Chapter 6 : The Process Cost Accounting System

Learning Objectives

After studying this chapter, you should be able to:

1. Describe the flow of products and their cost elements through continuous processing systems, and prepare the journal entries to record these events.

2. Explain equivalent units of production (EUP), and calculate EUP for each cost element in beginning and ending inventories and in the spoilage.

3. Describe the six steps for departmental cost accounting in a PCAS.

4. Demonstrate the differences in calculating product costs between FIFO and weighted-average methods.

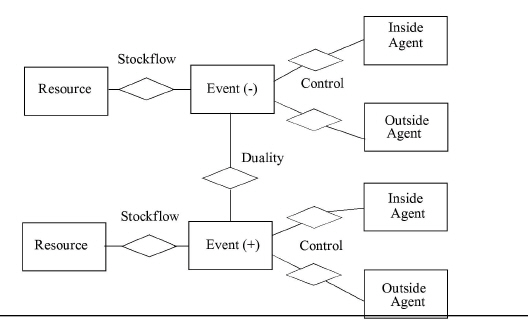

5. Prepare a list of attributes needed in a relational database to prepare process cost reports in an REA environment.

Introduction

Process cost accounting systems (PCASs) are used in mass production environments where homogeneous products flow continuously through processes (departments), such as grinding, mixing, molding, and canning. Examples include beer, cement, flour, dairy products, and paint. As partially completed products move from process to process (department to department), their costs are accumulated within each process and then transferred with the products.

Job order cost accounting systems (JOCASs), on the other hand, are used in industries such as construction, printing, consulting, and some furniture manufacturing companies where each job or batch of products is relatively unique and easily identified. As jobs move through production, costs are accumulated within the job until it is completed.

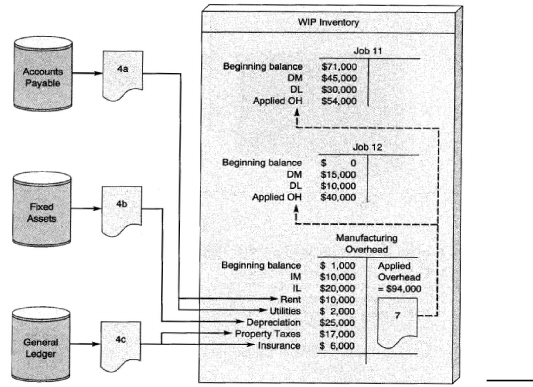

As with the basic CAS (Chapter 4) and the JOCAS (Chapter 5), perpetual inventory systems with subsidiary ledgers for RMI, WIP, and FGI are generally used in a PCAS. In a JOCAS, direct materials, direct labor, and applied overhead costs are directly traced (journalized) to individual job order cost records. As direct materials are requisitioned for production, their costs move with them out of the RMI subsidiary ledger into the job's subsidiary ledger account in WIP. As jobs are completed, their costs move with them out of the factory (WIP subsidiary ledger account) into FGI. The job cost sheets also move with them, leaving the WIP subsidiary ledger system and becoming the FGI subsidiary ledger system.

The subsidiary ledger system in a PCAS does not accumulate WIP costs by job. Instead WIP subsidiary ledgers are created for each process or department. The FGI subsidiary ledger system is basically the same. Each different type of product (milk, cheese, cream, butter, and so forth) has its own FGI subsidiary ledger account.

Basically, in process costing, WIP costs are accumulated in a particular workcenter, cell, or department for an entire period, such as a month, then this total is divided by the number of units produced during the period. The basic formula for calculating the product's cost in a PCAS is:

Unit cost = Total department costs/Total units produced

Because each product is indistinguishable from any other product, each bears the same average cost as any other unit during the period.

The basic CAS presented in Chapter 4 is an example of a one-process manufacturing operation. Cost elements are journalized to a single WIP subsidiary account (Product Costs). In multiple-process manufacturing, a WIP subsidiary ledger account is required for each process. The output of process 1 becomes a direct material input into process 2; then the output of process 2 becomes one of the direct materials input into process 3, and so forth.

In a PCAS, instead of using job cost sheets, a department production cost report is used to provide a summary of the number of units moving through the department during the period along with their costs. The key differences between a JOCAS and PCAS are summarized in Exhibit 6-1.

|

JOCAS |

PCAS |

|

Uniquely identifiable jobs are worked on during each period, with each job normally requiring different levels of production resources. |

Identical products are produced on a continuous basis or for long periods of time. |

|

Costs are accumulated by individual jobs. |

Costs are accumulated by departments. |

|

The job cost sheet is the record controlling the accumulation of costs by jobs. |

The department production cost report is the key document showing the accumulation of costs by department. |

|

Unit costs are computed by job on the job cost sheet. |

Unit costs are calculated by department on the department production cost report. |

Understanding The Flow Of Units And Costs

LEARNING OBJECTIVE 1

Describe the flow of products and their cost elements through continuous processing systems, and prepare the journal entries to record these events.

Costs flow from one department to another as the units being manufactured move through the departments. The PCAS objective is to determine the departmental costs of products so that these costs can be combined to yield the total COGM. The processing departments can be configured in an unlimited number of ways as can the computer technology that supports them, the flow of products through them, and the flow of costs.

What Are The Different Processing And Cost Flows?

Normally most process production flows follow one of two basic configurations:

• Sequential

• Parallel

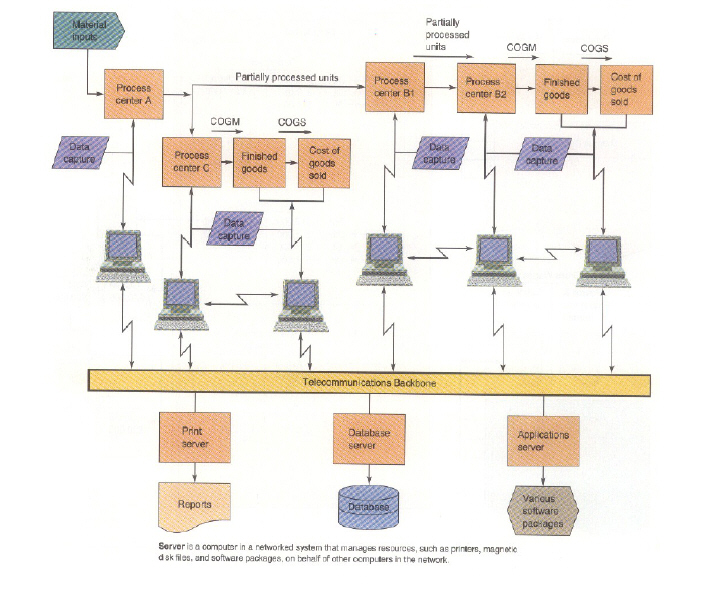

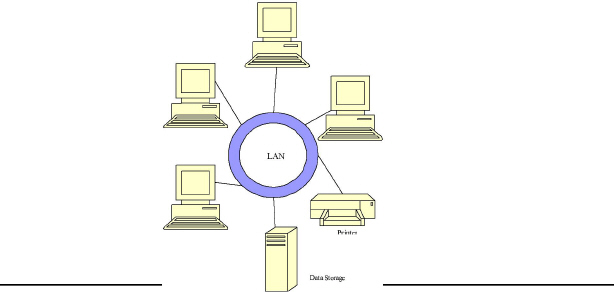

In addition to the flow of goods through these processes, modern plants also integrate computer technology to control processes, collect and process production cost data, and provide various performance measurement reports. The technology is linked together in a network, with computing resources distributed out to where workers and managers need them.

SEQUENTIAL PROCESSING. Sequential processing centers or departments and the supporting computer technology platform are illustrated in Exhibit 6-2

|

|

. Partially completed products flow from left to right, undergoing different kinds of processing in each processing center. Direct materials, direct labor, and applied overhead costs are traced to each center. Process center 2 receives the partially processed units from process center 1 together with the costs from process center 1. Process center 2 adds its own direct materials, direct labor (if materials and labor are added in process 2), and applied overhead costs. Process center 3 receives the further processed, but still incomplete, units and their costs from process center 2. Process center 3 then adds direct materials, direct labor, and applied overhead costs incurred in its process. The finished products and their total costs are finally transferred out of process center 3 to FGI. The costs of finished goods that are sold are then transferred to the COGS account. Meanwhile, the computer technology platform has collected and processed all the data generated by the total operation.

