Chapter 17 : Strategic Planning and the Master Budget

LEARNING OBJECTIVES

Learning objective 1. Discuss strategic planning and list its component steps.

Learning objective 2. Define the budgets that make up the master budgeting process.

Learning objective 3. Prepare the operating budgets for a manufacturing enterprise.

Learning objective 4. Explain how operating budgets are used in merchandising and service firms.

Learning objective 5. Describe how operating budgets are used to facilitate planning, controlling operations, and evaluating performance.

INTRODUCTION

The master budget is a vital tool that management accountants can use to assist enterprise members in planning, controlling, and evaluating activities. Before any budget is prepared, however, an enterprise should develop a strategic plan.

Once an enterprise has developed a strategic plan, the next step is to translate this plan into short-term and long-term budgets for implementation. The master budget contains both the short-term operating budgets and the long-term capital budget. The master budget translates and summarizes the financial results of the strategies chosen for the upcoming year. The strategies (plans) an enterprise chooses are directed toward accomplishing its goals. In this way, the budgets provide a tight, goal-congruent, rational linkage with the strategic plan.1

STRATEGIC PLANNING

Strategic planning is defined by the Institute of Management Accountants as a systematic and formalized process for purposefully directing and controlling future operations toward desired objectives for periods extending beyond one year. The strategic planning process begins with a mission statement (see p. 782), which sets out the enterprise's purposes. These should include both the business purposes and the social (responsibility) purposes to employees, the community, and the environment. Bently Nevada Corporation's mission statement is the first of six steps in the strategic planning process, shown in Exhibit 17-1.

|

Exhibit 17-1 Steps in the Strategic Planning Process |

|

|

Step 1 |

Define the enterprise’s mission and prepare a formal mission statement |

|

Step 2 |

Establish objectives that, if achieved, should accomplish the mission. |

|

Step 3 |

Define operating goals for the master budget period. |

|

Step 4 |

Analyze the external and internal environment |

|

Step 5 |

Determine strategies (actions) to capitalize on external opportunities and internal strengths and to overcome external threats and internal weaknesses. |

|

Step 6 |

Measure results against the strategies planned. |

Defining Objectives and Goals

Objectives are long-run statements of what the enterprise wants to accomplish. They serve as criteria for assessing long-run effectiveness. Objectives should be linked to the mission, so that if they are realized, organizational survival should result. Goals are measurable translations of objectives. They are bound by a time period, usually the master budget time frame (the budget horizon). Progress toward goal achievement is measured by the management accounting system and other information systems (manufacturing and marketing LANs, for example)2. Objectives and goals are often found in the Management Letter included in annual statements and in the Articles of Incorporation.

Among the objectives IMAX (see p. 783) includes in its mission statement are the following:

|

INSIGHTS & APPLICATIONS Strategic Priorities In day-to-day business activities, as well as in long-term planning, strategic decisions must be made. It is vital that a framework for decision making be established that accurately reflects corporate priorities and promotes consistency. At Bently Nevada we have the following priorities: Safety We continuously strive to create a safer workplace for our employees and to produce products that function at peak performance and safety levels. We will only design and market systems that reliably and effectively monitor the behavior of your machinery. Safety also applies to the environment. Bently Nevada is concerned about ecology and is taking every step possible to ensure protection of the environment. |

Quality We define quality as “conformance to customer require-menu.” Second only to safety, our highest priority is to consistently provide high quality products and services. Above all, we have a deep commitment to continually improve the way we assist our customers. We've worked hard over the past 35 years to achieve our reputation as the top vendor in our industry and we are proud of it! Timeliness Fast, reliable deliveries and prompt replies to inquiries are essential to our mutual success. Although timeliness is of the utmost importance, we will never jeopardize safety or quality to meet deadlines. Cost We will continue to provide products of increasingly better value through improved technology and better manufacturing methods. This process of continuous improvement allows us to pass along savings to you. Our commitment to you is to provide the best value in the industry. Courtesy of Bently Nevada Corporation |

• Create a world-class manufacturing environment

• Obtain a 10 percent market share in the next five years

For the upcoming year, IMAX has established four goals:

• To provide customer service and flexibility, IMAX has a three-day cycle time policy for custom configurations and a two-day shipping time policy on standard configurations.

• To maintain high quality and low inventories of materials, IMAX is developing relationships with a few high-quality suppliers.

• To promote a team concept, cross-training programs, just-in-time (JIT) cells, and quality circles have been made integral parts of the management plan.

• To work toward its 10 percent market share objective, IMAX has set a sales goal of 3,200 Highstepper Pentiums for the upcoming year.

Considering External and Internal Critical Factors

Strategic planning attempts to develop a combination of strategies to maximize the enterprise's performance while considering all critical factors, both external and internal.

External critical factors include the following:

• Customers

• Vendors

• Shareholders

• Government

• Competitors

• Product or service life cycles

Internal critical factors include the following:

• Employees

• Activity-based management (ABM)

|

INSIGHTS & APPLICATIONS IMAX Computers and the Highstepper Pentium “'Managing a new venture is often a greater challenge than managing an established business. To meet this challenge, it is critical that the start-up company implement a comprehensive budgeting process. |

IMAX Computers, a small start-up company, offers a new line of personal computers known as Highstepper. Competition in the PC industry is intense, and the technology can change rapidly. Flexibility, quality, and customer service are key success criteria. IMAX management believes their market niche is in the west coastal United States. In the short run, to establish itself, IMAX is concentrating its marketing efforts in this region. In the long run, national and international sales will be important for growth. Consequently, the Highstepper is advertised in national trade publications and at trade conventions. |

• Total quality management (TQM)

• Logistics

• Target costing, new product development, and life cycle analysis

• Throughput analysis

• Constraint optimization

These, and other, critical environmental factors can be organized into the organization's internal strengths and weaknesses, and its external opportunities and threats (SWOT). SWOT takes into account the interactions between the organization and its environment with respect to what the organization does or plans to do (its objectives and goals). Management should understand;

• What the organization can do well

• What it cannot do very well

• Where it is vulnerable

• What countermeasures are appropriate against these vulnerabilities

• Where the opportunities are

• How to take advantage of those opportunities

By using SWOT as a guidepost, alternate courses of action can be evaluated to determine how well the enterprise overcomes its weaknesses and threats, and capitalizes on its strengths and opportunities in attempting to achieve its goals and objectives.

