Chapter 10 : The Activity-based Costing System

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1 Define activity-based costing systems

2 Contrast traditional volume-based costing systems

3 Explain how to develop activity-based costing systems

4 Discuss how activity-based costing systems are used in service organizations

INTRODUCTION

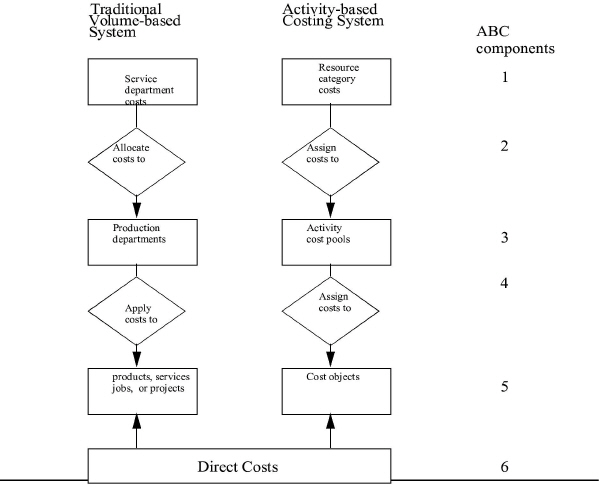

In general terms, the traditional volume-based costing system is shown on the left in Exhibit 10-1

|

, and the activity-based costing system is shown on the right. Both costing systems use a conventional two-stage process for assigning overhead costs to products, services, jobs, projects, or other cost objects.

This chapter focusses on the original ABC model, which was the most accurate. In the years since the original development of ABC, it has become clear that one flaw in ABC is that it can become more and more accurate, and complex every year without becoming more useful. Why? Because accuracy is NOT a “normal” good. So, in the last ten years or so, there has been a great deal of effort spent to “control” the tendency of ABC systems to become bloated and loose usefulness. One drawback of the recent developments is that they reduce accuracy as part of their “control”. So, for the bulk of this chapter we will focus on accuracy as our reason for studying ABC.

Under the traditional volume-based costing system, the second-stage cost driver is usually a predetermined overhead rate (POR) or multiple PORs with direct labor hours, direct labor dollars, machine hours, or materials dollars as the base (or denominator). The more units of a particular product that are produced, the more overhead costs are applied to the units. No matter what base is used, they all apply overhead costs in strict proportion to production volume.

The idea behind activity-based costing is that cost objects, which can be products, services, jobs, units, batches, customers, or anything the management accountant is trying to cost, consume activities. In turn, activities consume resources. Activity drivers measure the activities consumed, and resource drivers measure the resources consumed.

Activity-based costing systems try to determine what is really driving costs and charge a cost object for only the overhead it actually consumes. If, for example, 1,000 units of product A and 100 units of product B are produced, the traditional volume-based costing system will apply 10 times the overhead costs to product A relative to product B. But product A may not have used 10 times the overhead costs. Product B, being a more complex product with many special features, may have actually consumed most of the overhead costs because it required more support, such as setups, engineering changes, material purchasing, storing, handling, and so forth.

The accuracy of costing systems has become a matter of serious concern in some firms. Managers believe that their costing systems are grossly underestimating the cost of low-volume products and overestimating the cost of high-volume products. Production managers believe that certain products are not “earning their keep” because they are difficult to produce and thus place severe demands on resources and activities. But, with traditional volume-based costing systems, these difficult-to-produce products are reported as the most profitable. Managers in some construction firms, as well as in other firms that bid on customized jobs, are also concerned by the failure of their costing systems in developing winning bids. Examples of companies that have implemented activity-based costing systems are Caterpillar, General Dynamics, General Motors, Hewlett-Packard, Martin Marietta, and Siemens.

The concept of activity-based costing is simple and intuitively attractive to managers and workers who do not have an accounting background. It provides designers of costing systems new ways to cost products and services, modify behavior, and focus management attention on matters of strategic importance.1

DEFINING ACTIVITY-BASED COSTING

LEARNING OBJECTIVE 1

Define activity-based costing systems.

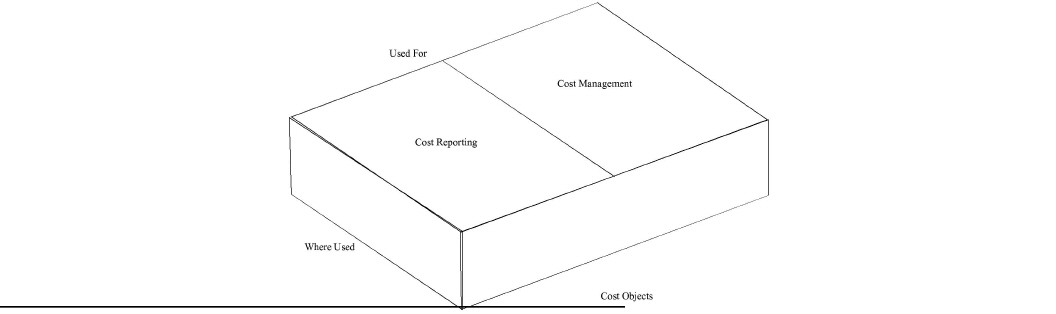

Activity-based costing (ABC) is the collection of financial and nonfinancial data about an enterprise's activities for two primary purposes:

• Costing the enterprise's cost objects

• Providing information for effective cost management through activity-based management

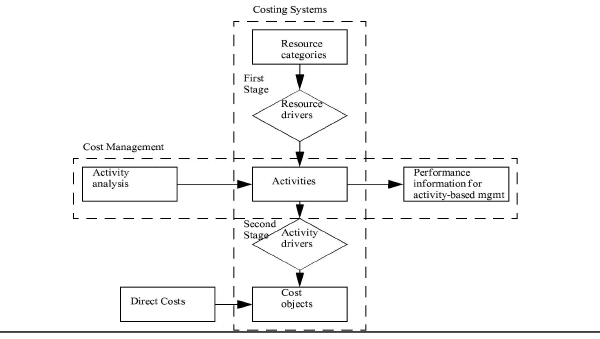

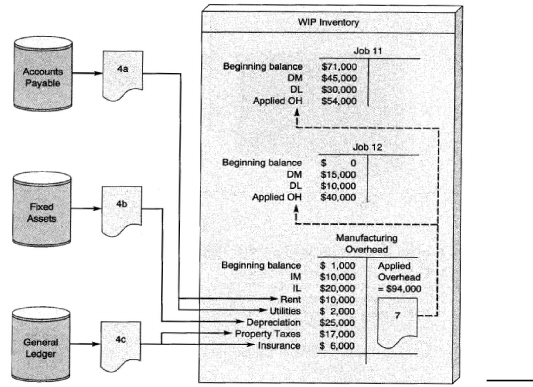

Exhibit 10-2

|

shows how ABC works to achieve these two purposes.

Activity analysis is the process of defining and describing activities and their corresponding cost drivers (i.e., resource drivers and activity drivers). Defining activities and cost drivers is the key to building an activity-based costing system. In turn, the ABC system is linked to activity-based management. Activity-based management (ABM) uses ABC information to support cost management via continuous improvement or to serve as a guide in completely reengineering activities (i.e., redesigning and rebuilding activities that are operating inefficiently and ineffectively) of the enterprise. Activities and cost drivers are the building blocks of all business processes and operations, so understanding them and their performance is essential to implementing sound cost management practices. Activity-based management is covered in Chapter 11.

Defining the Components of Activity-Based Costing Systems

An activity-based costing system includes six components:

• Resource categories

• First-stage resource drivers

• Activities and activity cost pools

• Second-stage activity drivers

• Cost objects

• Direct cost inputs

RESOURCE CATEGORIES. Resource categories represent the sources of costs that support activities. For example, “repairing automobile transmissions” is an activity in a repair shop. Specific mechanics, helpers, tools, utilities, and building space are resources that support this activity.

Typical resources in a manufacturing enterprise include the following:

• Procurement and various material handling and storage resources

• Office space and furniture and fixtures

• Equipment including production machines, transportation equipment, and information technology

• Utilities

• Salaries and benefits

• Buildings

• Accounting

• Engineering

• Insurance, licenses, and taxes

Normally, resources are expressed as cost elements within a chart of accounts or as a list of budgetary items in a budget. When a resource is dedicated to a single activity, assigning costs to the activity to form an activity cost pool is relatively simple. When a resource supports several activities, however, the resource consumption must be assigned among appropriate activities using a first-stage resource driver.

FIRST-STAGE RESOURCE DRIVERS. Activities drive the cost of resources. Therefore, first stage resource drivers are used to assign resource costs to activities, thereby forming activity cost pools that contain their proper share of resource costs.