PARALLEL PROCESSING. In parallel processing, different products go through different processing centers or departments, depending on the nature of the product. Exhibit 6-3

|

, illustrates this processing configuration, which is used in companies such as oil refineries. An oil refinery, for example, inputs crude oil into process center A where its output is refined further into several end products. In Exhibit 6-3, process center A performs a “cracking” process in which the heavy hydrocarbons in the crude oil are broken up by heat into direct materials for process centers B 1 and B2, which produce gasoline. Process center C processes the materials from A into kerosene. Other joint products (not shown in the exhibit) derived from crude oil are naphtha, benzene, and paraffin. Costing joint products is illustrated in the last section of this chapter.

A Simple Example Of The Physical Flow Of Units In A Pcas

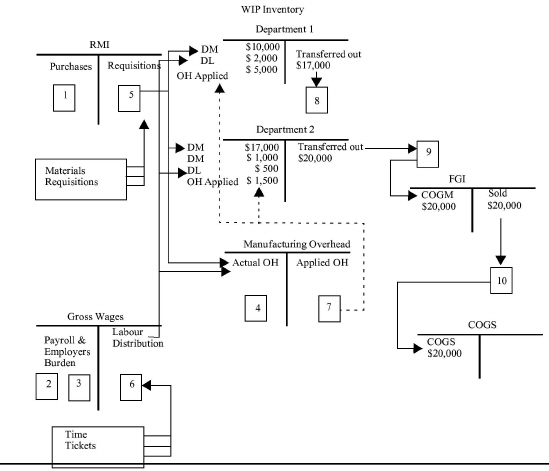

Exhibit 6-4

|

presents the physical flow of units, with their cost flows, for processing 10,000 gallons of milk at Model Dairies during May. Direct materials ($10,000), direct labor ($2,000), and applied overhead ($5,000) are used in department 1, where the 10,000 gallons of raw milk are pasteurized. In department 2, where packaging takes place, the pasteurized milk from process 1 is input as a direct material (transferred from process 1 at an average cost of $1.70 per gallon, or $17,000 in total for 10,000 gallons). Milk cartons are requisitioned from RMI ($1,000), and direct labor ($500) and applied overhead ($1,500) are incurred. These four costs are accumulated and divided by production volume to give an average cost per gallon of $2.00 ($20,000 divided by 10,000 gallons). The cartons of milk are transferred to cold storage (FGI at $20,000), awaiting delivery to customers (retail grocery stores). Then, when the milk is delivered, the COGS account is debited for $20,000 and FGI is credited for $20,000.

The PCAS journal entries that are different from those in a JOCAS are shown in Exhibit 6-5. Journal entries 1-4 recording the acquisition of cost elements (DM, DL, actual OH costs) are the same as in a basic CAS (reference Exhibit 4-4) and in a JOCAS (reference Exhibit 5-8).

When recording the usage of inputs, though, PCAS journal entries 5-7 debit WIP-Department instead of WIP-Job as in a JOCAS. A new journal entry is needed to transfer work-in-process between departments (new journal entry 8 in the PCAS). The journal entries to record the movement of completed products out of the factory and into finished goods inventory, and to record the sale of finished products, have been renumbered. Note that the subsidiary ledger systems for FGI and COGS are not set up by job number (because there are no jobs in a process costing system). Instead, they are set up by type of finished product (milk, butter, cream, cheese, and so on for Model Dairies).

|

Exhibit 6 -5 Model Dairies PCAS Journal Entries |

||

|

Partial Spreadsheet Program To Record Model Dairies Journal Entries For May 1995 |

||

|

Entries 1-4 are the same as in the prior chapters. |

dr's |

cr's |

|

5: REQUISITION OF RAW MATERIALS INTO THE FACTORY: WIP-Department 1 (DM) WIP-Department 2 (DM) WIP-Manufacturing Overhead (IM) Raw Materials Inventory

6: DISTRIBUTING GROSS WAGES TO PRODUCTS: WIP-Department 1 (DL) WIP-Department 2 (DL) WIP-Manufacturing Overhead (IL) Gross Wages

7: APPLYING OVERHEAD TO PRODUCTS: WIP-Department 1 (Applied OH) WIP-Department 2 (Applied OH) WIP-Manufacturing Overhead

8: WIP TRANSFER FROM DEPARTMENT 1 TO DEPARTMENT 2: WIP-Department 2 (DM from Dept. 1) WIP-Department 1

9: PRODUCTS COMPLETED: Finished Goods Inventory-Milk WIP-Department 2

10: PRODUCTS SOLD(INVENTORY RELIEF JOURNAL ENTRY ONLY): Cost of Goods Sold-Milk Finished Goods Inventory-Milk

|

$10,000 $1,000 ?

$2,000 $500 ?

$5,000 $1,500

$17,000

$20,000

$20,000 |

?

?

$6,500

$17,000

$20,000

$20,000 |

|

JOURNAL ENTRY RECORDING CONVENTIONS: |

||

|

1. Use a dash to separate a control account from a subsidiary account. 2. Use parentheses for a posting reference within a general ledger account. |

||

The important point to remember in designing the PCAS general ledger system is that WIP subsidiary accounts are departments rather than jobs. This is the only fundamental difference in assigning product costs between a PCAS and a JOCAS.

In most traditional process systems, though, each department has beginning and ending inventories of partially completed units on its assembly line for any month. This complicates the calculation of the costs of WIP transferred between departments for PCAS journal entry 8. An “equivalent units of production” calculation is needed, as explained in the next section. In JIT processes, where a cell produces the same sub-assembly over and over again (by kanban), there are no beginning and ending inventories within the cell, so the need to calculate equivalent units does not exist.

Determining Equivalent Units Of Production

LEARNING OBJECTIVE 2

Explain equivalent units of production (EUP), and calculate EUP for each cost element in the beginning and ending inventories and in the spoilage. (This learning objective will be continued on page 232.)

In the Model Dairies' example, all 10,000 gallons of milk were started and completed during May. But this situation is usually rare. In most traditional process systems, four types of events happen in any accounting period (i.e., a month):

• Products are started in the previous period (beginning WIP) and completed in the current period.

• Products are started in the current period and completed in the period.

• Products are started in the current period but are not completed by the end of the period (ending WIP).

• Products are spoiled (rejected) or reworked during the period.

What Is The Equivalent Units Of Production Calculation And Why Is It Needed?

Indeed, when beginning and ending inventories and spoilage exist, a calculation known as equivalent units of production (EUP) must be performed to measure how much production (work) was really done during the period. EUP represents the amount of completed output that could have been produced if all the work performed during the period had been for units both started and completed. It is an adjustment for the partial effort in beginning and ending inventories and in spoilage. In other words, EUP is how many units that could have been started, fully processed, and completed with the amount of inputs (costs) used during the month. EUP is divided into the total costs to obtain the cost per equivalent unit produced. This changes the basic formula for calculating unit cost to:

Unit cost = Total department costs / EUP

Returning to the Model Dairies example, assume that 10,000 gallons of milk were started during May in department 1, but only 9,000 were completed. The last 1,000 units were only 60 percent complete at the end of the month (thus, there were 1,000 gallons in ending WIP for department 1 in May). It is important to recognize that the $17,000 incurred in the department resulted in more than 9,000 gallons worth of milk production. Thus, the unit cost of the 9,000 gallons completed and transferred to department 2 is not $1.89 per gallon ($17,000 divided by 9,000 transferred gallons). Using this unit cost will overstate the cost of the 9,000 gallons transferred to department 2 and will result in no cost being associated with the 1,000 partially processed gallons left over at the end of May in ending WIP inventory.

Work was done on the ending WIP, so cost should be associated with it by the PCAS. But, how much? Ending WIP contained 1,000 gallons 60 percent complete, which is equivalent to the amount of work needed to fully complete 600 gallons (1,000 units 60 percent complete is equivalent to 600 units 100 percent complete). The formula for EUP is:

EUP = Units x Percentage complete

In department 1 during May, Model Dairies could have made 600 gallons of completely processed milk (pasteurized and ready to transfer to department 2) with the amount of work done on the ending WIP. This amount is in addition to the 9,000 gallons completed and transferred. Thus, Model Dairies pasteurized 9,000 gallons completely plus 1,000 gallons only 60 percent, or equivalently, the company did enough work to have made 9,600 gallons of fully pasteurized (completed) milk.The $17,000 in input costs used (recorded in journal entries 5-7) was enough to produce 9,600 gallons from start to finish (i.e., “from scratch”). On average, then, it cost $1.77 (rounded) per gallon to pasteurize milk in department 1 during May ($17,000 divided by 9,600 EUP). The total department 1 cost of the 9,000 gallons transferred out should be $15,930 ($1.77 per gallon times 9,000 gallons).