The internal environment revolves around the corporate culture. Culture is composed of generally accepted rules of behavior passed from generation to generation of employees. Five basic elements influence corporate culture:

• The internal environment created by management

• Its values

• Its heroes

• Rites and rituals (regular social activities)

• The informal communication (cultural) network

The external environment can be characterized in six dimensions:

• The firm's competition

• Its legal and political environment

• Economic conditions

• External social and cultural values and customs

• Technological environment within the industry

• International business and cultural environments3

|

INSIGHTS & APPLICATIONS Monsanto's Introduction of Cycle-Safe Monsanto's efforts to introduce Cycle-Safe illustrate the impact of a firm's external environment and the difficulty in predicting management's future environment. |

Although Monsanto went to great lengths to ensure the safety of Cycle-Safe and received a favorable response to the new product, management did not anticipate the FDA ban. Two dimensions of the external environment—legal and social-cultural—impacted on Monsanto. The company believed that the FDA ban was largely the result of the intense environmental concerns that permeated society at the time. Monsanto took a proactive stance to the FDA ban of Cycle-Safe. First it initiated legal action... [then] Monsanto refiled Cycle-Safe with the FDA and finally received its approval. |

Analyzing and predicting the external environment, even in the short run of the master budget horizon, can be at best risky and at worst uncertain:4

IMAX, in considering its sales goal and its goals for the world-class manufacturing objective, identified a number of external opportunities and threats:

• Many customer orders are for standard configurations. Therefore, many High-stepper Pentiums can be manufactured in a continuous (process) flow. While this can smooth production operations, a three-day finished goods inventory will have to be maintained because of the inherent variability in sales and because IMAX, as a start-up company, is unable to forecast short-term demand accurately.

• Although a few high-quality suppliers are available in the Silicon Valley area of northern California, establishing frequent deliveries (i.e., daily) for a JIT supply situation is not likely in the short run. A 10-day lead time is required for PC boards.

• IMAX chose to locate in Reno, Nevada, because of the area's distribution channels to the primary West Coast market and its low business and property taxes. Also, IMAX management feels it can establish a good relationship with the local government, and obtain favorable tax status by building a factory there.

• Through the local banking community and the Small Business Development Center at the University of Nevada, Reno, IMAX can apply for an SBA loan and develop long-run relationships for creating an EDI system.

• The new national government appears ready to support a proposed amendment to the Americans with Disabilities Act that will provide funding for small businesses with active policies for employing the handicapped.

IMAX management also has identified certain internal strengths and weaknesses that can impact its goal achievement:

• Production and administration facilities can be designed to facilitate efficient operations by handicapped employees. Many of the production processes are amenable to wheelchair-bound employees. Since IMAX is a new company, the plant and administration facilities can be designed for easy access and travel by handicapped employees. For example, fairly cheap land allows for single-story construction. When purchasing office equipment, two-drawer file cabinets (instead of four-drawer) should be selected to allow easy access by handicapped personnel.

• Employees are willing to learn and are motivated to produce high-quality computers. They are also able to design the technology platforms needed to become a world-class manufacturer. These include the ICBIS's LANs and an EDT system for suppliers and some customers.

• The owners have insufficient funds for capital improvements and working capital. This problem can be partly mitigated by the availability of SBA loan guarantees and possibly funds from special federal programs (noted above).

• To help overcome the funding problems, employees are willing to participate in a futures option in a stock purchase program if and when IMAX publicly offers stock (part of the five-year plan).

Setting Strategies

A strategy is a method or action to achieve a goal. For example, installation of new production facilities to make turbochargers for diesel engines represents a new program for an enterprise. Locating the facilities near a truck manufacturer and becoming the manufacturer's major AT supplier represents a strategy. With a clear mission, it is easier to perform sales forecasting and coordinate resources so activities and departments can work together for a common purpose. All people throughout the organization know what business they are in, what their purposes are, how they plan to conduct business, who their customers are, and what will be required to get the job done right the first time.

To ensure goal congruence and rational linkages in the strategic plan, environmental SWOTs should be matched with goals that they can affect. Strategies (and tactics, or specific plans of action) should be matched with specific environmental factors. Matching strategies and environmental factors promotes a proactive (rather than reactive) stance as management attempts to influence the enterprise's environmental dimensions.

Measuring Results

Each action should have a desired result that can be specified in a measurable way. The financial outcomes desired can then be compared against actual results. Profit variances are calculated to measure these differences just as cost variances are used to compare standard and actual costs.'