The resource driver establishes a relationship between resource costs and activity cost pools based on some measure of usage. For example, headcount measures the usage of salary costs, square feet measure the usage of office occupancy costs, and hours (e.g., CPU hours) measure the usage of computer costs. Assignments of these costs represent a clear cause-and-effect relationship.

ACTIVITIES AND ACTIVITY COST POOLS. An activity is what an organization does to convert inputs to outputs. It is an aggregation of highly related tasks that perform work in an organization.

Activities are “natural” identifiers, because they are easily understood by such diverse groups as engineers, production and logistics people, marketers, accountants, and top management. Thus, by corresponding to familiar terms and processes, activities provide an effective medium for communication between accounting and operating personnel.

Activities are costed first. The result of assigning resource costs to an activity is an activity cost pool. Often, the terms “activity” and “activity cost pool” are used interchangeably. In any event, the costs assigned to activity cost pools are in turn assigned to cost objects using an activity driver.

Activity-based costing systems assume that the costs of activities are variable, even though this assumption does not exactly hold true in practice. Cost inputs to activities are usually acquired or eliminated in large “chunks.” For example, a whole machine is purchased, not 10 percent of a machine. As a result, the costs of these inputs do not vary smoothly according to the activities consumed. The reported product or service costs are therefore linear approximations to what are typically a series of step functions.

SECOND-STAGE ACTIVITY DRIVERS. The costs in activity cost pools are assigned to the cost objects by means of activity drivers. The second-stage activity drivers arc measures of the consumption of the activity cost pools by cost objects. Like the first-stage resource driver, the second-stage activity driver must capture a cause-and-effect relationship. In this case, the relationship is between the activity cost pools and the cost objects.

COST OBJECTS. Cost objects are the point to which activity costs are assigned. A cost object can be almost anything the designer wants it to be. The following are typical cost objects:

• Products

• Services

• Units

• Batches

• Contracts a Cases

• Jobs

• Projects

• Customers

• Customer groups

• Distribution channels

• Sales territories

Ultimately, activities are performed in order to manufacture products, render services (e.g., contracts, cases, jobs, projects), or support customers.

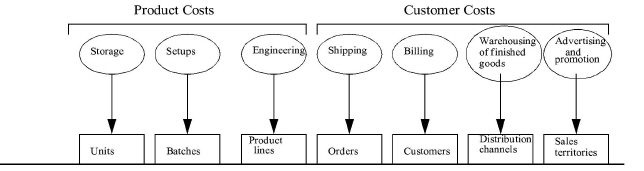

In some ABC systems, costs are assigned to different types of cost objects at different levels. For example, a batch is a higher-level cost object than a single unit of a product, where x number of units make up a batch of the particular product. A sales territory is a higher-level cost object than a customer. The number of levels of cost assignment varies from one enterprise to the next. Exhibit 10-3

|

, however, generally describes most manufacturing enterprises.

Product-driven activity costs are typically assigned at three levels through the use of activity drivers: the unit-level, batch-level, and product-level. Costs such as direct materials, direct labor, and storage costs are assigned on the basis of a unit of product. Costs of setups are usually assigned in terms of a batch of units of a particular product line. For example, tools and dies are set up to produce a batch of 1,000 units of product A. The product, such as product A, represents a specific product line. When an engineering change is made, it is therefore applicable to the product line.

It makes sense to keep activities of different levels separate because the costs of activities at different levels vary in response to different factors. For example, the cost of the batch-level activity setup varies with the number of batches. By contrast, the cost of a product-level activity such as engineering changes varies with the number of different product lines. Product A, for example, may require many more engineering changes than product B.

The number of levels of cost objects related to customer activities will vary among companies. Typically, there are four levels, such as order-level, customer-level, distribution channel-level, and sates territory-level. In some instances, several cost objects may occur at the same level. For example, a company may have several distribution channels, such as wholesalers, retailers, jobbers, and cooperatives, each of which would be treated as a cost object at the same level.

DIRECT COST INPUTS. Direct cost inputs are cost elements that are easily traced to cost objects. For example, a bill of materials and materials requisitions are used to trace direct materials costs to a specific cost object; that is, to a unit of product.

In some situations, especially where direct labor monitors automated processes, maintains equipment, and is salary-based, the only direct cost element is direct materials. At the other extreme, there are instances where three direct cost elements are used as direct cost inputs:

• Direct materials

• Direct labor

• Direct technology (or equipment)

Therefore, costs can be assigned to cost objects in four ways:

1. All costs are assigned to activity cost pools, and the activity costs are assigned to cost objects via appropriate activity drivers. This approach is applicable to some service organizations. The costing formula is:

Cost object = Costs assigned from activity cost pools

2. All costs except direct materials costs are assigned to activity cost pools, and the activity costs are assigned to cost objects via appropriate activity drivers. This approach is applicable to manufacturing enterprises in which “direct” labor has become “indirect” and technology costs cannot be traced directly to cost objects. The costing formula is:

Cost object = Direct materials + Costs assigned from activity cost pools

In enterprises that are automated, “direct” labor is usually engaged in setups, loading machines, maintenance, troubleshooting, and supervisory activities rather than actually performing work on the product. Moreover, workers frequently work on several products at the same time, making it impossible to trace labor hours intelligently to products.2

3. All costs except direct materials and direct labor costs are assigned to activity cost pools, and the activity costs are assigned to cost objects via appropriate activity drivers. This approach is applicable in any organization in which direct materials and direct labor costs are easily traced to cost objects. The costing formula is:

Cost object = Direct materials + Direct labor + Costs assigned from activity cost pools

This costing approach uses the three cost elements covered in previous chapters:

• Direct materials

• Direct labor

• Overhead

Although many organizations that use this approach have substantial technology costs, such costs are not easily traced to cost objects. These technology costs are therefore assigned to activity cost pools via resource drivers; then, the activity costs are assigned to cost objects via activity drivers.

4. All costs except direct materials, direct labor, and direct technology (or equipment) are assigned to activity cost pools, and the activity costs are assigned to cost objects via appropriate activity drivers. This approach is applicable to any organization in which direct materials, direct labor, and direct technology costs are easily traced to cost objects. Construction companies and manufacturing enterprises using separate manufacturing cells for specific products can use this approach. The costing formula is:

Cost object = Direct materials + Direct labor + Direct technology + Costs assigned from activity cost pools

Since technology costs are both a significant determinant of the cost of cost objects and a key factor in corporate decision making, accounting for this cost element treats technology as a direct cost element on the same level as direct materials and direct labor. If machinery, equipment, and various pieces of technology that one would find in a highly automated plant or typical construction company can be traced directly to the product, service, job, or project cost object, then “direct technology” should be treated as a separate direct cost element.

A rule of thumb in developing an ABC system is to first identify all costs that can be traced directly to cost objects. Then, all other costs are assigned to activity pools.

A Simple Example of How Activity-Based Costing Works

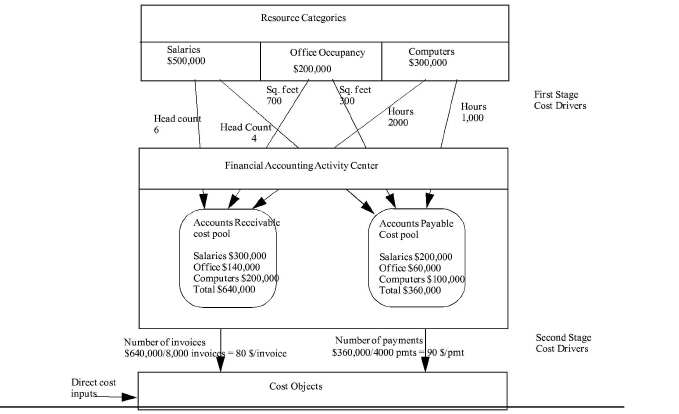

Exhibit 10-4

|

illustrates a simple ABC system that is used to assign financial accounting costs for accounts receivable and accounts payable activity costs to cost objects.

The resource categories in this example include three budgeted items:

• Salaries at $500,000

• Office occupancy at $200,000

• Computers at $300,000

These resource costs are assigned to the two activity cost pools using the following resource drivers:

• Headcount assigns salaries to each activity cost pool on the basis of the number of people who work there.

• Office occupancy costs are assigned to each activity cost pool based on the number of square feet occupied by each activity (i.e., accounts receivable and accounts payable).

• The number of computer hours (e.g., CPU hours) consumed by each activity is used to assign computer costs to each activity cost pool.

The accounts receivable cost pool and the accounts payable cost pool are aggregated into the financial accounting activity center, because they are highly related to it. Other activity cost pools, such as a payroll cost pool, financial reporting cost pool, and so forth, might also be added.

