rework and spoilage are expected (“normal”) and attributable to the overall condition of the production process, rather than caused by specific jobs, traditional CAS methods require that the budgeted costs for rework and spoilage be included in budgeted overhead and the POR. This allows these costs to be spread more evenly over all jobs, smoothing job costs and net income. The cost to rework defective units or the cost of rejected products (spoilage) is then charged to overhead.

If, on the other hand, rework and rejects are caused by extraordinary specifications or unusual conditions of a particular job, or the customer agrees to pay for these costs, the rework should be charged to the job. Abnormal spoilage, though, is written off to a loss (expense) account under traditional methods. In any case, the vast majority of rework and reject costs are not associated with specific jobs in a traditional CAS.

WCM managers, though, may prefer a different accounting for rework and spoilage. They argue that the costs should remain in the jobs where the rework and spoilage occurred. This eliminates the need to make special journal entries removing the costs from the jobs and “burying” them in the overhead account along with many other indirect cost elements. If these costs are truly random and common to all jobs, COGS and net income should not be materially affected. More importantly, if the job cost sheets include budget and cost variance data (as in Exhibits 5-15 and 5-22), the JOCAS can provide valuable information that will help managers deal with these problems.

Learning objective 4. Describe how an integrated computer-based information system (ICBIS) can support a JOCAS.

More and more companies are installing computerized information networks that integrate data collection and information reporting throughout the firm. These ICBISs contain job order costing software as well as a host of other software, such as materials requirements planning, work item modules, performance measures, and inventory control. These modules are integrated with financial accounting modules to form an ICBIS.

Integrating the modules increases the effectiveness and efficiency of operations. Specifically, timely information is available for controlling operations from online, realtime access to job cost sheets via workstation terminals. Expanding the job cost sheet to include budget and cost variance information will provide better accountability for performance evaluation. Finally, this type of information is critical to budgeting similar projects in the future.

With or without ICBISs, spreadsheet software has become a common tool for reporting and analyzing job costs as well as for preparing budgets for jobs. Spreadsheet programs can be linked together, further increasing efficiency in processing information in modern JOCASs.

Learning objective 5. Discuss how costs are estimated for construction projects and how work item software is used.

For any given project, the cost estimator and the management accountant must work together to estimate the direct costs for materials, labor, and equipment with reasonable accuracy. The bid price can then be determined by adding the costs for subcontract work, overhead, contingencies, insurance and bonds, and a target profit. The bid price of a project should be high enough to allow the contractor to complete the project with a reasonable profit, yet low enough to be competitive.

Cost estimates can be divided into:

• Preliminary cost estimates

• Detailed cost estimates

All cost estimates based on previous cost data should be adjusted for:

• Time

• Location

• Size

A work item software program is a special tool that management accountants can add to their JOCAS. It provides a systematic way for firms to bid on jobs. If a job is awarded, the management accountant can also use the work item software for other purposes:

• To accumulate actual costs

• To report variances

• As input to electronic spreadsheets for financial analysis m As a basis for bidding on future similar jobs.

Learning objective 6. Prepare a list of attributes needed in a relational database to prepare job cost reports in an REA environment.

Developing a Job Order Cost Accounting System in a relational database involves adding a number of attributes to the basic tables and writing the JOCAS reports. These should be seen as extensions of the basic model.

IMPORTANT TERMS

Abnormal spoilage Spoilage that is unexpected and in excess of normal spoilage.

Bid price The amount of money the owner must pay the general contractor to build a project.

Detailed cost estimate (final or definitive cost estimate) A forecast of direct materials, direct labor, equipment, subcontractor work, overhead, contingencies, insurance and bonds, and profit, for a project based on a complete set of contract documents, technical specifications, drawings, and site visits.

Job A job is an individual product, a small batch of unique products, a client, or case, or any other project that materials, labor, and the POR's basis can be directly traced to.

Job cost sheet (job order cost record) A record set up for each job started into production, which serves as a means for accumulating the direct materials, direct labor, and overhead costs chargeable to the job. It is used as a means for computing unit costs. Job cost sheets are often the subsidiary ledger accounts in WIP for product costs.

Normal spoilage Rejected products that are expected, and budgeted for, under present conditions.

Preliminary cost estimate (conceptual, approximate, or budget estimate) A ballpark estimate of what costs could be to build a project, including the target profit.