Variance analysis should not be restricted to budget-to-actual comparisons for the master budget period, however. Long-range trend comparisons illustrating the changes in budgets, standards, and variances should also be presented, possibly with the use of spreadsheet graphics, to facilitate continuous improvement. The effectiveness criteria developed by the firm should reflect where it is in its life cycle. Short-run criteria emphasize production and sales effectiveness, efficiency, and customer satisfaction. Both sets of stakeholders, external customers and employees, should be considered. Measures of product quality, on-time delivery, and service are important external customer criteria. Measures of employee turnover, absenteeism, attitudes, and learning are important “internal customer” criteria. Long-run criteria measure the changes in short-term results over time and additionally include overall organizational changes in flexibility and adaptivity.5

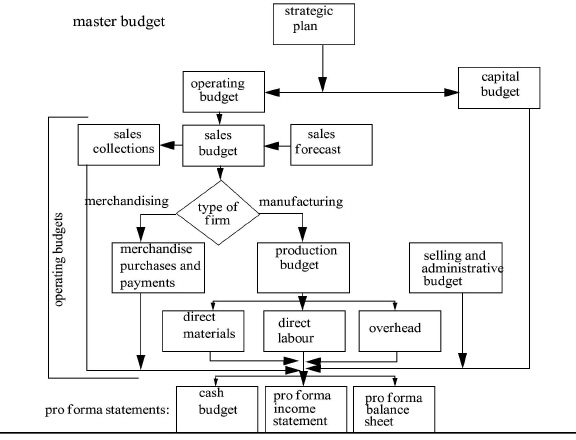

THE MASTER BUDGET

The master budget is a quantitative expression of a plan of action usually for the forthcoming fiscal year. It is a comprehensive set of all operating budgets and includes budgeted financial statements as well as a capital budget. The master budget model is illustrated in Exhibit 17-2.

|

Exhibit 17-2 The Master Budget Model |

|

Strategic Planning Compared with Budgeting

Strategic planning is different from preparing annual budgets, although the two are interrelated. One chief difference is the time period involved. Budgeting primarily involves one year, whereas strategic planning ultimately covers a period that can be three years, ten years, or more, depending on the firm's mission and objectives. The strategic plan is long range; the annual budget is short range. They are interrelated because the master budget is a tool used to achieve one or more of the actions outlined in the strategic plan.

Another difference is that the strategic plan contains relatively little financial data, whereas the master budget is financially based. The main parts of a strategic plan are narrative, for example: “To increase the quality of our products and decrease costs of quality, a total quality management (TQM) system should be implemented.” The objective is in normal type and the goal is italicized. Other examples follow the same pattern:

• “To increase after tax return to shareholders from 12 to 18 percent during the next five years, we need to increase sales from $50 million to $90 million during this period by decreasing time-to-market of new products by 20 percent.”

• “To increase our market share from 16 to 20 percent within the next four years, we must decrease our delivery time by 30 percent.”

• “To reduce production costs by 20 percent within two years, we must eliminate nonvalue-added activities and reengineer value-added activities.”

Role of Management Accountants in Strategic Planning and Budgeting

To a great extent, the reasons for strategic planning and budgeting are to enable management to re-engineer and continuously improve the organization, ensuring its success. During strategic planning, management accountants should review the mission, objectives, goals, and strategies looking for conflicts. For example, an enterprise might be reducing raw materials costs by substituting cheaper materials, while at the same time attempting to eliminate internal and external failure costs. These may be in conflict unless the cheaper raw materials meet quality standards. If this is indeed the case, then both can be achieved. On the other hand, if a trade-off is necessary, the people involved should be made aware which one has the greater priority.

Management accountants can also assist managers in determining how they should change the current situation to improve performance6. In simple terms, the enterprise must know where it is before it can determine where it wants to be.

Further, management accountants can provide reports comparing actual to budget. They can also develop a broad range of performance measurements. Both financial and non-financial information serve as a backdrop for strategic planning and budgeting; for example, product or service costs, activity analysis (e.g., determination of nonvalue-added activities), costs of quality, logistics costs, target costs, life cycle analysis, throughput, and constraint analysis can all be used.

Consequently, modern management accountants perform many roles in the strategic planning and master budgeting process. They serve as organizers, over-seers, facilitators, and even “number crunchers7”. As already noted, a link should exist between strategic planning and the master budget. The principal people who “audit” this link are management accountants. The manner in which the budgeting process is performed and the frequency of budget revisions can promote this linkage.

Many traditional enterprises prepare annual budgets using last year's budget and actual results as a starting point. The upcoming year's budget often simply adjusts the previous year's budget by changing prices without necessarily questioning the validity or appropriateness of last year's expenditures with respect to the organization's strategic plan. One of the main pitfalls with this approach is that the budgeting process may not give adequate consideration to continuous improvement. Implicitly, projected expenditures are justified because the activities creating them were accepted as legitimate last year. Another serious pitfall, especially prevalent with governmental operations in adverse economic environments, is the attitude of “spend it or lose it.” If any efficiencies have resulted in cost savings, the surplus funds are spent at the end of the fiscal year on nonbudgeted items. This frantic spending occurs because the responsibility center managers fear that their budgets will be cut if they do not spend all the funds budgeted in the previous year.

Zero-based budgeting presents an alternative approach to the incremental budgeting process just described. Under zero-based budgeting, each activity, department, or division is periodically rolled back to a zero budget and evaluated critically. Then, each responsibility center manager has to justify every activity and its costs as a condition of the responsibility center's continuation or elimination. Some businesses and government agencies apply zero-based budgeting during strategic planning, activity-based management (ABM), and reengineering initiatives, as discussed in Chapter 11.

Zero-based budgeting can be used as a tool for allocating funds for the annual master budget. Traditionally, incremental budgets worked on the assumption that all activities were worthy of receiving budget increases to cover increasing costs. The question, therefore, was not whether to continue the activity, but rather how much the current level of funding should be increased. In contrast, zero-based budgeting questions each activity in the current budget and determines whether it should be supported as is, re-engineered, or eliminated, consistent with the objectives and goals in the strategic plan.