An activity center represents an aggregation of related, function-specific activities. The sum of costs in the activity cost pools aggregated in an activity center equals the total costs associated with that activity center. In the example, the total costs assigned to the financial accounting activity center are $1,000,000.

Activity centers are only indirectly involved in the assignment of costs to cost objects. Nevertheless, activity centers do play an important role in the design of most ABC systems. For example, an activity center may correspond to a responsibility center where a particular manager is responsible for all the activity cost pools aggregated in that activity center. In other words, an activity center is a manageable set of related activity cost pools. In some instances, an activity center may be a traditional department, such as the financial accounting department. In small companies, the activity cost pools may stand alone and not be aggregated in activity centers.

The second-stage activity drivers are used to assign the accounts receivable cost pool and the accounts payable cost pool to cost objects. The number of invoices processed drives the accounts receivable cost pool and is therefore a reasonable device to assign these costs to cost objects. Likewise, the number of payments serves as an appropriate activity driver to assign the accounts payable cost pool to cost objects.

The direct cost inputs are other costs that can be directly traced to cost objects. Such direct cost elements include the following:

• Direct materials

• Direct labor

• Direct technology (or direct equipment)

The example in Exhibit 10-4 did not have any of these direct cost elements. All costs related to the financial accounting activity were included in the accounts receivable cost pool and the accounts payable cost pool.

Additional Factors to Consider When Selecting Cost Drivers

Cost drivers can be:

• Transaction-based

• Time-based

• Dollar-based

• Percentage-based

As a rule of thumb, the appropriate cost driver (i.e., resource driver and activity driver) is one that represents the primary output of the activity. In other words, a direct cause-and-effect relationship exists between changes in the cost driver and costs of the activity. In many instances, a cost driver that captures the number of activity transactions rather than the duration or dollar amount of activity transactions is preferable because it:

• Is readily available

• is easy to understand, measure, and apply

• Induces beneficial behavior

Substituting cost drivers that capture the number of transactions generated by an activity rather than the duration of the activity is an important technique for reducing measurement cost. The data required for these transaction-based cost drivers are readily available, because a transaction is generated every time the activity is performed. For example, a materials requisition is required every time materials move from RMI to the factory floor.3

Transaction-based cost drivers are not always appropriate, however. For example, if the inspection activity takes varying amounts of time, using “number of inspections” or “number of inspection reports” as an activity driver instead of “actual inspection hours” probably will distort product or service costs. A product or service that requires much inspection time is likely to be undercosted, whereas a product or service that requires little inspection time will be overcosted. How well a given activity driver captures the actual consumption of activity costs by a particular product or service is measured by the correlation between the quantities traced to the product or service and the actual quantities the product or service consumed.4

The effect that the use of a particular cost driver has on people's behavior must also be considered in selecting cost drivers. As a general rule, people will behave in accordance with how they are being evaluated, as shown in the case on the next page. If the cost driver is used for performance evaluations, then its behavioral effects should be taken into account.

Behavioral effects can be either beneficial or harmful, depending on whether the cost driver motivates people to behave in a way that will help the enterprise achieve its goals or in a way that is undesirable or dysfunctional. For example, a company that wants to reduce the number of unique parts that it processes in order to simplify activities, such as vendor selection, purchasing, inspection, maintenance of the bill of materials, storage, and accounting, may decide to apply the costs of these activities using “number of part numbers” as the cost driver. Then, by evaluating and rewarding product designers according to their ability to design low-cost products, they will be motivated to design products with fewer part numbers.5

Care must be exercised, however, when using cost drivers to modify behavior. A particular cost driver may induce too much “beneficial” behavior. For example, if reducing the part numbers causes designers to reduce the functionality and quality demanded by the marketplace, the induced behavior will be harmful.6

COMPARING TRADITIONAL VOLUME-BASED COSTING SYSTEMS TO ACTIVITY-BASED COSTING SYSTEM

Learning Objective 2

Contrast traditional volume-based costing systems with activity-based costing systems.

Traditionally, overhead costs have been applied according to four volume-related bases:

• Direct labor hours (DLhr)

• Direct labor dollars

• Machine hours (Mhr)

• Materials dollars

|

INSIGHTS S & APPLICATIONS Correcting Harmful Behavior at Purrintin Pet Food Company Management at Purrintin Pet Food Company was considering building a new 400,000 square-foot warehouse because its existing warehouses were full. The company’s storage and distribution costs were allocated based on product value. The use of this costing procedure meant that a 4-cubic-foot bag of dog food was allocated $3.89 in warehousing costs, while a single case of gourmet cat food was allocated $12.

|

This seemingly inexpensive storage cost for the bulky bags of dog food led the manager of dog food to keep excessive inventories of dog food on hand all the time.

By simply changing the assignment of storage and distribution costs by “amount of cubic feet” and “weight of units handled” cost drivers, both behavior and operating policies changed. The dog food product manager learned to manage inventory and no longer ordered in large batches, so the inventory of dog food shrank and the need for a new warehouse evaporated. As this case shows, arbitrarily spreading storage-and distribution costs over products distorts the underlying economics of storage and distribution and can lead to poor decision making and to dysfunctional behavior. On the other hand, reporting costs in accordance with what is causing the costs can lead to good decision making and to beneficial behavior, such as decreasing inventory and reducing storage and distribution costs.a |

|

aAdapted [ruin Michael C. O'Guin and Steven A. Rebischke, “Customer-Driven Costs Using Activity-Based Costing,” in Handbook of Cost Management, ed. Barry J. Brinker (Boston: Warren Gorham Lamont, 1992), p. B5-10. With permission. |

These bases provide a reasonably accurate product cost where overhead is consumed in relation to production volume. For example, employee benefits are related to direct labor, and energy costs are related to machine hours.7

The Impact of Diversity and Complexity on Costs

The designer of the costing system, in using these volume-related bases, assumes that all applied costs have the same behavior; that is, the costs increase in direct relationship to the volume of units produced. But many costs do not behave in a volume-related manner. They are driven by diversity and complexity, not by volume. For example, a simple concrete paving project drives costs by volume. The more concrete poured, the greater the costs. But a uniquely designed building with ornate patterns will primarily drive costs by diversity and complexity. Although both the paving project and the one-of-a-kind building project will use concrete, equating the material handling costs of the paving project with those of the building project will be substantially misleading and will generate distorted costs.

The paving project requires limited resources. It needs common forms and equipment but minimal support facilities. In contrast, the building project requires frequent setups, customized forms, and elaborate schemes for moving material.

Assumptions about Overhead Cost Behavior

Many people assume that a large and growing proportion of overhead costs is .fixed. In a large number of enterprises, the opposite is true. The so-called fixed costs are, in fact, the most variable and most rapidly increasing costs.8

Overhead costs vary due to a number of factors. If the enterprise introduces more products, if it needs to expedite more orders, if it has to inspect more

|

INSIGHTS & APPLICATIONS Cost Accounting Simplicity and Diversity Simplicity Company makes one product, turning out 300,000 units per year. Diversity Company produces a number of different products in different batch sizes. For example, product A is produced in 10-unit batches, whereas product B is produced in 1,000-unitbatches.Will Simplicity and Diversity have the same level of overhead costs? If not, which will have the higher overhead costs? Simplicity does not need a lot of things that Diversity will require, such as setups, material handling, purchasing, engineering, and indirect labor. Simplicity has one setup; Diversity has hundreds. Simplicity's material handling is minimal and simple; Diversity's is extensive and complex. Simplicity has one raw material furnished by one vendor. Therefore, Simplicity doesn't need a purchasing department. Diversity has hundreds of different raw material items. Consequently, one of Diversity's biggest overhead costs is purchasing. Simplicity's product was designed years ago and is easy to make. Consequently, Simplicity doesn't employ engineers and has very little indirect labor. Diversity has a varied product mix of complex products, most of which are difficult to make. The products have an average life cycle of three years. |

Diversity is, consequently, under pressure to develop innovative products on an ongoing basis. Thus, Diversity employs a large engineering and supervisory staff. To perform cost accounting at Simplicity, total costs are divided by the number of units produced. The total costs increase by a few percentage points each year due to inflation. The number of units produced each year averages 300,000, plus or minus 5,000 units.How should cost accounting be conducted at Diversity? Direct materials and direct labor can be traced to each product with a reasonable level of accuracy if sufficient data processing is performed. But what about overhead? Should a volume-based POR be used, or would activity-based cost drivers that apply overhead to products on the basis of each product's consumption of overhead be more accurate? If products A and B (as well as all the other products) are charged with overhead according to a volume based POR, product B will absorb much more over-head costs than product A because it is a high-volume product with batch sizes of 1,000 compared to batch sizes of 10 for product A. Product A, however, actually requires more setups, material handling, purchasing, engineering, and supervision than does product B because it is much more complex than product B. Product B is also standard, whereas product. A offers special customized features that require additional support costs.If an activity-based costing system is used instead of a volume-based costing system, then the amount of resources being consumed by product A would be assigned to it. Product B would also be costed with a higher degree of accuracy. |

components and use more parts, and so forth, it will need larger overhead support to perform these additional activities.