Computing Equivalent Units Of Production

The preceding example just considered the EUP for ending WIP. The EUP calculation is needed for each subset (or group) of partially completed units in the department for the month:

• The partially completed products in beginning WIP

• The partially completed products in ending WIP

• The partially completed products that are rejected during the month (spoilage)

Additionally, the EUP calculation has to be performed for each cost element that is input into the process at a different time, or in different amounts, from the other inputs. To demonstrate, consider again Model Dairies' ending WIP of 1,000 gallons in department 1. Those gallons were 60 percent complete. In other words, they were 60 percent through the department 1 process. But since all the raw milk was added at the beginning of the process, these 1,000 gallons were really 100 percent complete with respect to the amount (and cost) of raw milk input. Further complicating the unit cost calculation, only one-half of the direct labor needed to fully process these gallons had been incurred up to this point. So, the 1,000 gallons were only 50 percent complete with respect to direct labor. Finally, assume that overhead costs are used up uniformly throughout the process. Then, if the ending WIP was 60 percent “down-the-line”, these 1,000 gallons were 60 percent complete with respect to overhead.

|

Exhibit 6 -6 Model Dairies Department 1 Unit Cost |

|||||

|

PCAS FOR MODEL DAIRIES SPREADSHEET PROGRAM TO CALCULATE DEPARTMENT 1'S COST PER EUP For May 1995 |

|

|

|||

|

DATA SECTION: |

|

|

|

|

|

|

|

Units |

DM Added |

DL Added |

Applied OH |

|

|

Beginning WIP Inventory Beginning WIP % Complete Beginning WIP Cost Units Started Costs Added Ending WIP Inventory Ending WIP % Complete Units Completed Output Loss Output Loss % Complete |

0

10,000 1,000

9,000 0

|

- - $0 - $10,000 - 100.00% - - - |

- - $0 - $2,000 - 50.00% - - - |

- - $0 - $5,000 - 60.00% - - - |

|

|

SOLUTION SECTION: |

|

|

|

|

|

|

MODEL DAIRIES DEPARTMENT 1 COST REPORT MAY 1995 |

|

|

|||

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

|

Units Completed |

9,000 |

9,000 |

9,000 |

9,000

|

|

|

Less Beginning WIP |

0 |

0 |

0 |

0 |

|

|

Add Ending WIP |

1,000 |

1,000 |

500 |

600 |

|

|

Add Output Loss |

0 |

0 |

0 |

0 |

|

|

UNITS STARTED |

10,000 |

|

|

|

|

|

EQUIVALENT UNITS |

|

10,000 |

9,500 |

9,600 |

|

|

COST PER EUP: |

|

|

|

|

|

|

Beginning WIP Cost |

|

$0 |

$0 |

$0 |

$0 |

|

Costs Added This Month |

|

10,000 |

2,000 |

5,000 |

17,000 |

|

COSTS INCURRED |

|

$10,000 |

$2,000 |

$5,000 |

$17,000 |

|

UNIT COSTS |

|

$1.00 |

$0.21 |

$0.52 |

$1.73 |

|

|

|

|

|

||

Because each cost element is input in differing amounts and at differing times, separate EUP and unit cost calculations have to be performed for each cost element. The management accountant for Model Dairies created a spreadsheet program to perform all these calculations and determine the cost to make a gallon of pasteurized milk in department 1 for May. Exhibit 6-6 shows the output from this program.

There was no beginning WIP or spoilage, so these can be ignored at this time. They will be addressed in the next section. In interpreting the program's output, each cost element should be considered separately. First, consider the direct materials column (DM Added) of the program's Solution Section:

In total, 10,000 gallons of raw milk were input into the process at a cost of $10,000. Of these, 9,000 gallons were fully processed (completed), plus there were another 1,000 gallons in ending WIP (1,000 gallons times 100 percent complete for the raw milk direct material). In total, EUP for raw milk equals 10,000 gallons. Dividing the $10,000 cost by 10,000 EUP results in a $1.00 per gallon average cost for raw milk.

Second, consider the direct labor column (DL Added):

Enough labor was used (and cost incurred) to process the 9,000 gallons that were completed, plus 500 EUP in the ending WIP (1,000 gallons times 50 percent complete for labor). The $2,000 incurred on labor was enough to equivalently produce 9,500 completely processed gallons, yielding a unit cost for direct labor of $0.21 per gallon (rounded).

Third, consider the overhead column (Applied OH):

Enough overhead was incurred to fully process the 9,000 gallons completed, plus another 600 EUP in ending WIP (1,000 gallons times 60 percent complete for overhead). The $5,000 in applied overhead was enough to equivalently produce 9,600 completely processed gallons, yielding a unit cost for overhead of $0.52 per gallon (rounded).

In total, then, the cost of fully processing a gallon of raw milk into pasteurized milk within department 1 during May was $1.73 (the sum of the three inputs' unit costs).

Note that this example included the ending WIP percentage complete for each cost element. If information is only available from the shop floor as to the stage of completion of beginning WIP, ending WIP, or spoilage, then the management accountant will have to figure out what percentage complete each input is at these stages. In other words, the management accountant must answer the question, “If the ending WIP is 60 percent processed, what percentage complete is each cost element at that stage of the process?” This is the second of the six steps involved in departmental cost accounting in a PCAS.

Steps In Preparing The Pcas Journal Entry 8 For Department Transfers

LEARNING OBJECTIVE 3

Describe the six steps for departmental cost accounting in a PCAS.

The best way to learn how to set up and perform the steps necessary in preparing journal entry 8 is to go through, in detail, steps 2 through 5 in the six-step approach to departmental cost accounting. This section will highlight all six steps. In the next section, steps 2 through 5 will be demonstrated.

The Six-step Approach To Departmental Cost Accounting

Step 1. Journalize the acquisition and use of the cost elements. As in any basic CAS, journal entries 1-7 must be prepared and posted to the appropriate subsidiary ledger accounts in RMI and WIP.

Step 2. Summarize the flow of cost elements and calculate the input’s percentage complete. Units must be identified, such as those started in this period and those still in process from the previous period. This determines the number of units “to account for.” Units are “accounted for” according to whether they are transferred to the next process (department) or to finished goods (if this is the last department in the factory), are still in process (ending WIP), or were spoiled. The total units “accounted for” must agree with the total units “to account for.” Then, the percentage complete of each cost element for the partially completed units must be determined.

Step 3. Compute equivalent units of production. EUP must be calculated for each cost element in each subset of units only partially processed during the month (i.e., beginning WIP, ending WIP, and spoilage). If all direct materials are at the same degree of completion, a single direct materials calculation can be made. If multiple direct materials are used and are placed into production at different points, EUP calculations will be needed for each direct material. For example, in making vegetable soup, a tomato stock may be introduced at the beginning of the process, vegetables added at the 30 percent stage of completion, and cans brought in for packaging at the end of the process.

Step 4. Compute unit production costs. Once costs are accumulated by the processing centers or departments, and the period's output is determined in terms of EUP, unit production costs are computed by dividing the department's costs by its output expressed in EUP.

Step 5. Calculate the costs of completed and transferred output, ending WIP, and spoilage. In this step, total production costs are assigned to units transferred out, ending WIP inventory, and spoiled units. Journal entry 8 is prepared to record the transfer of products to the next department (or to FGI if this is the last department). In a normal PCAS, journal entry 8 is prepared from a department production cost report.

Step 6. Prepare cost management reports analyzing whether department costs were within budget. A variety of management control reports can be prepared. In a normal PCAS, departmental costs can be compared against budgeted costs, similar to the job cost reports in Exhibits 5-15 and 5-22 in the previous chapter. In a standard PCAS, standard costs can be used to prepare detailed cost variance reports by department. These types of reports will be illustrated in Chapter 8.

Cost Flows Within A Department: Fifo Versus Weighted-average Methods

So far, two production flows between departments (processes) have been identified: sequential and parallel processing. The question is, “Which department (WIP subsidiary ledger account) is debited for the costs of WIP transferred out of department X?” The calculation of EUP or unit costs is the same for sequential and parallel processes.

A new question, which does affect the calculation of EUP and unit cost, now needs to be addressed: “How does production flow through a particular department?” Most PCASs are based on one of two types of product flows: first-in, first-out (FIFO) and weighted-average (WA). Differences occur only when beginning WIP exists.