The budget horizon is the length of time the master budget covers. Master budgets normally span the fiscal year of an enterprise. To achieve effective decision making and cost management, annual operating budgets are usually broken down into shorter time periods, such as quarters, months, or weeks. A frequent variation of the fiscal-year operating budget is the continuous budget in which a 12-month forecast is always available by adding a month or a quarter in the future and dropping the month or quarter just ended. This rolling budget process reflects the dynamics of the enterprise and forces managers to rethink operations constantly no matter what time of the year it is.

Integrated computer-based information systems (ICBISs) with comprehensive databases are especially useful in supporting continuous budgeting. By using simulation models, forecasting techniques, and electronic spreadsheets, managers can determine the impact of various operating alternatives on the master budget and generate the results almost instantaneously. For example, if the cost of raw materials has changed significantly or a competitor is setting lower prices that have to be met, computer programs can quickly produce revised operating budget alternatives that reflect the new raw materials costs and management's new pricing decisions. Management then selects the operating budget that appears to be most feasible for the forthcoming period. Management also may want to analyze the effect of adding or dropping a product line. Computer programs can update current budgeted data, answer what-if questions, and generate a new master budget showing the effects of alternative proposals.

The Master Budget Components

An operating budget (the major subject of this chapter) is the first part of the master budget, representing expected results of operations. For manufacturing firms, it contains the sales, production, direct materials, direct labor, manufacturing overhead, and selling and administrative expense budgets. In merchandising firms, the budgets for manufacturing costs are replaced with budgets for merchandise purchases and payments, as shown in Exhibit 17-2. Service enterprises have only sales and expense budgets.

The operating budget serves many roles in strategic planning, master budgeting, and responsibility accounting:

• An operating budget is a planning tool because it is a written plan for the future operations of an enterprise congruent with the strategic planning objectives.

• An operating budget is a control tool because it helps manage sales, costs, and profits by setting guidelines. People are less inclined to spend money for things that are not needed if they know all expenditures will be compared with specific line items in the budget.

• An operating budget is a performance evaluation tool because budgets can reveal the progress, or lack of progress, of managers. A budget, therefore, is just as likely to enhance a manager's career as it is to be detrimental to a manager's career.

• Moreover, managers can also use budgets as self-evaluation tools.

• An operating budget can be a motivational tool, especially when managers and workers take part in preparing the budget. If, on the other hand, the budget is forced on them, the budget will probably be viewed as a threat.

• An operating budget is a means of communication and coordination. A budget conveys the objectives the enterprise is trying to achieve.

The capital budget focuses on planned capital outlays for property, plant, and equipment. It is a listing of all approved long-term expenditures planned to improve an enterprise's operating capacity and efficiency. The capital budgeting methodology is covered in Chapters 22 through 24.

The master budget culminates in estimated financial statements, referred to as pro forma statements. These statements include the following:

• Cash budget

• Budgeted income statement

• Budgeted balance sheet

STEPS IN PREPARING THE OPERATING BUDGETS

Preparing the operating budgets involves the following eight steps:

l. Make a sales forecast.

2. Prepare the sales budget.

3. Develop the production budget.

4. Prepare the direct materials purchases budget.

5. Prepare the direct labor budget.

6. Prepare the manufacturing overhead budget.

7. Prepare the selling and administrative expenses budget.

8. Prepare budgeted financial statements.

These steps are addressed in the following sections.

Step 1: Make the Sales Forecast

The sales forecast is a projection of the number of products to be sold within the budget horizon. It is the basis of the sales budget, which, in turn, is the basis for all of the other operating budgets. Consequently, the accuracy of the sales forecast directly affects the reliability of the master budget.

Sales forecasts can be classified in many ways. Among the most common are sales by products, by product lines, by distribution channels, by class of customer, and by territories. The following methods are normally used to forecast sales:

• Estimate method

• Statistical method

THE ESTIMATE METHOD. The estimate method is essentially subjective and assumes that the forecaster's knowledge and experience are sufficient to develop reliable forecasts. Generally, one of the following processes is used to develop the sales forecast:

• Top-down. A small group of strategic-level managers determine the sales forecast generally with aid from their staff. Often, this approach results in a sales goal being communicated to lower-level managers. In enterprises with highly centralized decision making and well-defined lines of authority, an autocratic approach sometimes results, based on top management's belief in a Theory X level of motivation in employees. While this approach may be adequate in very stable organizations and external environments, it may not be effective in other situations. More importantly, an autocratic process does not assure that employees will accept the budget as legitimate. Consequently, they may not be motivated to attempt to achieve it. Instead, employees may fight the budget, claiming that it places unrealistic demands upon them. Dysfunctional behavior may also result even if top management uses a consultative approach to budgeting. In this approach, top management consults with operations personnel, but the final forecast and budgets are set at the top without formal employee agreement.

• Bottom-up. The key feature of this approach is that multiple levels of managers and salespersons are involved in the forecasting process. As an example, many companies require that individual sales representatives estimate sales for their sales areas. These estimates are then combined to obtain a total sales figure. In contrast to the autocratic and consultative approaches, this approach relies on participative budgeting. Often, many iterations of sales forecasts, operating budgets, and pro forma statements are conducted before the final agreement of operations personnel is obtained. This approach is based on a Theory Y belief in motivation. Operating personnel are motivated to prepare realistic budgets and accept them as valid benchmarks for performance evaluation. There is also some evidence that line management and shop floor personnel will set and achieve more ideal standards than top management would set. The bottom-up approach is particularly effective in unstable external environments requiring decentralized operations.