Because many overhead costs are driven by the introduction of new products and the diversity and complexity of production, not by the volume of production, nonproduction volume-related cost drivers are required, such as the number of each of:

• Purchase orders

• Receipts

• Inspections

• Payments

• Setups

• Material movements

• Engineering change orders

• Materials requisitions

ABC authorities, such as Robin Cooper and Robert S. Kaplan, have observed that the most variable and most rapidly increasing costs are often those traditionally classified as fixed, such as equipment and building depreciation, procurement, insurance, supervision and indirect labor, and utilities. This phenomenon occurs in companies that are introducing new products, which in turn will need additional activities such as material handling, setups, inspection, and various other support activities.9

|

INSIGHTS & APPLICATIONS Product Strategy at Zohr Electronics Management at Zohr Electronics changed its product mix by introducing low-volume specialty products in its line. Initially, these products did not consume procurement, receiving, engineering, quality control, setup, storage, and other activities. But shortly, as new products were added, the demands for these activities increased substantially.The introduction of these low-volume specialty products was due in large part to information reported by the division's volume-based product costing system, |

which used a division wide overhead rate based on direct labor hours. This costing system showed that low-volume specialty products cost less to produce than high-volume standard products. The costing system, therefore, reported that low-volume specialty products were among the most profitable products sold by the division. When Zohr installed a new activity-based costing system, the cost to produce low-volume specialty products was higher than the cost to produce high-volume standard products. Using this information, management made the following decisions: 1. Dropped certain products Increased the price of some low-volume products 2. Decreased the price of some high-volume products 3. Changed the design of certain complex products to simplify and decrease the demand for an array of activities |

How One Product May Be Cross-Subsidizing Another Product

To trace costs to products, the amount of each activity consumed by a product must be determined. For example, a complex product that requires an average of 30 materials requisitions consumes a much greater proportion of the stock-room. activity than a simple product, which requires one materials requisition. If processing one materials requisition costs $40, then $1,200 in stockroom activity costs should be charged to the complex product, and $40 should be charged to the simple product.

If product A consumes 70 percent of the purchasing activity and product B consumes 10 percent, then products A and B should be charged with 70 percent and 10 percent of the purchasing costs, respectively. To charge products A and B the same amount of purchasing costs obviously distorts product costs. In such a situation, product B is cross-subsidizing product A. Management may decide to drop product B because it will show a lower profit than it would show if it were assigned the proper amount of purchasing costs. The proper decision may be to eliminate product A instead or to eliminate neither.

Under a traditional volume-based costing system, significant product cost distortions, cross-subsidization, and incorrect management decisions may exist. In general, under a traditional volume-based costing system, low-volume products are undercosted and high-volume products are overcosted. As a result, the risk of making poor decisions increases in proportion to the level of distortion in reported costs.

How the Costing System Influences Decision Making

Exhibit 10-5a

|

a. Overhead cost applied based on direct labour cost |

|

b. Overhead applied based on activities required |

||||

|

Cost element |

Product AX |

Product BX |

|

Cost element |

Product AX |

Product BX |

|

Direct Materials |

$23.00 |

$38.00 |

|

Direct Materials |

$23.00 |

$38.00 |

|

Direct Labour |

$ 7.00 |

$ 7.00 |

|

Direct Labour |

$ 7.00 |

$ 7.00 |

|

Total overhead at 500% of direct labour |

$35.00 |

$35.00 |

|

Setup driver |

$10.00 |

$20.00 |

|

|

|

|

|

Material Handling Driver |

$14.00 |

$26.00 |

|

SAMC |

$65.00 |

$80.00 |

|

SAMC |

$54.00 |

$91.00 |

|

Current selling price |

$68.00 |

$80.00 |

|

Current selling price |

$68.00 |

$80.00 |

|

Gross profit (loss) per unit |

$ 3.00 |

$10.00 |

|

Gross profit (loss) per unit |

$14.00 |

($ 1.00) |

shows how an inappropriate overhead application method can distort management's view of the profitability of its product mix. Wysiwyg Computer Products Inc. produces two different computer circuit boards in a highly automated manufacturing facility. Direct labor costs have typically been in the order of only 5 percent of total product cost. Nevertheless, the company's management accountants continue to use a POR based on direct labor.

Management has become concerned over declining sales in its high-volume circuit board Ax. Several competitors have undercut Wysiwyg's price on this product, yet the company's cost data show that it is making only a small profit on sales of circuit board Ax. The low-volume circuit board Bx appears to be quite profitable, however. Since the company is clearly having difficulty competing on its high-volume product, management has even suggested that circuit board Ax be discontinued in favor of the more profitable circuit board Bx.

Ada Contrary, a recent graduate of Very Big University's School of Accountancy, has just joined the company. Her curiosity is sparked when she hears a rumor of a major product line being discontinued, and she decides to investigate.

To her surprise, she finds that although direct labor costs are a very small portion of total product costs, Wysiwyg still uses a direct labor overhead application method in costing its products. She knows that an ABC system would be far more appropriate in this highly automated plant and would certainly provide management with a different profitability picture.

Ada does some more research and develops Exhibit 10-5b to present to management. The exhibit shows how the more realistic overhead application provided by the activity-based method can lead to very different pricing and product mix decisions.

Observing the manufacturing process, Ada finds that overhead costs are driven by machine setups and material handling. She elects to use these as the cost drivers in applying overhead between products Ax and Bx. As the exhibit illustrates, the low-volume nature of product Bx requires more frequent machine setups, hence the greater overhead applied to that product based on the setup driver. The process has been streamlined for the high-volume product Ax, so it requires fewer setups, and less overhead is applied based on the setup driver.

Product Ax makes fewer demands on material handling as well, whereas producing product Bx requires many materials requisitions and trips to the storeroom. Therefore, the material handling driver assigns more overhead to product Bx than to product Ax.

Note that the same amount of total overhead cost ($70) is applied between one unit of circuit board Ax and one unit of circuit board Bx, regardless a< the overhead application method. Under the direct labor overhead application method, however, too much overhead was applied to Ax and too little was applied to Bx, giving a false impression of the total costs of producing these products.

Management may now decide to reduce circuit board Ax's selling price to enable it to compete better. The low-volume circuit board Bx is not profitable given the current selling price, so management may decide to raise the price or discontinue the product altogether. By changing the overhead application method used by the company's management accountants, Ms. Contrary saved Wysiwyg from a bad decision and earned herself a substantial salary increase!

In What Kind of Environments Is ABC Appropriate?

If the products in a plant possess similar characteristics, either a volume-based POR or an activity-based cost driver will produce reasonably accurate product costs. In those rare instances where a company produces only one product in a one-department operation, a formal cost accounting system is not even needed. Costs can be assigned to the product simply by dividing total costs by output during the period.

By connecting costs with their causes, ABC enables managers to know, with reasonable accuracy, the consequences of their decisions. The major criticism of ABC in earlier years was the cost of processing data. But as computer costs continue to fall, the most diverse and complex companies can implement and operate an ABC system efficiently on a microcomputer. Moreover, several ABC software packages are available at reasonable cost.

It can be concluded that ABC is especially appropriate in companies where the following are true:

• Competition is high.

• Product mix is diverse in batch sizes, physical sizes, degree of complexity, and raw material characteristics.

• Product life cycles are short, such as three years or less.

• Collection and manipulation of data are performed by an integrated computer-based information system (ICBIS).

As a rule of thumb, companies will find ABC more valuable for developing product or service costs as their products and services become more numerous and diverse and the source of their costs shifts from direct to indirect categories. However, even if product diversity is not a problem, ABC can prove valuable for purposes of cost management. Even companies with homogeneous products, or even a single product, can put ABC to good use. The discipline of identifying activities and computing their costs can reveal opportunities either for cutting the cost of performing the activities or for eliminating nonvalue-added activities.

The three strategic goals of ABC systems are summarized as:

1 Appropriate pricing decisions based on good cost information

2 Appropriate product mix decisions based on good profitability information

3 Good cost management by focusing on activities and cost drivers

ACTIVITY-BASED COSTING SYSTEM DEVELOPMENT LIFE CYCLE

Learning

Objective 3

Explain how to develop activity-based costing systems

This section outlines a methodology for developing an activity-based costing system. The methodology is referred to as ABC systems development life cycle, which is a structured series of phases followed by the systems project team in developing an ABC system:

Phase one. Plan the system.

Phase two. Analyze and define resource categories.