Beginning WIP in a department means that some processing costs are “left over” from last month. Last month's ending WIP is this month's beginning WIP. With a FIFO flow, the first units worked on are the first units completed. Production flows through a department as if on an assembly line or a JIT. Product 1 is started, then product 2, then product 3, and so forth. Product 1 is finished first, followed by product 2, then 3, and so forth. This production flow allows the PCAS to separate last month's production effort, and costs, from this month's. Thus, with a first-in, first-out (FIFO) cost flow method, department production cost reports can be prepared that isolate last month's costs from this month's, promoting cost trend analyses from month to month.

Some production processes within a department do not work on one product after another. For example, in the oil refinery mentioned earlier, when crude oil is input into the cracking process, it is mixed up with crude oil already in the processing tank. The output from this process is a mixture of leftover crude input last month (beginning WIP) and new crude input this month. Because last month's and this month's “work” are commingled, so are the costs in the PCAS. The best the PCAS can do is to compute a weighted- (or moving) average unit cost across the two months. This means that with a weighted-average (WA) cost flow method, beginning WIP (and its costs) are averaged with work (and costs) done this month in calculating EUP and unit costs. Thus, the only difference between the FIFO and WA methods is whether beginning WIP is separately accounted for or averaged in with this month's work.

Product Costing For First-in, First-out (Fifo) Process Flows

LEARNING OBJECTIVE 2

Explain equivalent units of production (EUP), and calculate EUP for each cost element in the beginning and ending inventories and in the spoilage.

The Pretty Pots example on the next page demonstrates steps 2 through 5 using a FIFO process flow. The data for Pretty Pots' production of clay pottery during July are included in the example.

Step 2: Summarize The Flow Of Cost Elements And Calculate The Inputs' Percentage Complete

Panel (a) of Exhibit 6-7

|

is called an input usage flow diagram. This is a line chart that maps how and when inputs are added into a process or department. To calculate EUP, the management accountant needs to know how much of each input is in the product. Review the Model Dairies example at the beginning of the chapter. Ending WIP was 1,000 gallons, 100 percent complete for raw milk, 50 percent complete for direct labor, and 60 percent complete for overhead. To obtain these percentages, the management accountant needs to know the input usage flows; that is, how much of an input is added into the process and when. Roy Potter's line chart provides a simple map of these input usage flows for Pretty Pots Molding Department. Preparing the input usage flow diagram is step 2 of the six steps in process costing.

|

INSIGHTS & APPLICATIONS Pretty Pots Production Data for the Molding Department Pretty Pots uses two processes, Molding and Firing, to manufacture clay flowerpots. Each pot is processed through both departments. From the firing process, the clay flowerpots are transferred to finished goods. In the Molding Department, a raw clay mixture known as Mud-X is started at the beginning of the process and mixed with water for two hours. |

The smooth liquefied clay is injected into molds where excess moisture is vaporized. Once the clay has set, the molds are removed, and the pots inspected. Sometimes, the clay has too much or too little moisture, causing the pots to collapse or crack, resulting in spoilage. After the clay pots are cured, they are transferred to the Firing Department where they are subjected to extreme heat. After firing is completed, the pots are glazed and/or handpainted and then transferred to the finished goods warehouse.Roy Potter, the management accountant, obtained the following information from the PCAS about Molding Department production data for July: |

Reviewing the input usage flow diagram in Exhibit 6-7a, notice that all direct materials (Mud-X and water) are added at the beginning of processing. Thirty percent of the direct labor is added over the first one-fourth (25 percent) of the process. This is the mixing operation in Roy Potter's notes. One-half of the direct labor is used over just 10 percent of the process (the mold removal and inspection operation). The last 20 percent of the direct labor used in the department is required during the last 40 percent of processing (curing). Overhead is used up uniformly throughout the department's operations.

|

|

COSTS |

UNITS |

|

Beginning work-in-process: |

|

50 |

|

Direct materials |

$ 75 |

|

|

Direct labor |

27 |

|

|

Applied overhead |

60 |

|

|

Total beginning WIP cost |

$162 |

|

|

Units started during July |

|

150 |

|

Units completed and transferred to Firing during July |

|

145 |

|

Ending work-in-process |

|

30 |

|

Spoilage during July |

|

25 |

|

Input costs incurred during July: Direct materials (Mud-X) |

$150 |

|

|

Direct labor |

354 |

|

|

Applied overhead |

492 |

|

|

Total costs added to process |

$996 |

|

|

Realizing that he needed more information, Roy went to see the production manager to find out how the molding process worked. The production manager walked Roy through the department, showing him how pots are made. The process wasn't as simple as Roy expected, so, he took some notes: During the first 25 percent of the process, clay and water are mixed. They are put into a big drum at the beginning of processing. The mixing process uses 30 percent of the department's labor time.

During the next 25 percent of the process, injection and molding take place. No labor is involved in this operation. The next 10 percent of the process involves mold removal and inspection (MR&I). This is a labor-intensive operation, requiring 50 percent of the department's labor time. |

The last 40 percent of the process is curing. This operation uses 20 percent of the labor needed to make pots in the Molding Department.

Now Roy understood the process better. He had observed the various operations involved, how much of each cost element was used in each operation, and when it was input. He then went back to his office and drew a simple line chart of the Molding Department's process.This line chart is shown in Exhibit 6-7a. He took the line chart back to the production manager to verify its correctness. With the line chart, Roy now had a simple method to calculate the percentage complete of beginning and ending WIT and spoilage for each cost element. With the percentage complete information, he could then write a spreadsheet program to calculate EUP and provide a department production cost report. |

With his input usage flow diagram, Roy Potter can now calculate how much of each input is in the beginning and ending WIP, as well as the spoiled pots for any month. All he has to do for a given month is to draw two dashed vertical lines where beginning and ending inventories are, and add the number of pots for each to the bottom of the diagram. Roy did this from the PCAS information for July in panel (b) of Exhibit 6-7. At the beginning of the month (BI), there were 50 pots 40 percent complete (i.e., they were 40 percent of the way down the assembly line). At the end of the month (EI is ending WIP on the input usage flow diagram), there were 30 pots 80 percent complete. Spoilage is identified when the pots are 60 percent complete (QC stands for quality control inspection in the diagram); 25 pots were rejected during July.

HOW MUCH OF EACH COST ELEMENT (ITS PERCENTAGE COMPLETE) IS IN BEGINNING WIP? The beginning WIP percentage complete for each input can be determined by noting how much of the input is in a pot by the time it is 40 percent “down-the-line.” Since all direct materials are added at the beginning, 100 percent of Mud-X and water are already in each pot comprising the beginning WIP. No more Mud-X or water has to be added to finish these pots in July. All the direct materials were added in June. In other words, the beginning WIP is 100 percent complete with respect to direct materials.

How much of the direct labor is in the beginning WIP? The answer is 30 percent. This amount was input by the time the pots are 25 percent down-the-line, and no more labor is used between that time and the point where the beginning WIP is. So, the beginning WIP is 30 percent complete with respect to direct labor.

Since overhead is added uniformly throughout the process, if the pots are 40 percent down-the-line, 40 percent of the overhead required to complete them has already been added. The beginning WIP is 40 percent complete with respect to overhead.

Roy Potter constructed a spreadsheet program to calculate EUP given the number of pots and their percentage complete for each input. The program, shown in Exhibit 6-8,

|

Exhibit 6 -8 Molding Department's EUP at Pretty Pots |

||||

|

PCAS FOR PRETTY POTS SPREADSHEET PROGRAM TO CALCULATE MOLDING DEPARTMENT'S EUP For July 201x |

||||

|

DATA SECTION: |

|

|

|

|

|

|

Units |

DM Added |

DL Added |

Applied OH |

|

Beginning WIP Inventory |

50 |

|

|

|

|

Beginning WIP % Complete |

|

100.00% |

30.00% |

40.00% |

|

Beginning WIP Cost |

|

$75 |

$27 |

$60 |

|

Units Started |

150 |

|

|

|

|

Costs Added |

|

$150 |

$354 |

$492 |

|

Ending WIP Inventory |

30 |

|

|

|

|

Ending WIP % Complete |

|

100.00% |

90.00% |

80.00% |

|

Units Completed |

145 |

|

|

|

|

Output Loss |

25 |

|

|

|

|

Output Loss % Complete |

|

100.00% |

80.00% |

60.00% |

|

Cost Method |

1 |

(1 = FIFO, 2 = WA) |

|

|

|

SOLUTION SECTION: FIFO |

|

|

|

|

|

|

|

PRETTY POTS MOLDING DEPARTMENT COST REPORT JULY 201x |

||

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

|

Units Completed |

145 |

145 |

145 |

145 |

|

Less Beginning WIP |

<50> |

<50> |

<15> |

<20> |

|

Add Ending WIP |

30 |

30 |

27 |

24 |

|

Add Output Loss |

25 |

25 |

20 |

15 |

|

UNITS STARTED |

150 |

|

|

|

|

EQUIVALENT UNITS |

|

150 |

177 |

164 |

|

|

|

|

||

is the same one used in the Model Dairies illustration (Exhibit 6-6). Roy uses the Data Section to input each month's information. The percentage complete information for each cost element in the beginning WIP pots is in the second line (row) of the Data Section (the “Beginning WIP % Complete” line). The Solution Section is the formal report, which is automatically updated each time new raw data are input into the Data Section.