THE STATISTICAL METHOD. In contrast to the estimate method, the statistical method uses objective data, such as financial, operating, and economic data, as a basis for forecasts. Historical, financial and operating data are generated by management accountants and stored on computer databases. Economic data are obtained from government publications, trade journals, consultants, and various research companies. External data, such as housing starts, regulatory effects, automobile production, weather forecasts, oil prices, projected interest rates, projected inflation rate, and projected GNP are also used. Both the internal and external data are fed into various sophisticated statistical and econometric models to generate sales forecasts.

Then, the forecasts are presented to the budget committee for approval. Three versions may be considered:

• Best case

• Worst case

• Most likely case

A best case budget is prepared with the assumption that everything will work out as planned. A worst case budget predicts just the opposite and includes the necessary corrective actions that would be performed if the anticipated problems occur. For example, management may establish a line-of-credit just in case additional funds are needed. A most likely case budget includes normal disruptions, constraints, and estimation errors.

The budget committee decides which sales forecast is most reasonable and supportive of the strategic plan. In addition, a budget committee may sometimes make specific recommendations for increasing sales, quality improvement, faster delivery, efficient order processing, advertising campaigns, and the like.

Returning to the IMAX case, top management chose a participative budgeting approach to setting the sales forecast. IMAX's sales staff, armed with a simple questionnaire, surveyed their customers to determine how many Highsteppers they planned to buy and how much they would be willing to pay. IMAX's entire budget is based on the sales forecast-the number of Highsteppers that it will sell and the price they will be sold for. Sales forecasting is the main “gear” that drives all the other “budget gears,” and it is the most uncertain part of IMAX's budgeting process. It must be supported by a combination of facts, market surveys, detailed analysis, and assumptions. The data from these surveys were given to IMAX's management accountant, Hal Segiguchi, who entered the data into a spreadsheet program. The program produces the sales budget discussed next.

Step 2: Prepare the Sales Budget

Once a sales forecast is made, a sales budget is, prepared. The sales budget is the expected sales in units and dollars and includes a schedule of cash collections from sales. It serves as a basis for preparing the other budgets. Clearly, the sales level affects the production and purchasing levels, the operating expense levels, as well as cash flow.

The sales budget should be supportive of the strategic plan. For example, management must be careful about deviating from long-term pricing strategies to meet short-term sales projections.

Hal Segiguchi used one of the Highsteppers to run the spreadsheet program, which generated different results based on several sets of assumptions about pricing and promotion. The spreadsheet program includes an “add-in” program for statistical forecasting and sensitivity analysis. The results were sent to the budget committee for review. The forecast and pricing they selected were returned to Hal, who prepared the sales budget. To keep the procedures and calculations to a manageable level, only the budgets for the second quarter of 2014 are presented in the exhibits that follow.

Exhibit 17-3 presents the sales forecast, which is based on a stable sales price of $2,000 per computer. The sales staff, based on their survey results, believe 20 percent of IMAX's customers will pay in cash. Cash sales for each month in the second quarter of 2005 comprise the first set of four “sources of cash from sales” included in the Collections of Sales schedule.

|

Exhibit 17-3 IMAX's Sales Budget |

|||||||

|

Sales Forecast: |

Feb. |

March |

April |

May |

June |

July |

Aug. |

|

Sales (units) x sales price |

350 $2,000 |

250 $2,000 |

00 $2,000 |

230 $2,000 |

270 $2,000 |

300 $2,000 |

220 $2,000 |

|

Sales revenues |

$700,000 |

$500,000 |

$400,000 |

$460,000 |

$540,000 |

$600,000 |

$440,000 |

|

COLLECTIONS OF SALES: |

|

|

Amounts Collected |

|

|||

|

Month |

Sales Formula |

|

April |

May |

June |

|

|

|

This month-cash* |

|

|

|

|

|

|

|

|

April |

$400,000 x 20% |

|

$80,000 |

|

|

|

|

|

May |

$460,000 x 20% |

|

|

$92,000 |

|

|

|

|

June |

$540,000 x 20% |

|

|

|

$108,000 |

|

|

|

This month-credit** |

|

|

|

|

|

|

|

|

April |

$400,000 x 80% x 50% x 98% |

156,800 |

|

|

|

||

|

May |

$460,000 x 80% x 50% x 98% |

|

180,320 |

|

|

||

|

June |

$540,000 x 80% x 50% x 98% |

|

|

211,680 |

|

||

|

From last month's credit sales |

|

|

|

|

|

|

|

|

March |

$500,000 x 80% x 35% |

140,000 |

|

||||

|

April |

$400,000 x 80% x 35% |

|

112,000 |

|

|

||

|

May |

$460,000 x 80% x 35% |

|

|

128,800 |

|

||

|

From 2 months ago-credit sales |

|

|

|

|

|

|

|

|

February |

$700,000 x 80% x 14% |

78,400 |

|

||||

|

March |

$500,000 x 80% x 14% |

|

56,000 |

|

|

||

|

April |

$400,000 x 80% x 14% |

|

|

44,800 |

|

||

|

Total cash collected from sales in 2nd quarter: |

|

$455,200 |

$440,320 |

$493,280 |

|

||

|

*Cash sales = 20% of each month's total sales. **Credit sales collection pattern = 50% collected in month of sale (less 2% discount), 35% in next month, 14% two months after sales, and 1% bad debts. |

|||||||

|

MANUAL CALCULATIONS PROCEDURES: 1. Find information on when sales are collected. (Cash versus Credit Sales, and Credit Collection Pattern) 2. Setup schedule format. (3 columns + 1 column for each month included in the budget period. There will be 1 group of rows for each source of cash. For this example, there are 4 sources of cash deposited into the bank each month. Within each group of rows, there will be 1 row for each month in the budget period.) 3. Write in given information. (In column 1, write down the month that belongs on each row; in column 2, write in the sales for that month; and then, in column 3, write in the multiplication chains [the collection formula].) 4. Turn on your calculator and complete each month's column. (The last three columns in the “Amounts Collected” section.) |

|||||||

The sales staff has two choices for credit sales: extending in-house credit or accepting national credit cards. When in-house credit is offered, a credit collection pattern is used to show how much of a month's credit sales are projected to be collected in that month and in subsequent months. The following pattern is used in Exhibit 17-3:

• Fifty percent of a month's credit sales will be collected within that month.