Reworked units Defective products that are fixed and sold as acceptable finished units.

Scrap Fragments of material removed during the production or construction process.

Spoilage A rejected job or products within a job. Spoiled jobs or units are discarded and are sometimes sold for disposal value.

DEMONSTRATION PROBLEMS

DEMONSTRATION PROBLEM 1 Journal entries for a normal JOCAS.

Using the annual information below for Topper, Inc., prepare the journal entries for each event using a normal JOCAS. (Note: this is the same problem as Demonstration Problem 1 in Chapter 4. It is repeated to facilitate comparisons between journal entries in a basic CAS and in a JOCAS.)

1. Raw materials beginning balance is zero, and the ending balance is $20,000. Purchases made on account are $100,000.

2. There is a $200,000 factory payroll for the year, with the following withholding rates: federal income taxes 10%, state income taxes 5%, Social Security taxes 7.5%, pension plan 2%, health insurance 1.5%.

3. Topper's payroll tax burden and fringe benefits rates are as follows: federal unemployment tax rate = 0.8% and the state's = 5.4%; fringe benefits include vacation pay (2 weeks when 50 weeks are worked in a year), Topper's contribution to a pension plan of 5.0%, and its contribution to the health insurance plan of 3.3%.

4. Other actual overhead costs, paid on account, are $88,000. Factory equipment depreciation equals $200,000.

5. Direct materials requisitioned equal $75,000.

6. $175,000 of factory labor costs represents direct labor.

7. Overhead allocation assuming a POR of 200% of direct labor cost.

New information:

8. The direct materials were for two jobs: job 31 = $50,000 and job 42 = $25,000. (See item 5 above)

9. Job 31 had $100,000 of direct labor, and job 42 had $75,000. (See item 6 above) \

10. Job 31 had a beginning balance of $650,000. It was the only job completed and sold.

11. FGI and COGS accounts do not have subsidiary accounts for each job.

Study note: Verify that the only journal entries that have changed from the Chapter 4 solution are the three cost element usage journal entries (JEs 5-7), and that COGS has changed to $1,000,000 due to the sale of job 31.

Solution To Demonstration Problem 1

|

|

|||

|

Ref General Ledger Account Titles |

dr's |

cr's |

Notes: |

|

PURCHASE (ACQUISITION) OF RAW MATERIALS: 1: Raw Materials Inventory Accounts Payable |

$100,000 |

$100,000 |

given all RMI purchases are charge d |

|

PREPARING (RECORDING) PAYCHECKS: 2: Gross Wages FIT Withholdings Payable SIT Withholdings Payable FICA Taxes Payable Pension Plan Payable Health Insurance Payable Wages Payable |

$200,000 |

$20,000 $10,000 $15,000 $4,000 $3,000 $148,000 |

given +$GROSS WAGES*0.1 +$GROSS WAGES*0.05 +$GROSS WAGES*0.075 +$GROSS WAGES*0.02 +$GROSS WAGES*0.015 GROSS WAGES - WITHHOLDINGS |

|

EMPLOYER'S PAYROLL TAXES & BENEFITS (BURDEN): 3: Gross Wages FICA Taxes Payable FUTA Taxes Payable SUTA Taxes Payable Pension Plan Payable Health Insurance Payable Vacation Payable |

$52,000 |

$15,000 $1,600 $10,800 $10,000 $6,600 $8,000 |

SUM (EMPLOYER BURDEN) = withheld from paycheques +$GROSS WAGES*0.008 +$GROSS WAGES*0.054 +$GROSS WAGES*0.05 +$GROSS WAGES*0.033 +$GROSS WAGES*0.04 |

|

OTHER OVERHEAD COSTS INCURRED: 4: WIP-Manufacturing Overhead (Other OH costs) WIP-Manufacturing Overhead (Depreciation) Accounts Payable Accumulated Depreciation-Factory Equipment |

$88,000 $200,000

|

$88,000 $200,000 |

amounts given

amounts charged

|

|

REQUISITION OF RM INTO THE FACTORY: 5: WIP-Job 31 (DM WIP-Job 42 (DM) WIP-Manufacturing Overhead (IM) Raw Materials Inventory |