Phase three. Analyze and define activities.

Phase four. Determine first-stage resource drivers and establish activity cost pools.

Phase five. Determine second-stage activity drivers and assign costs to cost objects.

These phases are shown in the ABC systems development life cycle depicted in Exhibit 10-6

|

. It is referred to as a “life cycle” because the ABC system is dynamic and is subject to continuous improvement and refinement. The ABC systems development life cycle can be used to develop a pilot (or prototype) ABC system or a full-blown enterprise wide system that supplants the present costing system. The ABC systems development life cycle is used in the next sections to develop an ABC system for the Panametric Corporation.

Phase One: Plan the System

Work on developing an ABC system should not start until there is common understanding and agreement throughout the organization. People should understand both how an ABC system works and that it has two primary purposes:

• Costing of cost objects

• Providing information for daily operational management, continuous improvement, and, in some instances, business re-engineering (Note: Business or activity reengineering is the subject of Chapter 11.)

The following discussion helps provide the common understanding and agreement needed to embark on ABC systems development.

The systems planning phase establishes a broad strategic framework and clear vision of the enterprise and an understanding of how the ABC system will serve the enterprise. An excellent starting point is to hold a number of joint application development sessions that involve a large number of participants throughout the organization.

By fostering active involvement, some of the mistrust and bickering that might otherwise occur between various managers and workers and management accountants is reduced if not eliminated. Ideally, the ABC system will become the workers' and managers' system. They must feel that the ABC system is an integral part of their operational control system. Indeed, when these people feel they own the system, they are motivated to work with it and strive for its success.

Another reason for involving workers and managers in systems development at Panametric is to enable management accountants to understand in detail what activities are performed and what is required to get the job done. On the other side, workers and managers need to understand what it takes to develop the ABC system and what its purposes are.

In many situations, after an ABC system is installed, users need considerable training to learn how to work with the system. With a participative approach, training requires less time and effort because the people gain more knowledge about the system while it is being planned and developed. In some situations, certain workers and managers will become members of the systems project team. They will become superusers who are highly skilled in how the system works. These superusers can effectively train other users.

Another key outcome of joint application development is an enterprisewide model, such as that presented in Chapter 3. This model, which describes all the major entities of the enterprise and their relationships, serves as a blueprint of how the organization works, its environment, and its interdependencies.

Normally, the ABC systems development life cycle is performed by a multidisciplinary systems project team that draws its members from different areas throughout the organization. The systems project team at Panametric includes the following:

• Management accountant

• Engineering representative

• Production representative

• Marketing representative

• Logistics representative

• Financial accounting representative

Thus, the management accountant, who generally serves as the systems project leader, can draw on the talent and skills of a diverse work force.

The project team members must work together as partners toward a common end, creating an optimally performing enterprise. Top management support is essential to develop, implement, and operate an ABC system successfully. Serious commitment at the highest level of the enterprise is the key to making the transition to an ABC system work. This is especially true when the ABC system leads to reengineering the business and the way in which people work together. Executives at Panametric strongly support the development of an ABC system, because they believe it will provide reasonably accurate cost information and help them improve operations.

Phase Two: Analyze and Define Resource Categories

In analyzing and defining resource categories, the systems project team may choose to combine certain ledger accounts and budgetary items that are associated with the same or similar resource categories. On the other hand, the team may choose to split certain ledger accounts or budgetary items that are consumed differently by different activities.

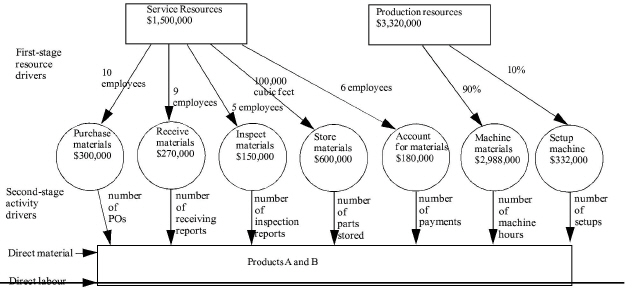

The systems project team at Panarnetric Corporation has divided budgeted items into two resource categories:

• Service resources

• Production resources

The budgeted costs of these resources are presented in Exhibit 10-7

|

Budget |

|

|

|

|

Service and Production Resources |

|

|

|

|

For the year 20x5 |

|

|

|

|

Service Resources |

|

|

|

|

Salaries |

|

$800,000 |

|

|

Benefits |

|

100,000 |

|

|

Insurance |

|

20,000 |

|

|

Utilities |

|

140,000 |

|

|

Depreciation |

|

440,000 |

$1,500,000 |

|

|

|

|

|

|

Production Resources |

|

|

|

|

Supervision |

|

$970,000 |

|

|

Benefits |

|

90,000 |

|

|

Insurance |

|

60,000 |

|

|

Utilities |

|

200,000 |

|

|

Depreciation |

|

2,000,000 |

3,320,000 |

|

Total Budgeted Resources |

|

|

$4,820,000 |

.

Phase Three: Analyze and Define Activities

During activity analysis and definition, both service and production activities of an enterprise are identified in order to establish a basis for determining their cost and performance. This process decomposes an organization into elemental activities that are understandable and easy to manage. It is a process of “dividing to conquer.”

Activity analysis describes what an enterprise does; that is, how time, effort, and resources are spent and the inputs and outputs of activities. Activities are not necessarily traditional organizational segments, such as departments. In some instances, activities may cross department boundaries. In other instances, a department may contain several activities.

Key management personnel and technical experts are consulted through interviews. Job descriptions are useful, because they are typically written in terms of tasks that make up activities. The interviewing process is usually iterative. Often, the same person has to be interviewed several times to attain the necessary information.

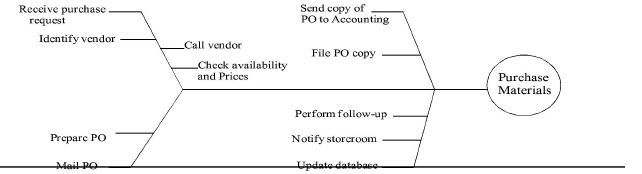

THE ACTIVITY FLOW DIAGRAM. An activity flow diagram describes the activities that are performed in an organization and shows their interdependencies. The symbols used to prepare activity flow diagrams are presented in Exhibit 10-8

|

Meaning |

Symbol |

|

Source or Destination |

|

|

Activity that transforms inputs to outputs |

|

|

Input and output flows |

|

.

The rectangle represents a source or destination of the initial or final inputs or outputs of the system under analysis. Sources or destinations can be persons, companies, departments, or other systems. They define the boundaries of the system being modeled. Labels of the sources and destinations should be descriptive, such as Vendor, Customer, Finished Goods, and Shop Floor.

To avoid crossing the input and output flow lines, sources and destinations may be duplicated. Normally, sources and destinations should be located on the perimeters of the activity flow diagram. This placement is consistent with their definition as systems boundaries.

Activities, which convert inputs to outputs, are represented by circles. By convention, the name (description) of an activity consists of a verb and an object or object clause, such as Purchasing (or Purchase) Materials, Update Accounts Receivable, or Check Credit.

All activities must have both inputs and outputs. An activity that shows inputs but no outputs is called a “black hole,” because the input enters the activity and disappears or nothing takes place. An activity with output but no input is creating something from nothing, which is a “miracle.” An activity can have more than one input or output.

Input and output flow is indicated by a line and an arrow. It represents the input and output among sources, destinations, and activities. All input and output flows either initiate an activity or result from an activity. For example, a supervisor on the shop floor (source) issues a materials requisition to the purchase materials activity, which is input that initiates a purchase order output from the purchase materials activity that is sent to a vendor (destination). Each input and output flow line should have a noun or noun clause next to it (usually above the line or to its right or left) describing the input or output that is being transferred. Inputs and outputs can be paper documents, electronic data, materials, and various measurements (e.g., machine hours).

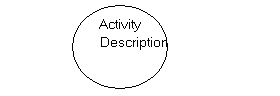

|

APPLYING THE ACTIVITY FLOW DIAGRAM. Exhibit 10-9 presents an activity flow diagram that models the purchasing, inspecting, receiving, accounting, machining, and setting up activities at Panametric Corporation. The model clearly shows both what activities are being performed and their interdependencies. In many instances, one activity will trigger the performance of another activity.