• Thirty-five percent of a month's credit sales will be collected in the subsequent month (a “one-month lag”).

• Fourteen percent of a month's credit sales will be collected two months in the future (a two-month lag on collections).

• One percent of a month's credit sales are projected to be uncollectible.

• To collect credit sales within the month of sale, IMAX will have to offer a 2 percent credit sales discount. This can be justified by the cost savings from not having to send out monthly statements to credit customers paying from the invoices.

The sales manager and staff decided against accepting national credit cards because they would charge a 3 percent fee, maintaining the separate bank accounts required by each card would involve extra costs, and IMAX could be backtracked for sales rejected by the credit card companies. The credit card companies' experience in backcharges is greater than the 1 percent of in-house credit sales projected to be uncollectible.

Exhibit 17-3's schedule for Collections of Sales includes four sources of cash deposits into IMAX's bank account within any given month. The first section of the exhibit includes the cash sales for that month. The second section represents deposits from credit sales made during the month. The third section, and the third type of cash deposits made in a month, comes from collections of credit sales made in the previous month. The fourth section includes deposits from collections of credit sales made two months ago.

The “Formula” column of the schedule shows the multiplication chains that represent the credit collection pattern_ The first set of percentages (20 and 80 percent) are the portion of a month's sales that are cash versus credit. The second set of percentages (50, 35, and 14 percent, respectively) are the percentages of a month's credit sales collected in subsequent months. The third set of percentages in the chain represents the net amounts collected within the month of sale adjusted for the 2 percent credit sales discount8. Procedures for setting up this section of the sales budget manually, and verifying the amounts, are presented at the bottom of Exhibit 17-3.

Step 3: Develop the Production Budget

The production budget presents the production quota for the budget period, adjusted for planned changes in finished goods inventory levels. The production budget is used in conjunction with raw materials inventory plans to prepare the direct materials purchases budget. It is also used to prepare the direct labor budget and manufacturing overhead budgets.

Although the sales budget is usually developed before the production budget, there should be continuous communication between production and marketing to ensure that production requirements are somewhat uniform throughout the year and capacity is not exceeded. With a stable production policy, manufacturing resources will be better utilized. Moreover, careful planning of production, inventory levels, labor needs, and other resource requirements can result in significant savings.

Exhibit 17-4 presents IMAX's production budget. According to this budget, sufficient units have to be available to meet sales needs and provide for the desired ending inventory. Because of the production cycle time for the Highstepper Pentium and inherent uncertainty in daily sales, three days of FGI is desired. Consequently, each month's beginning FGI should be 10 percent (3 of 30 days in a month) of the month's projected sales. This is equivalent to having a desired ending FGI equal to 10 percent of next month's sales forecast.

|

Exhibit 17-4 IMAX's Production Budgeta |

||||

|

|

April |

May |

June |

July |

|

Sales (in units) |

200 |

230 |

270 |

300 |

|

Plus desired ending FGI |

23 |

27 |

30 |

|

|

Units needed |

223 |

257 |

300 |

|

|

Less beginning FGI |

<20> |

<23> |

<27> |

|

|

Production quota |

203 |

234 |

273 |

|

|

aNote: Ending FGI = 10% of next month's sales forecast. |

Step 4: Prepare the Direct Materials Purchases Budget

The direct materials purchases budget presents the expected usage of direct materials in production and facilitates planning of purchases. It also assists managers in reducing ordering and carrying costs, whether the inventory management approach is economic order quantity (EOQ) and safety stock, material requirements planning (MRP), or just-in-time (JIT).

A direct material's required quantity is a function of its standard quantity and the production quota. The engineering staff and production personnel, through developing a bill of materials and standard cost card, know how many direct materials (the standard quantity) are required to produce a finished computer. The direct materials standard price is normally estimated by the purchasing manager. In addition, the purchasing manager plans direct material inventory levels, purchases, and the cost of these purchases.

Sufficient direct materials must be available to meet production needs and provide the desired ending direct materials inventory for each month in the budget period. Thus, part of the direct materials requirement will normally exist in the form of beginning direct materials inventory. The remainder will be purchased from suppliers. A 10-day supply of PC boards is needed for production of the Highstepper Pentium (a 10-day supply is one-third of a month). Since IMAX is unable to negotiate JIT deliveries, one-third of the projected PC boards needed in a month should be in that month's beginning direct materials inventory. Or, equivalently, a month's ending direct materials inventory should be one-third of the next month's projected PC boards needed.