HOW MUCH OF EACH COST ELEMENT (ITS PERCENTAGE COMPLETE) IS IN THE SPOILED POTS REJECTED AT QC? Many traditional production processes have quality control (QC) inspection points throughout the process. In JITs, quality control is the responsibility of each cell worker when performing each operation within the cell. Thus, rejects (spoilage) can occur at any stage of production. If pots are rejected at the end of a process, calculating the EUP for each cost element is simple. Because each rejected pot is complete by the time it reaches the end of the process, 100 percent of all inputs are already in the pot; that is, it is 100 percent complete with respect to all cost elements.

But what if a pot is rejected part way through a process, such as at the 60 percent stage of completion in the Molding Department? How much of each cost element is in one of these rejected pots? Roy Potter used his input usage flow diagram in Exhibit 6-7b to determine the percentage complete of each cost element. Since all direct materials are added at the beginning, spoilage (the rejected pots) is 100 percent complete with respect to direct materials.

By the time a pot gets 60 percent through the department, 80 percent of the direct labor needed to make a pot already has been used (added to it). Thirty percent was incurred by the time the pots were 25 percent processed. By the time these pots were 60 percent of the way through the department, another 50 percent of labor was added. In total, then, spoilage is 80 percent complete with respect to direct labor.

Since overhead is added uniformly throughout the process, if pots are rejected when they are 60 percent through the department, then spoilage is 60 percent complete with respect to overhead. In Exhibit 6-8's Data Section, Roy Potter entered these percentages in the line labelled “Output Loss % Complete.”

HOW MUCH OF EACH COST ELEMENT (ITS PERCENTAGE COMPLETE) IS IN ENDING WIP? The ending WIP is 80 percent complete with its processing in the Molding Department. Since all direct materials are added at the beginning, 100 percent of the direct materials are already in these pots. No more direct materials have to be added next month to finish them. Thus, they are 100 percent complete with respect to direct materials. If the ending WIP is 80 percent processed through the department, then these pots are 80 percent complete with respect to overhead because overhead is added uniformly throughout the process.

Calculating the direct labor percentage complete is harder, however. Looking at the input usage flow diagram in Exhibit 6-7b, it is easy to see that 80 percent of direct labor is added by the time the pots are 60 percent of the way through the department. But, how much is added between the 60 percent and 80 percent stages of completion? Assuming the last 20 percent of labor is added uniformly over the last 40 percent of processing in the department, the amount added between 60 and 80 percent can be calculated using simple linear interpolation.

First, the amount of labor added between the 60 and 80 percent stages of completion can be intuitively determined. This is one-half of the processing (curing) during which 20 percent of labor is used. One-half of 20 percent is 10 percent. Alternatively, 20 percent of labor is added over 40 percent of the department's processing. Therefore, one-half percent of labor is added for each percent of processing. If 20 percent more processing is done, then 10 percent more labor is used. Using linear interpolation to verify this intuition:

|

percent added = |

Distance from starting point of line segment to units |

x |

input added over line segment |

|

length of line segment |

since 60% to 80% = 20%,

10% = (20% / 40%) X 20%

The labor added to the pots in ending WIP is 90 percent of what is needed to fully make a pot. Eighty percent was added by the time processing reached QC, and another 10 percent of labor was added during the curing process. In total, then, the ending WIP is 90 percent complete with respect to direct labor. These percentages are in the Data Section line “Ending WIP % Complete” (Exhibit 6-8).

Before completing step 2, Roy Potter used the input usage flow diagram to verify that all pots have been accounted for. Since there were 50 pots in beginning WIP and 150 pots started in July, two hundred pots could have been completed. In accounting for these 200 pots, 145 were completed, 30 were in ending WIP, and 25 pots were spoiled (rejected at QC). This internal control check is formally shown in the spreadsheet's Solution Section “Units” column. The “Units Started” of 150 pots is a summation of that column. This result is visually compared to the Data Section entry for units started to make sure they agree. Step 2 is now finished. The rest of the PCAS calculations are relatively simple.

Step 3: Calculate Fifo Eup

EUP is calculated for each subset of pots (beginning and ending WIP, spoilage) for each input. If there are three subsets of pots and three cost elements, then nine EUP calculations need to be made. The EUP formula is:

EUP = Units X Percentage complete

In the Solution Section of the spreadsheet program in Exhibit 6-8, each of these nine EUP calculations can be verified by looking at the spreadsheet cells for the three middle columns (DM Added, DL Added, Applied OH) and the three rows for the partially completed pots (Less Beginning WIP, Add Ending WIP, Add Output Loss). Output loss refers to rejected pots (spoilage).

Why are the beginning WIP pots subtracted from the pots completed? Remember that FIFO accounts for last month's work and costs separately from this month's. Consider Mud-X (the DM Added column in the spreadsheet's Solution Section). Even though 145 pots were completed in July, were 145 pots' worth of Mud-X needed in July? No, 50 pots were leftover from June (the July beginning WIP). All the Mud-X needed to make these pots was added in June, and no more was needed in July. In other words, to complete 145 pots in July, given a fully completed beginning WIP with respect to direct materials, only 95 pots' worth of Mud-X had to be requisitioned in July. In addition to this 95 pots' worth of Mud-X needed to complete the 145 pots, another 30 pots in ending WIP and 25 rejects also were 100 percent complete with respect to direct materials. In total, enough direct materials were used in July to fully process 150 pots (145 - 50 = 95, 95 + 30 + 25 = 150 EUP for direct materials).

Before proceeding, the definition of EUP should be reviewed to see if it makes sense. This same logic should be verified with the other cost elements (the DL Added and Applied OH columns in the Solution Section of Exhibit 6-8).

Step 4: Calculate Cost Per Unit

This is really a cost per EUP. This calculation is added to the bottom of the spreadsheet program as shown in Exhibit 6-9In July1, $150 worth of direct materials were requisitioned into the Molding Department. This was enough to make 150 pots, so the cost of Mud-X per pot was $1 in July. Remember, FIFO only considers July's effort (work or resources used) and costs. That is why the beginning WIP EUP was subtracted from the completed pots in the EUP calculation, and why beginning WIP cost is not considered in the cost per unit calculation here. (The work, as measured in EUP, is for the same time period as the costs. Both are only for July.) To emphasize that Beginning WIP Cost should not be included in the Cost Per EUP, Roy entered “n/a” in the cells for the Beginning WIP Cost line.

Because each cost element is used up in a different way throughout the Molding Department, separate EUP and cost per EUP calculations are necessary. Whenever two cost elements have identical usage flows, their EUP will be the same. Whenever cost elements have different usage flows, they must be accounted for individually.

|

Exhibit 6 -9 Molding Department's Unit Cost at Pretty Pots |

|||||

|

PCAS FOR PRETTY POTS SPREADSHEET PROGRAM TO CALCULATE MOLDING DEPARTMENT'S COST PER UNIT For July 1995 |

|

||||

|

DATA SECTION: |

|

|

|

|

|

|

|

Units |

DM Added |

DL Added |

Applied OH |

|

|

Beginning WIP Inventory Beginning WIP % Complete Beginning WIP Cost Units Started Costs Added Ending WIP Inventory Ending WIP % Complete Units Completed Output Loss Output Loss % Complete Cost Method (1 = FIFO, 2 = WA) |

50

150

30

145 25

1 |

100.00% $75

$150

100.00%

100.00% |

30.00% $27

$354

90.00%

80.00% |

40.00% $60

$492

80.00%

60.00% |

|

|

SOLUTION SECTION: FIFO |

|

|

|

||

|

|

PRETTY POTS MOLDING DEPARTMENT COST REPORT JULY 1995 |

|

|||

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

|

Units Completed |

145 |

145 |

145 |

145 |

|

|

Less Beginning WIP |

<50> |

<50> |

<15> |

<20> |

|

|

Add Ending WIP |

30 |

30 |

27 |

24 |

|

|

Add Output Loss |

25 |

25 |

20 |

15 |

|

|

UNITS STARTED |

150 |

|

|

|

|

|

EQUIVALENT UNITS |

|

150 |

177 |

164 |

|

|

COST PER EUP: |

|

|

|

||

|

Beginning WIP Costs |

|

n/a |

n/a |

n/a |

n/a |

|

Costs Added This Month |

|

$150 |

$354 |

$492 |

$996 |

|

COSTS INCURRED |

|

$150 |

$354 |

$492 |

$996 |

|

UNIT COSTS |

|

$1.00 |

$2.00 |

$3.00 |

$6.00 |

|

|

|

|

|||

The good news is that the formula is always the same, only the numeric values change. This is why process costing is an ideal application for spreadsheet software. The EUP formula, for example, can be entered into one cell and then copied to all the other spreadsheet cells where other EUP calculations are to be performed. If separate data and report (solution) sections are properly created in the program, then each month's raw data can be input, and the program will update the results for that month. In other words, the modern management accountant needs to know how to create “template” programs that are reusable month after month. Creating such a program fox process costing was relatively simple for Roy Potter, the management accountant for Pretty Pots.