The initial input to the system is a materials requisition from the shop floor (a source) to the store materials activity. If the materials requested are on hand, they are immediately transferred to the machine materials activity. If they are not on hand, a purchase request is sent to the purchase materials activity, which prepares a purchase order and sends it to the appropriate vendor (a destination). A copy of the purchase order is sent to the accounting activity. The vendor (a source) sends the ordered materials to the inspect materials activity along with a bill of lading. The materials are inspected for quality and specifications. An inspection report and the materials are transmitted to the receive materials activity, which counts the materials, prepares a receiving report, and transmits the report and materials to the store materials activity. If accepted by the store-room personnel (i.e., the store materials activity personnel may reject the materials because of discrepancies), the needed materials are immediately moved to the machine materials activity for processing. Also, a receiving report for the materials is sent to the account for materials activity, which serves as an authorization to pay the vendor's invoice, assuming that no discrepancies exist. From time to lime, depending on the product being machined, the machine materials activity requires a setup machine activity. When this need occurs, the machine materials activity prepares a setup request for the setup machine activity, which in turn performs the setup. Upon completion of the machine materials activity, the completed products are transferred to finished goods (a destination). The machine materials activity is responsible for all materials and product movement within Panametric.

|

,

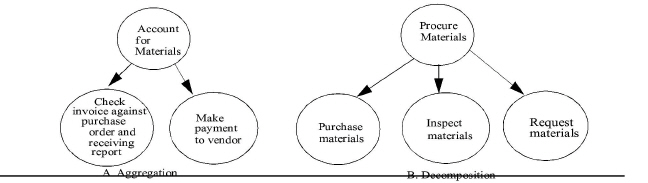

AGGREGATING AND DECOMPOSING ACTIVITIES. Activities arc composed of tasks, which are pieces of work assigned to people or machines. A task may be computational, procedural, or physical. Homogeneous tasks make up a function-specific activity. A fishbone diagram, (also called a cause-and-effect diagram), illustrated in Exhibit 10-10 can be used as a tool for defining activities, such as the purchase materials activity.

The systems project team groups all related tasks that pertain to and make the activity operational. In Exhibit 10-10, the tasks on the task side of the fishbone diagram represent all the pieces of work necessary to make the purchase materials activity operational. Unrelated tasks, for example, would be verifying quantity and prices and making a payment to a vendor. These tasks are related to the account for materials activity.

The process of combining tasks into a homogeneous group to form a function-specific activity is referred to as aggregation. The process of breaking down groups of dissimilar tasks into several function-specific activities is called decomposition. In either case, the proper definition of activities requires looking into activities to determine the detailed internal workings of the tasks that make up the activities. Exhibit 10-11

|

illustrates the aggregation and decomposition processes. Panel (a) shows the aggregation of two previously defined activities into one well-defined, function-specific activity. Checking the invoice against the purchase order and receiving report, and making a payment to a vendor, are actually highly related tasks that make up the account for materials activity.

In panel (b), the previously-defined procure materials activity contains three function-specific activities: purchase materials, inspect materials, and receive materials. All of these activities contain tasks that are related to their specific activities.

Here are some rules of thumb that help in performing aggregation and decomposition:

• Usually, there should be from two to ten well-defined, function-specific activities per traditional organizational unit or department. In some instances, one small department may equal one activity. In other instances, an activity may transcend more than one department. If more than ten activities are defined for a typical department (e.g., accounting, procurement, painting, finishing, and milling), then the activities should be reviewed for aggregation. On the other hand, if one activity is defined for one medium- or large-size department, the activity should be reviewed for decomposition.

• Activities that are the responsibilities of different people should not be aggregated.

• Generally, an activity should contain no more than five to fifteen well-defined, highly-related tasks.

• If an activity contains only one task, it has probably been subjected to excessive decomposition.

• If an activity contains unrelated tasks, it needs to be decomposed.

• If there is only one input and one output, the activity has been decomposed enough.

• If there are multiple inputs and outputs, the activity may be a candidate for decomposition. However, a well-defined, function-specific activity may contain two or three inputs and two or three outputs and may not require decomposition.

In addition to interviewing, the systems project team spends a great deal of time observing activities as they are performed. Statistics dealing with time, distance, quantity, and frequency are gathered. For example, an activity dealing with movement of a component may generate the following statistics:

Time: 15 minutes to move materials from storeroom to machining

Distance: 1,500 feet

Quantity: One batch of four pallets

Frequency: Performed 30 times per day, on average

Such statistics can then be used to assist in determining activity costs being consumed.

Phase Four: Determine First-Stage Resource Drivers and Establish Activity Cost Pools

The first-stage resource drivers assign resource costs (defined in phase two) to various activities (defined in phase three) forming activity cost pools, as shown

|

Activity |

First-Stage Resource Driver |

Amount Assigned to Activity Cost Pools |

|

Store materials |

(100,000 CubicFeet x $6) |

$ 600,000 |

|

Purchase materials |

($900,000 x 10/30) |

300,000 |

|

Receive materials |

($900,000 x 9/30) |

270,000 |

|

Inspect materials |

($900,000 x 5/30) |

150,000 |

|

Account for materials |

($900,000 x 6/30) |

180,000 |

|

Machine materials |

($3,320,000 x .90) |

2,988,000 |

|

Setup machine |

($3,320,000 x .10) |

332,000 |

|

Total budgeted costs assigned to activity cost pools |

$4,820,000 |

|

|

|

|

|

in Exhibit 10-12. The first-stage resource driver used to assign a portion of service costs to the store materials activity is “number of cubic feet,” which is 100,000 cubic feet charged at $6 per cubic foot. Total service costs are $1,500,000 less the $600,000 (100,000 CF x $6) charged to the store materials activity. The remaining $900,000 in service costs are assigned to the purchase materials, receive materials, inspect materials, and account for materials activities using “headcount” as the resource driver. The headcount equals 30, with 10 in purchasing, 9 in receiving, 5 in inspecting, and 6 in accounting. Thus, each activity is assigned its fair share of the $900,000 service resource costs.

The $3,320,000 production resource costs are assigned to the machine materials and setup machine activities. Based on a great deal of analysis, the systems project team at Panametric determines that 90 percent of the $3,320,000 ($2,988,000) should be assigned to machine materials and 10 percent ($332,000) to setup machine.

Phase Five: Determine Second-Stage Activity Drivers and Assign Costs to Cost Objects

Once the costs of resources consumed by activities have been assigned to the activity cost pools, second-stage activity drivers can be determined and applied. These activity drivers are usually the outputs designated on the activity flow diagram. For example, the primary output of the purchase materials activity is purchase orders. Therefore, the number of purchase orders is the second-stage cost driver for the purchase materials activity cost pool. The costs from this activity cost pool are assigned to products on the basis of how many purchase orders they cause to be processed. For example, a complex product containing hundreds of parts will usually cause more purchase orders to be processed than a simple product containing two or three parts. Thus, the complex product should be charged with the bulk of purchasing costs.

Notice that the purchase materials activity has one input and three outputs, as shown in the activity flow diagram in Exhibit 10-9. The purchase request input is a trigger to activate the purchase materials activity. The three outputs are the purchase orders sent to vendors, the copies of the purchase orders sent to the account for materials activity, and a notification sent to the store materials activity. The cost of the purchase materials activity can be expressed as a cost per purchase request, purchase order, or copy of purchase order. Generally, the best measure, and therefore the best activity driver, is the primary output of the activity. In the case of the purchase materials activity, the best activity driver is the purchase order output, because the primary reason for performing this activity is to generate purchase orders.

Here are some rules of thumb for determining activity drivers:

• If an activity has more than one output, the activity should be analyzed further to see if it should be decomposed into more than one activity, each with its own individual output measure. If the activity is indeed function-specific and cannot logically be further decomposed, then the primary output should be used as explained earlier.

• If two or more activities have the same primary output measure, they should be aggregated into one activity.

The result of phase live at Panametric is the completed ABC system design shown in Exhibit 10-13

|

. All of the second-stage activity drivers are designated for each activity cost pool. The direct cost elements, direct materials and direct labor, are also shown. The system is ready to cost products A and B, the two cost objects for Panametric Corporation's ABC system.

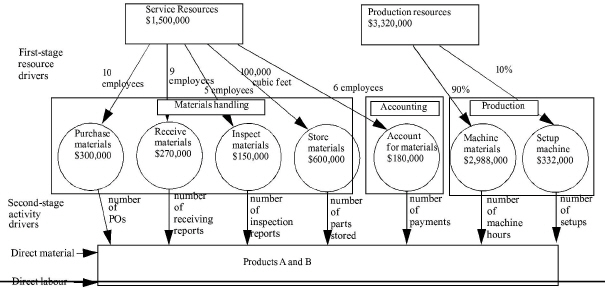

In some instances, the systems project team may wish to group several activity cost pools into one activity center as shown in Exhibit 10-14

|

. For example, the activity cost pools of purchase materials, receive materials, inspect materials, and store materials may be included in an activity center called “materials handling.” The accounting activity center and account for materials activity cost pool are the same. The machine materials activity cost pool and setup machine activity cost pool may be included in an activity center called “production.''