The direct materials purchases budget is normally accompanied by a computation of expected cash disbursements for direct materials purchases. This schedule is necessary for developing the cash budget. Disbursements for direct materials consist of payments for some of the prior month's purchases and some of the current month's purchases. PC board shipments are received every 10 days, and 2/3 of a month's purchases are paid within that month, and the last one-third of the month's purchases are paid in the next month9. The direct materials purchases budget for PC boards is illustrated in Exhibit 17-5,

|

Exhibit 17-5 IMAX's Direct Materials Purchases Budget for PC Boards |

||||||

|

|

|

March |

April |

May |

June |

July |

|

Production quota X standard quantity of PC boards |

|

245 5 |

203 5 |

234 5 |

273 5 |

292 5 |

|

PC boards needed for current production |

|

1,225 |

1,015 |

1,170 |

1,365 |

1,460 |

|

Plus ending inventory |

1/3 |

338 |

390 |

455 |

487 |

|

|

Less beginning inventory |

1/3 |

<408> |

<338> |

<390> |

<455> |

|

|

PC boards to purchase |

|

1,155 |

1,067 |

1,235 |

1,397 |

|

|

X standard price |

|

$100 |

$100 |

$100 |

$100 |

|

|

Total purchase cost |

|

$115,500 |

$106,700 |

$123,500 |

$139,700 |

|

|

Accounts Payable Payment Schedule: |

|

|

|

|

||

|

To pay this month |

2/3 |

|

$71,133 |

$82,333 |

$93,133 |

|

|

Owed from last month |

1/3 |

|

38,500 |

35,567 |

41,167 |

$46,567 |

|

Cash outflow for accounts payable payments |

|

$109,633 |

$117,900 |

$134,300 |

|

|

|

Notes: I. The production quotas for March and July were based on sales from Exhibit 17-3. 2. Ending PC boards inventory = one-third of next month's needs. 3. Supplier payment terms require payment of two-thirds of a month's purchases within the month in order to obtain the purchase discount included in the standard price. |

||||||

which includes only the budget for PC boards. Each direct material included on the standard cost card has its own purchases and payments budget. Obviously, the use of a computer program is advantageous. This program can be part of the MRP II program in the production LAN or a component of the standard cost program in the management accounting LAN; alternatively, it can reside in a centralized database in an ICBIS, accessed by each LAN as needed. The standard cost card is presented in Exhibit 17-10.

Step 5: Prepare the Direct Labor Budget

The production quota is also used as a basis for the direct labor budget. This budget contains the direct labor hours to schedule each month, the direct labor cost, and a schedule of cash flows for the payment of labor-related costs.

The method used to convert production quota to direct labor hours varies from one company to another. Some companies have comprehensive standard cost records and sufficient experience to estimate standard direct labor hours fairly accurately. On the other hand, if the product is new, an industrial engineer may set up time and motion studies and learning curve analyses to develop reliable labor standard quantities.

After meeting with the cell workers, IMAX's industrial engineer determined that 20 direct labor hours will be required to complete one Highstepper Pentium. The standard direct labor rate includes the wage rates budgeted and the projected payroll taxes and fringe benefits. Standard labor hours are based on practical standards, with allowances for inspection time within each task10. The resulting direct labor budget is shown in Exhibit 17-6.

Step 6: Prepare the Manufacturing Overhead Budget

The manufacturing overhead budget contains the expected cost of all indirect manufacturing elements necessary to meet the production budget. The manufacturing overhead budget summarizes the overhead costs of all the different responsibility centers. Like different direct materials, each responsibility center should have a separate overhead budget. Therefore, overhead cost equations are needed for each overhead resource, activity, service center, and production department. As all overhead flows into the production department’s overhead accounts and predetermined overhead rates (PORs) within the production budgeting process, the PORs include all the different indirect and support activities. This allows the management accountant to prepare a summary budget for all overhead costs using the departmental PORs. To further simplify the concept, assume IMAX uses just one plantwide variable overhead (VOH) POR and fixed overhead (FOH) POR.

|

Exhibit 17-6 IMAX's Direct Labor Budget |

||||||

|

|

|

March |

April |

May |

June |

July |

|

Production quota |

|

245 |

203 |

234 |

273 |

|

|

x standard quantity |

|

20 |

20 |

20 |

20 |

|

|

Direct labor hours to schedule |

|

4,900 |

4,060 |

4,680 |

5,460 |

|

|

X standard price |

|

$15 |

$15 |

$15 |

$15 |

|

|

Total direct labor cost |

|

$73,500 |

$60,900 |

$70,200 |

$81,900 |

|

|

Wages Payable Payment Schedule: |

|

|

|

|

|

|

|

To pay this month |

75% |

|

$45,675 |

$52,650 |

$61,425 |

|

|

Owed from last month |

25% |

|

18,375 |

15,225 |

17,550 |

$20,475 |

|

Cash outflow for wages payable payments |

|

|

$64,050 |

$67,875 |

$78,975 |

|

|

Note: Workers are paid weekly so the last week's labor cost is paid in the first week of the next month. |

||||||

Exhibit 17-7 presents the summary overhead budget for IMAX. The VOH POR of $10 per direct labor hour captures all the VOH items within the factory. The budgeted fixed overhead of $40,000 per month includes $25,000 per month in building and equipment depreciation. Note that this is subtracted from the budgeted overhead because it is not a cash cost. Also note that in the Payment Schedule, all overhead costs are paid on a one-month lag. In other words, all overhead costs incurred in a month are paid in the next month.

A word of caution is in order. Many fixed overhead costs are not incurred uniformly throughout the year. For example, property taxes and insurance may only be paid semi-annually or annually. In these situations, the fixed overhead costs should be budgeted in amounts representative of when actual payments are expected to be made. This further highlights the necessity of having separate budgets for individual overhead activities. The IMAX illustration in Exhibit 17-7 is oversimplified.