Step 5: Calculate The Costs Of Completed Output, Ending Wip, And Spoilage

Roy Potter calls the final section of his spreadsheet program “Cost Allocations.” It is added to the bottom of the program and is shown in Exhibit 6-10 Again, only one formula is needed for virtually all the cells in this section of the spreadsheet:

Total cost of an input item for a particular subset of units = EUP X Cost per unit

Remembering that EUP = Units X Percentage complete for a cost element leads to the conclusion that there is only one basic formula in process costing:

EUP = Units X Percentage complete for a cost element

This formula yields EUP. When calculating the total cost of an input item, the cost per unit value is attached to the formula:

Total cost of an input for particular units = Units x % complete for a cost element x Cost per unit

To verify this, consider the DM Added column in the Cost Allocations section for ending WIP. There are 30 pots in ending WIP, 100 percent complete with respect to direct materials, multiplied by the direct materials cost of $1 per pot. For the direct labor cost in the output loss (spoilage), there are 25 spoiled pots, 80 percent complete with respect to direct labor, multiplied by the direct labor cost of $2 per pot (total direct labor cost in spoilage is $40).

The Units Completed subsection needs further elaboration. FIFO accounts for each month's work and costs separately. The 145 completed pots involved 50 pots from beginning WIP (started but not finished last month) plus 95 pots started and completed this month. This is shown in the “Units” column. The 50 pots have a beginning WIP cost (costs incurred last month) of $75 for direct materials, $27 for direct labor, and $60 in applied overhead. These 50 pots needed some more inputs to finish them in July. How many?

Cost to complete beginning WIP units = Units x (1 %Complete last month) X Cost per unit

To illustrate, the direct materials costs to complete the beginning WIP is zero. The beginning WIP was 100 percent complete with respect to direct materials last month, so no more direct materials had to be added in July.

|

Direct materials costs to complete the beginning WIP units |

= 50 units X (1 - 100%) X $1.00 per unit |

|

= 50 units X (1 - 1.00) X $1.00 per unit |

|

|

|

= $0 |

For direct labor, these 50 pots were 30 percent complete last month (this month's beginning WIP percentage complete). Therefore, only 70 percent of the required labor to make a pot had to be added in July. The 50 pots times 70 percent labor needed in July times July's labor cost of $2.00 per pot equals $70.

|

Direct labor costs to complete the beginning WIP units |

= 50 units X (1 - 30%) X $2.00 per unit |

|

= 50 units X (1 - 0.30) X $2.00 per unit |

|

|

= $70 |

For applied overhead:

|

Applied overhead costs to complete the beginning WIP units |

= 50 units X (1 - 40%) X $3.00 per unit |

|

|

= 50 units X (1 - 0.40) X $3.00 per unit |

|

|

= $90 |

These costs are shown in the Costs to Complete line just below the Beginning WIP Costs line in the Units Completed subsection of Cost Allocations in Exhibit 6-10. In total, the beginning WIP had a cost from June of $162. Another $160 (in direct labor and overhead) was needed to finish them in July.

The 95 pots started and completed in July had 100 percent of each cost element added in July times the July cost per pot for each input item. This is the same basic formula used for the ending WIP and spoilage.

|

Costs for 95 pots started and completed in July: |

||

|

|

Direct materials: |

95 pots X 100% complete X $1.00 per pot = $ 95 |

|

|

Direct labor: |

95 pots X 100% complete X $2.00 per pot = $190 |

|

|

Applied overhead: |

95 pots X 100% complete X $3.00 per pot = $285 |

|

Costs for 30 pots in ending WIP inventory: |

|||

|

|

Direct materials: |

30 pots X 100% complete X $1.00 per pot = $30 |

|

|

|

Direct labor: |

30 pots X 90% complete X $2.00 per pot = $54 |

|

|

|

Applied overhead: |

30 pots X 80% complete X $3.00 per pot = $72 |

|

|

Costs for 25 pots rejected (spoiled): |

|||

|

|

Direct materials: |

25 pots X 100% complete X $1.00 per pot = $25 |

|

|

|

Direct labor: |

25 pots X 80% complete X $2.00 per pot = $40 |

|

|

|

Applied overhead: |

25 pots X 60% complete X $3.00 per pot = $45 |

|

|

|

|

|

|

Before making the journal entry to record the pots transferred from the Molding Department to the Firing Department, Roy Potter performed one more internal control check. Have all the costs in WIP-Molding Department been accounted for? The beginning WIP cost was $162, costs added in July were $996, which equals $1,158 to account for. The cost of the pots transferred to Firing was $892, the cost of ending WIP was $156, and the cost of the spoiled pots was $110. The costs accounted for sum to the same $1,158. Therefore, all costs have been accounted for, and Roy Potter is ready to make journal entry 8 to record the transfer of the 145 completed pots from Molding to Firing.

The costs calculated in the preceding example were based on a FIFO flow of pots through the Molding Department. If a WA flow is appropriate, the costs could be different. Consequently, before making journal entry 8, the differences between the FIFO cost per unit and the WA cost per unit should be discussed.

Product Costing For Weighted-average (Wa) Process Flows

LEARNING OBJECTIVE 4

Demonstrate the differences in calculating product costs between FIFO and weighted-average methods.

In a FIFO flow, last month's work and costs can be separated from this month's. Last month's effort (the beginning WIP) is backed out of the EUP calculation, and last month's (July's beginning WIP) cost is separately treated in the Cost Allocations section of the department's production cost report. In a WA flow, however, the units worked on last month cannot be separated from the units worked on this month. Because the units in beginning WIP and the units started this month are mixed together, their costs cannot be separately accounted for and, instead, must be averaged together. This is the only difference between FIFO and WA: in FIFO, the beginning WIP is separately accounted for, but in WA it is averaged in with this month's work and costs.

|

Exhibit 6 -10 Molding Department's FIFO Cost Report at Pretty Pots |

|||||

|

SOLUTION SECTION: FIFO |

|

|

|||

|

|

PRETTY POTS MOLDING DEPARTMENT COST REPORT JULY 1995 |

|

|||

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

|

Units Completed |

145 |

145 |

145 |

145 |

|

|

Less Beginning WIP |

<50> |

<50> |

<15> |

<20> |

|

|

Add Ending WIP |

30 |

30 |

27 |

24 |

|

|

Add Output Loss |

25 |

25 |

20 |

15 |

|

|

UNITS STARTED |

150 |

|

|

|

|

|

EQUIVALENT UNITS |

|

150 |

177 |

164 |

|

|

COST PER EUP: |

|

|

|

|

|

|

Beginning WIP Cost |

|

n/a |

n/a |

n/a |

n/a |

|

Costs Added This Month |

|

$150 |

$354 |

$492 |

$996 |

|

COSTS INCURRED |

|

$150 |

$354 |

$492 |

$996 |

|

UNIT COSTS |

|

$1.00 |

$2.00 |

$3.00 |

$6.00 |

|

COST ALLOCATIONS: |

|

|

|

|

|

|

UNITS COMPLETED: |

145 |

n/a |

n/a |

n/a |

n/a |

|

Beginning WIP Costs |

50 |

$75 |

$27 |

$60 |

$162 |

|

Costs To Complete Beg. WIP |

|

0 |

70 |

90 |

160 |

|

Started This Month |

95 |

95 |

190 |

285 |

570 |

|

COSTS TRANSFERRED OUT |

|

$170 |

$287 |

$435 |

$892 |

|

ENDING WIP INVENTORY |

30 |

$30 |

$54 |

$72 |

$156 |

|

OUTPUT LOSS |

25 |

$25 |

$40 |

$45 |

$110 |

|

COSTS ACCOUNTED FOR: |

|

$225 |

$381 |

$552 |

$1,158 |

|

|

|

|

|

|

|

To illustrate, study the WA department production cost report for the Molding Department in Exhibit 6-11. In the EUP section, the beginning WIP EUP is not subtracted from the completed units (line 2). EUP includes last month's work on the beginning WIP with this month's work on all the products. Thus, in the Cost Per EUP section, the beginning WIP costs are also included in the Costs Incurred. The work on all the units is combined, and the costs for all this work are combined. The resulting unit cost is an average cost of work done last month with work done this month.