Developing a large number of activity centers leads to a detailed representation of the organization and how it performs its work. But creating separate activity centers for a simple organization or for activity cost pools that are similar or stand on their own may add needless complexity to the ABC system without providing any additional insights into how resources are consumed. Thus, the systems project team should choose activity centers that have a clear meaning according to manageable segments of the organization. Doing so increases the likelihood that managers will use and correctly interpret ABC cost information as they manage activities in the organization.

How activity cost pools are organized within activity centers is irrelevant as far as calculations are concerned and thus cannot affect unit product or service costs. The total cost of activity cost pools will be the same whether they are grouped within activity centers or not.

The advantage of a two-stage cost assignment process over a single-stage procedure is that different measures of resource consumption can be used at each stage. For example, the service resources are assigned to the store materials activity based on the number of cubic feet, the first-stage resource driver. Knowing how many resources the activity itself is consuming is beneficial to management in trying to control activity-level costs. The activity driver used to assign store materials costs to products is the number of materials requisitions. This cost driver is a good measure of how different products consume the store materials activity costs. At this level, management can focus on the products, services, or customers to determine their profitability.

Costing Cost Objects

The systems project team creates an activity cost pool for each activity and selects an activity driver for each activity cost pool. The activity driver is used to apply the costs of the activity cost pool to each product or service (or other cost object) according to the amount of activity costs consumed. The costs consumed arc assigned to the cost object through a bill of activities, which lists activities and associated costs required by the cost object.

The bill of activities for products A and B manufactured by Panametric Corporation is shown in Exhibit 10-15

|

Exhibit 10 -15 Bill of Activities for Product-Driven Activities |

||||||

|

Bill of Activities, Products A and B For the Period Ended December 31, 20x4 |

||||||

|

|

Product A (50,000 units) |

Product B (100,000 units) |

||||

|

Activity Second-Stage Cost Pool Activity Driver Rate |

Activity Driver Quantity |

Activity Cost |

Unit Cost |

Activity Driver Quantity |

Activity Cost |

Unit Cost |

|

Purchase materials $60 per purchase order |

$ 60 x 4,000 |

$ 240,000 |

$ 4.80 |

$ 60 x 1,000 |

$ 60,000 |

$ 0.60 |

|

Receive materials $90 per receipt |

$ 90 x 2,500 |

225,000 |

4.50 |

$ 90 x 500 |

45,000 |

0.45 |

|

Inspect materials $50 per inspection |

$ 50 x 2,500 |

125,000 |

2.50 |

$ 50 x 500 |

25,000 |

0.25 |

|

Store materials $20 per part stored |

$ 20 x 20,000 |

400,000 |

8.00 |

$ 20 x 10,000 |

200,000 |

2.00 |

|

Account for materials $72 per payment |

$ 72 x 1,500 |

108,000 |

2.16 |

$ 72 x 1,000 |

72,000 |

0.72 |

|

Machine materials $996 per machine hour |

$ 996 x 1,000 |

996,000 |

19.92 |

$ 996 x 2,000 |

1,992,000 |

19.92 |

|

Setup machine $3,320 per setup |

$ 3,320 x 90 |

298,800 |

5.98 |

$ 3,320 x 10 |

33,200 |

0.33 |

|

Total activity costs assigned to products |

|

$ 2,392,800 |

|

|

$ 2,427,200 |

|

|

Activity costs per unit |

|

|

$ 47.86 |

|

|

$ 24.27 |

|

Direct materials costs per unit |

|

|

60.00 |

|

|

50.00 |

|

Direct labor costs per unit |

|

|

24.00 |

|

|

24.00 |

|

Total costs per unit |

|

|

$ 131.86 |

|

|

$ 98.27 |

|

|

||||||

. Production for the period is 50,000 units of product A and 100,000 units of product B. The activity costs consumed by each product are determined by multiplying the activity driver rate times the activity driver quantity generated. For example, product A caused 4,000 purchase orders to be generated during the period. It costs $60 to produce one purchase order. Therefore, product A is charged with $240,000 ($60 x 4,000 purchase orders) of the costs of the purchase materials activity. The cost per unit is $4.80 ($240,000 - 50,000 units). Product B caused only 1,000 purchase orders to be produced, so it is charged with only $60,000 ($60 x 1,000 purchase orders) of the costs of the purchase materials activity. The cost per unit is $0.60 ($60,000 100,000 units). The total activity costs assigned to product A and product B are $2,392,800 and $2,427,200, respectively. The activity costs per unit for product A and product B are $47.86 ($2,392,800 - 50,000 units) and $24.27 ($2,427,200 = 100,000 units), respectively. Direct materials and direct labor costs per unit are also included in the bill of activities. This way, the total costs per unit for each product are disclosed for management's attention.

The cost per unit for direct materials is determined from the bill of materials displayed in Exhibit 10-16

|

|

. The actual amount of direct materials used comes from materials requisitions.

At the top of the exhibit is the bill of materials for product A, which is made up of two of part A.1, four of part A.2, and one of part A.3, for a total cost of $60 per unit. Part A.1 is composed of three of component 1.1 and two of component 1.2, for a total cost of $15 per unit. Part A.2 is a stand-alone part. Part A.3 requires one each of components 3.1, 3.2, and 3.3, for a total cost of $10 per unit- At the bottom of the exhibit is the bill of materials for product B, which requires one of part B.1 and one of part B-2, for a total cost of $50 per unit.

As the exhibit shows, product A is more complicated than product B. Because of this added complexity, product A drives the activity cost pools with greater intensity and frequency than does product B.

Direct labor costs represent the second direct cost element that is traced directly to the products. These costs are applied to the products based on data collected on time tickets. The cost per unit for direct labor is $24 ($12 x 2 hours) for both products.

An interesting and revealing exercise is to use the data of the Panametric Corporation to calculate the cost per unit of products A and B under four different costing systems:

• Activity-based costing system just presented

• Activity-based costing system using three direct cost elements: direct materials, direct labor, and direct technology

• Traditional volume-based costing system using a plantwide predetermined overhead rate (POR) based on direct labor hours

• Traditional volume-based costing system using two predetermined overhead rates (PORs) based on materials dollars and machine hours

The results are presented in Exhibit 10-17.

|

Exhibit 10 -17 Calculation of Unit Costs Using Four Different Costing Systems |

|||

|

Activity-based costing: |

Product A |

Product B |

|

|

Direct materials |

$ 60.00 |

$ 50.00 |

|

|

Direct labor ($12 x 2 DLhr) |

24.00 |

24.00 |

|

|

Activity costs |

47.86 |

24.27 |

|

|

Total cost per unit |

$ 131.86 |

$ 98.27 |

|

|

Activity-based costing with direct technology as a cost element: |

|

|

|

|

Direct materials |

$ 60.00 |

$ 50.00 |

|

|

Direct labor |

24.00 |

24.00 |

|

|

Direct technology |

19.92 |

19.92 |

|

|

Activity costs |

27.94 |

4.35 |

|

|

Total cost per unit |

$ 131.86 |

$ 98.27 |

|

|

Machine (Direct technology): A: $2,988,000 x 1/s = $996,000 / 50,000 units - $19.92 per unit B: $2,988,000 x 1/s = $1,992,000 / 100,000 units = $19.92 per unit |

|

||

|

|

|

|

|

|

Activities without the machine materials activity: |

||

|

|

Product A |

Product B |

|

Purchase materials |

$ 240,000 |

$ 60,000 |

|

Receive materials |

225,000 |

45,000 |

|

Inspect materials |

125,000 |

25,000 |

|

Store materials |

400,000 |

200,000 |

|

Account for materials |

108,000 |

72,000 |

|

Setup machine |

298,800 |

33,200 |

|

Total activity costs |

$1,396,800 |

$435,200 |

|

A: $1,396,800 - 50,000 units = $27.94 per unit B: $435,200 - 100,000 units = $4.35 per unit |

||

|

Traditional volume-based costing system using a plantwide predetermined overhead rate on Direct Labour Hours: |

||||

|

|

Product A |

Product B |

||

|

Direct materials Direct labor ($12 x 2 DLhr) A: Overhead ($80.33 x 20,000 DLhr) - 50,000 units B; Overhead ($80.33 x 40,000 DLhr) - 100,000 units |