$50,000 $25,000 $5,000 |

$80,000 |

given given “plug” to balance calculate from T-account |

|

DISTRIBUTING GROSS WAGES TO PRODUCTS: 6: WIP-Job 31 (DL) WIP-Job 42 (DL) WIP-Manufacturing Overhead (IL) Gross Wages |

$100,000 $75,000 $77,000 |

$252,000 |

given given “plug” to balance gross pay + employer burden |

|

OVERHEAD ALLOCATION TO PRODUCTS: 7: WIP-Job 31 (Applied Overhead) WIP-Job 42 (Applied Overhead) WIP-Manufacturing Overhead |

$200,000 $150,000 |

$350,000 |

POR = 200% of DL$

DL$ = $175,000 (given) |

|

PRODUCTS COMPLETED: 8: Finished Goods Inventory WIP-Job 31 |

$1,000,000 |

$1,000,000 |

COGM calculated within T-account |

|

PRODUCTS SOLD (INVENTORY RELIEF ENTRY ONLY): 9: Cost of Goods Sold Finished Goods Inventory |

$1,000,000 |

$1,000,000 |

COGS calculated within T-account |

|

JOURNAL ENTRY RECORDING CONVENTIONS: 1. Use a dash to separate a control account from a subsidiary account. 2. Use parentheses for a posting reference within a general ledger account. |

|||

DEMONSTRATION PROBLEM 2 Accounting for scrap, rework, and spoilage. Waste Management Company has a traditional CAS. During the month of April, it incurred some significant scrap, rework, and spoilage costs. As the new management accountant, you have been asked to prepare the journal entries necessary to record these costs. You have found the following information:

Scrap: From the Accounts Receivable Department, receipts issued for the sale of scrap equal $5,000. You check with the shop floor foreman and find that the scrap could not be identified as coming from any particular jobs. Although workers collect scrap after each job and set it aside, no records are kept as to how much came from any job.

Rework: Rework occurred on two jobs during the month. Job 25 rework required $500 in direct materials and $1,000 in direct labor. The shop foreman believed that this was just normal rework that occurs due to the type of production process in place. He did believe, though, that this amount was a bit curious. Job 28 rework costs were due to the special nature of the job. These costs were not significant, however, being only $75 in direct materials and $100 in direct labor.

Spoilage: Forty products made in job 27 were rejected by quality control inspection. From talking to the shop floor foreman, you learn that up to 25 rejects were considered normal for this job. The rest were considered beyond normal expectations. This job was not unique relative to any other job, according to the foreman. From the job cost sheet, the direct materials and direct labor costs per unit on this job were $10 and $12, respectively.

From the JOCAS records, you also found that normal rework and spoilage were included in the overhead budget. The POR is based on budgeted direct labor cost of $600,000 for the year. The budgeted overhead included:

|

Indirect materials |

$ 20,000 |

|

Indirect labor |

40,000 |

|

Depreciation |

100,000 |

|

Factory utilities |

50,000 |

|

Normal rework |

60,000 |

|

Normal spoilage |

30,000 |

|

Total budgeted overhead |

$300,000 |

Solution To Demonstration Problem 2

|

SCRAP JOURNAL ENTRY: |

||

|

Cash Scrap Sales |

$5,000 |

$5,000 |

Comment: Since the scrap could not be identified with specific jobs, those jobs' costs could not be credited (reduced) and the market value set up in a subsidiary RMI account. If this is a significant amount, since workers collect scrap after each job, possibly the JOCAS should be changed to trace scrap directly to jobs.

|

REWORK JOURNAL ENTRY: |

||

|

WIP-Manufacturing Overhead (Rework) |

$1,900 |

|

|

RMI |

|

$ 500 |

|

Gross Wages |

|

$1,000 |

|

WIP-Manufacturing Overhead |

|

$ 400 |

Comment: The regular POR is 50% of direct labor cost (total budgeted overhead of $300,000 divided by budgeted direct labor cost of $600,000). However, this POR cannot be used in allocating overhead to the reworked products because it includes an allowance for rework. Normal rework is included in the overhead budget to spread its costs over the good products made. Therefore, the amount of the normal rework in the POR has to be deducted from it to yield a “rework allowance-free” POR. Since normal rework is 10% of direct labor cost ($60,000 - $600,000), the adjusted POR should be 40% of direct labor cost, and the applied overhead should be $400.