|

Exhibit 6 -11 Molding Department's Weighted-Average Cost Report at Pretty Pots |

|||||

|

SOLUTION SECTION: WA |

|

|

|||

|

|

PRETTY POTS MOLDING DEPARTMENT COST REPORT JULY 1995 |

|

|||

|

|

|||||

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

|

Units Completed |

145 |

145 |

145 |

145 |

|

|

Less Beginning WIP |

<50> |

n/a |

n/a |

n/a |

|

|

Add Ending WIP |

30 |

30 |

27 |

24 |

|

|

Add Output Loss |

25 |

25 |

20 |

15 |

|

|

UNITS STARTED |

150 |

|

|

|

|

|

EQUIVALENT UNITS |

|

200 |

192 |

184 |

|

|

|

|

|

|

|

|

|

COST PER EUP: |

|

|

|

|

|

|

Beginning WIP Costs |

|

$75 |

$27 |

$60 |

$162 |

|

Costs Added This Month |

|

150 |

354 |

492 |

996 |

|

COSTS INCURRED |

|

$225 |

$381 |

$552 |

$1,158 |

|

UNIT COSTS |

|

$1.13 |

$1.98 |

$3.00 |

$6.11 |

|

COST ALLOCATIONS: |

|

|

|

|

|

|

UNITS COMPLETED: |

145 |

$163 |

$288 |

$435 |

$886 |

|

Beginning WIP Costs |

|

n/a |

n/a |

n/a |

n/a |

|

Costs To Complete Beg. WIP |

|

n/a |

n/a |

n/a |

n/a |

|

Started This Month |

|

n/a |

n/a |

n/a |

n/a |

|

COSTS TRANSFERRED OUT |

|

$163 |

$288 |

$435 |

$886 |

|

ENDING WIP INVENTORY |

30 |

$34 |

$54 |

$72 |

$159 |

|

OUTPUT LOSS |

25 |

$28 |

$40 |

$45 |

$113 |

|

COSTS ACCOUNTED FOR:, |

|

$225 |

$381 |

$552 |

$1,158 |

Under Cost Allocations, the same formula used with FIFO is used with WA to calculate the total costs:

Total Cost = Units X % complete for a cost element X Cost per unit

The total cost of the completed units is straightforward with WA. There is no distinction between, or separate accounting for, beginning WIP and the rest of the units completed. To illustrate, the total cost of direct materials in the completed pots during July was $163 (145 pots times 100 percent complete times $1.13 per pot for direct materials).2 The same is true for each cost in this section. The cost of pots transferred to the Firing Department for journal entry 8 is $886 (145 pots times $6.11 each).

Comparing The Department Production Cost Reports

The FIFO and WA calculations for EUP, cost per unit, and cost totals are compared in Exhibit 6-12.FIFO accounts for beginning WIP separately, whereas WA does not. This single difference between the two methods leads to the six lines being different in the FIFO and WA reports as described next:

• Less Beginning WIP (EUP section, line 2). With FIFO the beginning WIP EUP is subtracted so that it can be separately accounted for. With WA it is not backed out and, thus, is included in EUP totals.

|

|

Exhibit 6 -12 Comparing the FIFO and Weighted-Average Methods |

||||||||||

|

SOLUTION SECTION: FIFO |

|

|

|

|

|

WA |

|

|

|

|

|

|

|

|

PRETTY POTS |

|

|

PRETTY POTS |

|

|||||

|

|

|

MOLDING DEPARTMENT COST REPORT |

|

|

MOLDING DEPARTMENT COST REPORT |

|

|||||

|

|

|

|

JULY 1995 |

|

|

|

|

JULY 1995 |

|

|

|

|

EUP: |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

Units |

DM Added |

DL Added |

Applied OH |

Totals |

|

|

Units Completed |

145 |

145 |

145 |

145 |

|

145 |

145 |

145 |

145 |

|

|

|

|

Less Beginning WIP |

<50> |

<50> |

<15> |

<20> |

|

<50> |

n/a |

n/a |

n/a |

|

|

Add Ending WIP |

30 |

30 |

27 |

24 |

|

30 |

30 |

27 |

24 |

|

|

|

Add Output Loss |

25 |

25 |

20 |

15 |

|

25 |

25 |

20 |

15 |

|

|

|

UNITS STARTED |

150 |

|

|

|

|

150 |

|

|

|

|

|

|

EQUIVALENT UNITS |

|

150 |

177 |

164 |

|

|

200 |

192 |

184 |

|

|

|

COST PER EUP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning WIP Cost |

|

n/a |

n/a |

n/a |

n/a |

|

$75 |

$ 27 |

60 |

62 |

|

Costs Added This Month |

|

$150 |

$354 |

$492 |

$996 |

|

150 |

354 |

492 |

996 |

|

|

|

COSTS INCURRED |

|

$150 |

$354 |

$492 |

$996 |

|

$225 |

$381 |

$552 |

$1,158 |

|

UNIT COSTS |

|

$1.00 |

$2.00 |

$3.00 |

$6.00 |

|

$1.13 |

$1.98 |

$3.00 |

$6.11 |

|

|

COST ALLOCATIONS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITS COMPLETED: |

145 |

n/a |

n/a |

n/a |

n/a |

145 |

$163 |

$288 |

$435 |

$886 |

|

|

Beginning WIP Costs |

50 |

$75 |

$27 |

$60 |

$162 |

|

n/a |

n/a |

n/a |

n/a |

|

|

Costs To Complete Beg. WIP. |

|

0 |

70 |

90 |

160 |

|

n/a |

n/a |

n/a |

n/a |

|

|

Started This. Month |

95 |

95 |

190 |

285 |

570 |

|

n/a |

n/a |

n/a |

n1a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COSTS TRANSFERRED OUT |

|

$170 |

$287 |

$435 |

$892 |

|

$163 |

$288 |

$435 |

$886 |

|

ENDING WIP INVENTORY |

30 |

$30 |

$54 |

$72 |

$156 |

30 |

$34 |

$54 |

$72 |

$159 |

|

|

OUTPUT LOSS |

25 |

$25 |

$40 |

$45 |

$110 |

25 |

$28 |

$40 |

$45 |

$113 |

|

|

|

COSTS ACCOUNTED FOR: |

|

$225 |

$381 |

$552 |

$1,158 |

|

$225 |

$381 |

$552 |

$1,158 |

• Beginning WIP Costs (Cost Per EUP section, line 1). Beginning WIP cost is separately accounted for with FIFO, but is included with this month's costs in WA.

• The four lines under Units Completed (Cost Allocations section, Costs Transferred Out). With FIFO the cost of the units completed has to be separated between last month's cost and this month's cost (to complete the beginning WIP and the units both started and completed). Since last month and this month are combined with WA, no separate accounting is needed.

When the department production cost report is prepared manually, WA involves fewer calculations and is easier. When the reports are prepared with spreadsheet software, though, both methods can be run from the same program. Furthermore, the program can be used again in subsequent months simply by inputting a new month's raw data in the Data Section. The six lines of differences noted above can be dealt with by using an “If-Then” statement. For example, in the EUP section, the beginning WIP line can read, “If FIFO, subtract the beginning WIP EUP, if not, then input n / a.” In this way, one program can be used with multiple departments, some with FIFO flows and some with WA flows.3

Comparing The Fifo And Wa Information

By separately accounting for this month's costs, FIFO allows across-month cost comparisons (trend analysis). Exhibit 6-12 can be used to demonstrate this. This month's unit cost ($6.00, FIFO) is less than the average cost over the last two months ($6.11, WA). Costs must have decreased from last month. But, by how much? Look at the beginning WIP cost for direct materials. The $75 cost was for 50 pots, which were 100 percent complete with respect to direct materials. Last month's direct materials cost per EUP must have been $1.50 per pot ($75 = 50 pots times 100 percent complete times $1.50 unit cost). This month the direct materials only cost $1.00 per pot.