$ 60.00 24.00 32.13 |

$ 50.00 24.00

32.13 |

||

|

$106.13 |

||||

|

Calculation of plantwide predetermined overhead rate based on direct labor hours: |

|

|||

|

A: Direct labor hours budgeted B: Direct labor hours budgeted |

20,000 40,000 |

|

|

|

|

Total direct labor hours budgeted |

60,000 |

|||

|

Total resources: Service resources Production resources |

$1,500,000 3,320,000 |

|

|

|

|

Total resources budgeted |

$4,820,000 |

|||

|

$4,820,000 - 60,000 DLhr = $80.33 per DLhr |

|

|

||

|

Traditional volume-based costing system using two predetermined overhead rates based on direct materials dollars and machine hours: |

|

|||

|

|

|

|

Product A |

Product B |

|

Direct materials |

|

$ 60.00 |

$ 50.00 |

|

|

Direct labor ($12 x 2 DLhr) |

|

24.00 |

24.00 |

|

|

A: |

OH based on materials dollars ($562,500 / 50,000 units) |

11.25 |

|

|

|

B: |

OH based on materials dollars ($937,500 / 100,000 units) |

|

9.38 |

|

|

A: |

OH based on machine hours ($1,106,667 / 50,000 units) |

22.13 |

|

|

|

B: |

OH based on machine hours ($2,213,333 / 100,000 units) |

|

22.13 |

|

|

|

Total cost per unit |

|

$117.38 |

$105.51 |

|

Predetermined overhead rate based on direct materials dollars: Service resources: |

||

|

A: ($60 x 50,000 units) = $3,000,000 (3/8ths) |

|

|

|

B: ($50 x 100,000 units) = 5,000,000 (5/8ths) |

|

|

|

Total direct materials $8,000,000 (8/8ths) |

|

|

|

|

|

|

|

A: $1,500,000 x 3/8 = $562,500 / 50,000 units = $11.25 per unit B: $1,500,000 x 5/8 = $937,500 / 100,000 units = $9.38 per unit |

|

|

|

|

||

|

|

|

|

|

Predetermined overhead rate based on machine hours: |

|

|

|

Production resources: |

|

|

|

A: Machine hours budgeted |

1,000 |

(1/3) |

|

B: Machine hours budgeted |

2,000 |

(2/3) |

|

Total machine hours budgeted |

3,000 |

(3/3) |

|

|

|

|

|

A: $3,320,000 x 1/3 = $1,106,667 / 50,000 units = $22.13 per unit B: $3,320,000 x 2/3 = $2,213,333 = 100,000 units = $22.13 per unit Note: All numbers are rounded to the nearest penny. |

||

|

|

|

|

The total costs for producing both products are $16,420,000 no matter which costing system is used. The total unit costs, however, present a radically different picture. Under both activity-based costing systems, the total unit costs are the same. However, when direct technology (machine) costs are treated as a direct cost element, one can clearly see that product A is driving most of the activity costs ($27.94 per unit for product A versus $4.35 per unit for product B). But when volume-based costing systems are used, the overhead costs per unit for both products are equal ($32.13 for each) when the POR is based on DLhr or near equal ($33.38 for product A and $31.51 for product B) when PORs are based on materials dollars and machine hours.

Market-Driven Activity-Based Costing Systems

A market-driven ABC system can be developed along with a product-driven ABC system. Whereas product-driven ABC system costs are assigned to cost objects, such as units, batches of units, and product lines, market-driven ABC system costs are assigned to such cost objects as customers, customer groups, distribution channels, and sales territories. Just as products have varying degrees of complexity and diversity and make different demands on resources and activities, so too do customers, customer groups, distribution channels, and sales territories.

Two different enterprises that produce the same products can incur different market-driven costs, depending on their target customers, distribution strategies, sales territories, and advertising campaigns. The product-driven costs for the two enterprises may be the same, but the market-driven costs will probably be substantially different.

Market-driven activities represent a sizable portion (anywhere from 20 to more than 50 percent) of an enterprise's total costs. Assigning such costs to their sources helps management identify relative profitability of customers, customer groups, distribution channels, and sales territories. These activities may be providing a competitive advantage or disadvantage depending on how resources are deployed to meet the needs of the market.

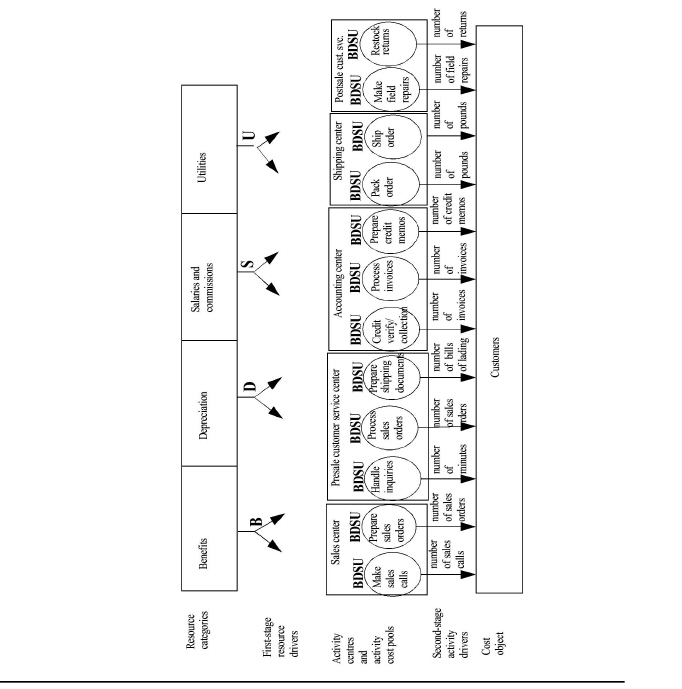

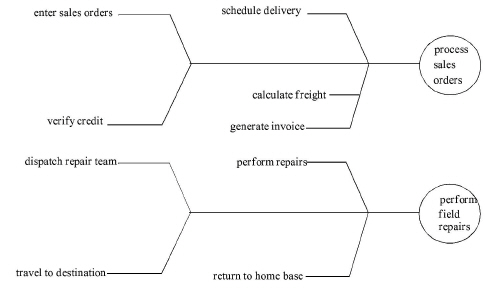

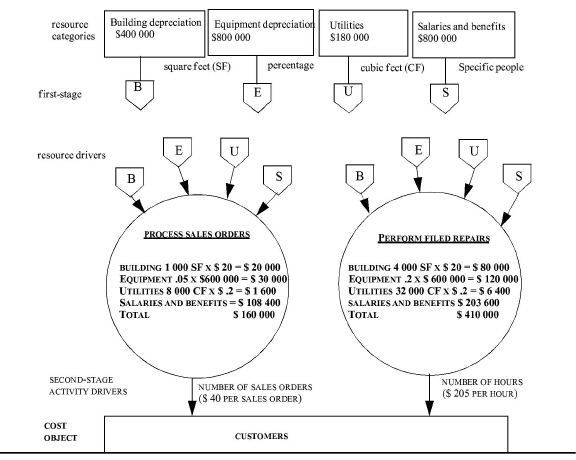

Exhibit 10-18

|

shows a general ABC model to cost customers. The resource categories include benefits, depreciation of buildings and a variety of equipment, salaries and commissions, and utilities. These resource costs are assigned to activity cost pools by using such resource drivers as headcount, square feet and cubic feet, hours of equipment usage, and kilowatt hours. Activity cost pools are aggregated into activity centers. Each activity center is managed by a separate person. The second-stage activity drivers assign the costs from the activity cost pools to the customers.

A bill of activities for customer A is presented in Exhibit 10-19.

|

Exhibit 10 -19 Bill of Activities for Market-Driven (Customer) Activities |

||

|

|

Bill of Activities Customer A For the Period Ended December 31, 20x4 |

|

|

Sales |

$200,000 |

|

|

Cost of goods sold [Determined from product-driven ABC system.] |

< 140,000> |

|

|

Gross profit |

$ 60,000 |

|

|

Less market-driven activity costs: |

|

|

|

Activity Cost Pool |

Activity Driver Rate |

Activity Driver Quantity |

Activity Cost |

|

Make sales calls |

$40 per sales call |

10 sales calls |

$ 400 |

|

Prepare sales orders |

$30 per sales order |

50 sales orders |

1,500 |

|

Handle inquiries |

$10 per minute |

100 minutes |

1,000 |

|

Process sales orders |

$80 per sales order |

50 sales orders |

4,000 |

|

Process shipping documents |

$40 per shipping document |

12 shipping documents |

480 |

|

Process credit |

$60 per notice |

2 notices |

120 |

|

Process invoices |

$70 per invoice |

50 invoices |

3,500 |

|

Prepare credit memos |

$70 per credit memo |

6 credit memos |

420 |

|

Pack orders |

$2 per pound |

1,000 pounds |

2,000 |

|

Ship orders |

$ 3 per pound |

1,000 pounds |

3,000 |

|

Make field repairs |

$300 per field repair |

3 field repairs |

900 |

|

Restock returns |

$100 per return |

6 returns |

600 |

|

Total market-driven activity costs |

<17,920> |

|

Profit contributed by Customer A |

$ 42,080 |

|

|

|