A similar calculation shows that direct labor went up. Last month, it cost $1.80 per pot ($27 = 50 pots times 30 percent complete times $1.80 unit cost). Workers got a raise effective July 1st. Overhead cost did not change because it is applied using a POR that does not change from month to month.4

Spoilage Accounting And Journal Entry 8

Spoilage has to be accounted for within journal entry 8, when the cost of the 145 completed pots is transferred from the Molding Department to the Firing Department. In traditional PCASs, normal spoilage is allocated to all the good pots made. In this way, the costs of rejects can be averaged into the cost of the salable pots. This is the same logic used in a JOCAS. The question is, “How much spoilage cost should be included in the cost of the good pots transferred to Firing?”

As in a traditional JOCAS, abnormal and normal spoilage are accounted for differently in a traditional PCAS. Abnormal spoilage is credited out of the WIP-Molding Department subsidiary ledger account and debited to a loss account. Normal spoilage is averaged over all the pots made. In a traditional JOCAS, normal spoilage is budgeted for and included in the POR. This can also be done in the PCAS. Then the cost of normal spoilage will be debited to overhead. The calculation of normal and abnormal spoilage, and journal entry 8, is shown below as Method 1 in the section titled Preparing Journal Entry 8 for Transfers.

Normal spoilage can also just be allocated over the good pots each month rather than being included in the overhead budget and the POR. Conceptually, this is a better approach than Method 1 in that the POR allocates spoilage to good pots as well as to pots that will eventually be spoiled. This does not happen in Method 2, as illustrated following Method 1.

Calculating Normal And Abnormal Spoilage

Refer to the input usage flow diagram in Exhibit 6-7b. Fifty pots in beginning WIP went through inspection (QC is at the department's 60 percent stage of completion), along with all 150 of the pots started in July. In total, 200 pots were inspected in July.5 Assume management considers a 10 percent failure rate (reject or spoilage rate) of the pots inspected to be normal. The first 20 pots rejected in July are normal output loss (NOL), and any excess is abnormal output loss (AOL).

Total spoilage is allocated between normal and abnormal as follows:

Normal spoilage cost = (NOL units/ Total spoilage) X Output loss cost

and,

Abnormal spoilage cost = (AOL units / Total spoilage) X Output loss cost

Pretty Pots Molding Department's spoilage in July is calculated as follows (using FIFO):

Normal spoilage cost = (20 units / 25 units) x $110 = $88

Abnormal spoilage cost = (5 units / 25 units) x $110 = $22

Preparing Journal Entry 8 For Transfers

In a traditional PCAS, using Method 1, which charges normal spoilage to overhead, the journal entry to record spoilage and transferred pots is:

|

JOURNAL ENTRY 8: Transfers between Departments (Method 1: Normal Spoilage to Overhead) |

||

|

WIP-Firing Department (pots) |

$892 |

|

|

WIP-Manufacturing Overhead (Spoilage) |

$ 88 |

|

|

Loss from Abnormal Spoilage |

$ 22 |

|

|

WIP-Molding Department |

|

$1,002 |

Before the Method 2 journal entry is made, the normal spoilage has to be allocated between the ending WIP and the pots transferred, because it has to be spread over all the good units that passed inspection. Of the 200 pots inspected, 25 were rejected; consequently, 175 passed.

To ending WIP cost = (30 units / 175 units) X $88 = $15 (rounded)

To transferred pots = (145 units / 175 units) X $88 = $73 (rounded)

|

Journal entry 8: Transfers between Departments (Method 2: Normal Spoilage to Good Pots) |

||

|

WIP-Firing Department (pots) |

$965 |

|

|

Loss from Abnormal Spoilage |

$ 22 |

|

|

WIP-Molding Department |

|

$987 |

With either method, the management accountant should verify that all costs have been correctly accounted for:

|

|

Method 1 |

Method 2 |

|

Good pots finished |

$892 |

$892 |

|

+ NOL (method 2) |

0 |

73 |

|

Costs to Firing Department |

$ 892 |

$ 965 |

|

Ending WIP good pots |

$156 |

$156 |

|

+ NOL (method 2) |

0 |

15 |

|

Ending WIP total cost |

$ 156 |

$ 171 |

|

+ Overhead (NOL, method 1) |

$ 88 |

$ 0 |

|

+ AOL (to loss account) |

$ 22 |

$ 22 |

|

Total costs accounted for |

$1,158 |

$1,158 |

Journal Entry 8 For World-class Manufacturing

Proponents of WCM, JIT, and TQM believe all spoilage is a nonvalue-added cost that should be accounted for separately and should not be allocated to the good output. These management accountants journalize all spoilage to a cost variance, as can be done in a JOCAS:

|

JOURNAL ENTRY 8: Transfers between Departments (WCM: All Spoilage to Cost Variance) |

||

|

WIP-Firing Department (pots) |

$892 |

|

|

WIP-Molding Department Spoilage Cost Variance |

$110 |

|

|

WIP-Molding Department |

|

$1,002 |

This spoilage is then reported to management in a special report along with the other cost variances of the Molding Department in July.

Through the concept of continuous improvement, world-class manufacturers are striving to eliminate spoilage, but to help achieve this goal, they need a performance measurement system. A performance measurement system, among other things, measures the production process and lets managers and workers know how well they are progressing toward the goal of zero defects. In these manufacturing environments, the goal is to drive spoilage or rework to insignificant levels in the short run (while eliminating them entirely in the long run).

In the meantime, spoilage and rework are still a significant part of production in many manufacturing firms. Thus, the purpose of this discussion, and the corresponding discussion in the last chapter for JOCASs, has been to explain how to account for such costs of spoilage when they do occur. By accounting for and spotlighting these costs, the management accountant can make management aware of their magnitude. Thus, managers can, at the very least, use this information to start on the road to total quality management.

Joint And By-product Costing In A Pcas

This section discusses situations in which a process or department produces more than one type of product (output). Depending on the monetary significance of the products, they can be joint products, or one is the main product and the other a by-product.

Joint costs are those costs incurred in a single operation that yields two or more products or services simultaneously. Joint products are two or more products (or services) that:

• Have relatively significant sales values, and

• Are not separately identifiable as individual products until their split-off point

The split-off point is the production juncture where the joint products and by-products become individually identifiable. For example, in mining gold, the leaching process yields both gold and silver. If both have significant sales value, they are joint products.

By-products are incidental products of a joint process that:

• Have minor sales value as compared with the sales value of the major product or products, and

• Are not separately identifiable as individual products until their split-off point

By-products are often disposed of for small amounts of revenue or are recycled in the production process. Current market values for gold are around $400 per ounce, compared to around $4 per ounce for silver. Many mining companies therefore treat silver (and the other ores that are leached out of the mining process) as a by-product. At one time, silver was accounted for as a joint product--and may be again in the future.

Contrarily, many products once considered by-products now make significant contributions to the enterprise's profits and have been reclassified as joint products. For example, shavings and wood chips, once considered by-products of lumber mills, are now sold to paper mills as raw materials for making paper products.

Joint costs are incurred up to the split-off point. The following are examples of industries where joint costs are common:

• Meat packing

• Lumber

• Dairy

• Food processing

• Petroleum

• Chemical

Joint products receive some pro rata share of the department's joint production costs prior to split off, generally according to some arbitrary cost allocation formula. By-products are not assigned any of the prior joint costs. By-products are inventoried at their net realizable value, as is scrap held for sale in Chapter 5. By-products' net realizable values are deducted from the joint costs prior to allocating them between the joint products.

At the split-off point, several products emerge, and the management accountant has to allocate the costs incurred up to that time among the joint products. The arbitrary methods usually selected to allocate these joint costs are based on some physical measure or on the joint products' relative sales values at the split-off point. In practice, many variations of these allocation methods are used.

The Physical Measure Method

Under the physical measure method, the total production costs incurred in the joint process are allocated to the various joint products according to the ratios of their physical output measurement. Product output measurements include units, litres, pounds, tons, gallons, or square feet. The cost allocated under this method may bear no relation to the costs incurred or the revenue generated by the various products.

The Relative Sales Value Method

Under the relative sales value method, joint costs are allocated among the various joint products in proportion to their anticipated sales values; that is, the expected market prices of the products when they are sold. The relative sales value method is probably the most widely used method.

This method is based on the assumption that costs should be allocated on the basis of a product's ability to “bear” them. Thus, products with the largest sales value should absorb most of the costs. The sales value used in this method is often the value at the split-off point. In situations where products are sold without additional processing, the relative sales value is the market price of each product times the quantity produced.