|

Exhibit 17-7 IMAX's Manufacturing Overhead Budget |

|||||

|

|

|

|

|

|

|

|

|

March |

April |

May |

June |

July

|

|

Production quota |

245 |

203 |

234 |

273 |

|

|

X direct labor standard quantity |

20 |

20 |

20 |

20 |

|

|

Direct labor hours to schedule |

4,900 |

4,060 |

4,680 |

5,460 |

|

|

X VOH POR |

$10 |

$10 |

$10 |

$10 |

|

|

Total VOH cost |

$49,000 |

$40,600 |

$46,800 |

$54,600 |

|

|

Total FOH cost |

40,000 |

40,000 |

40,000 |

40,000 |

|

|

Less noncash FOH items: Depreciation |

<25,000> |

<25,000> |

<25,000> |

<25,000> |

|

|

Total cash-related FOH costs |

$15,000 |

$15,000 |

$15,000 |

$15,000 |

|

|

Total budgeted cash overhead |

$64,000 |

$55,600 |

$61,800 |

$69,600 |

|

|

|

|

|

|

|

|

|

Manufacturing Overhead Payment Schedule: |

|

|

|

|

|

|

To pay this month |

0%, |

$ -0- |

$ -0- |

$ -0- |

|

|

Owed from last month |

100% |

64,000 |

55,600 |

61,800 |

$69,600 |

|

Cash outflow for overhead payments |

|

$64,000 |

$55,600 |

$61,800 |

|

|

Notes: 1. Noncash items are subtracted from FOH because only cash-paid costs should appear on the cash budget. 2. All overhead costs arc paid on a one-month lag. |

|||||

Step 7: Prepare the Selling and Administrative Expenses Budget

The selling and administrative expenses budget includes planned expenditures for nonmanufacturing activities. Like the costs in the manufacturing over-head budget, selling and administrative expenses can be divided into variable and fixed components.

To develop this budget, IMAX managers in charge of marketing and administration analyzed the amount of resources they needed to meet the sales budget. The results of this analysis are presented in Exhibit 17-8. This summary budget uses the same format as the summary overhead budget. Like the overhead budgets, selling and administrative budgets should be individually prepared by each responsibility center manager.

A word of caution is in order when budgeting variable selling and administrative expenses. Some expenses vary with sales revenues, such as the 5 percent sales commission used in the IMAX case, other expenses, though, such as shipping costs, vary with sales volume. Consequently, the budget may contain two variable selling expense lines. Consistent with activity-based costing, some administrative expenses may vary with the activities performed. For example, some order processing and accounts receivable costs will vary with the number of shipments and/or sales orders processed.

|

Exhibit 17-8 IMAX's Selling and Administrative Expenses Budget |

|

||||

|

|

March |

April |

May |

June |

July |

|

Sales revenues (Exhibit 17-3) |

$500,000 |

$400,000 |

$460,000 |

$540,000 |

|

|

X variable selling expenses |

5% |

5% |

5% |

5% |

|

|

Total variable selling expenses |

25,000 |

20,000 |

23,000 |

27,000 |

|

|

Total fixed selling expenses |

20,000 |

25,000 |

20,000 |

20,000 |

|

|

Total fixed administrative expenses |

130,000 |

120,000 |

125,000 |

150,000 |

|

|

Less noncash expenses: Depreciation |

<5,000> |

<5,000> |

<5,000> |

<5,000> |

|

|

Total cash-related fixed S & A expenses |

$145,000 |

$140,000 |

$140,000 |

$165,000 |

|

|

Total cash S & A expenses budgeted |

$170,000 |

$160,000 |

$163,000 |

$192,000 |

|

|

|

|

|

|

|

|

|

Selling And Administrative Expenses Payment Schedule: |

|

|

|

||

|

To pay this month 0% |

|

$ -0- |

$ -0- |

$ -0- |

|

|

Owed from last month 100% |

|

170,000 |

160,000 |

163,000 |

$192,000 |

|

Cash outflow S & A expenses payments |

$170,000 |

$160,000 |

$163,000 |

|

|

|

Notes: 1. Noncash items are subtracted from fixed administrative expenses because only cash-paid costs should appear on the cash budget. 2. All selling and administrative expenses are paid on a one-month lag. |

|||||

Step 8: Prepare Budgeted Financial Statements

The foregoing budgets produce the necessary data to prepare IMAX's pro forma (budgeted) financial statements. These statements include the following:

• The cash budget discloses the expected cash inflows and outflows for the budget period. The cash budget is interrelated to all the other budgets and is the starting point for the preparation of the pro formas.

• The sales budget, standard cost card, and selling and administrative expenses budget provide the data necessary to prepare the pro forma income statement. Additional data on other income, other expenses, and income taxes are also gathered from other sources and included.

• The pro forma balance sheet shows the projected financial position of the enterprise at the end of the budget period. Many of the amounts needed are created in the process of preparing the operating budgets. As these amounts are identified, they can be “posted” to the pro forma balance sheet. Detailed instructions for preparing the pro formas are presented next.

THE CASH BUDGET. Exhibit 17-9 presents IMAX's cash budget for the second quarter, 2005. It pulls together much of the data generated in the preceding steps. Hal Segiguchi's spreadsheet program copied the monthly totals from the operating budgets into this report. He then input into the Data Section of the program amounts for nonoperational cash flows obtained from general ledger personnel and the Finance Department.

Prior to Hal's new spreadsheet program and Highstepper Pentium, he had to prepare the budgets manually. Obviously, this was a time-consuming and complex process. Hal followed these steps in manually preparing IMAX's budgets:

Step 1. Get a big table. In the middle of the table, Hal placed a sheet of four-column accounting working paper for the cash budget. On each side of this paper, Hal placed a sheet of working paper for the pro forma income statement and balance sheet. His strategy was to develop the operating budgets as needed to provide the amounts for the cash budget. As soon as amounts needed for the income statement and balance sheet were created on an operating budget, they were “posted” to the pro formas. In this way, the cash budget served as the focal point for his manual process. Additionally, this process allowed Hal to prepare the pro formas simultaneously with the operating budgets.

Step 2. Begin the cash budget. Hal then began with the cash budget's first entry. If this entry needed a supporting schedule, he would prepare it, post the amounts to the cash budget and pro formas, and then place the schedule next to the pro formas on the table. Hal set up the cash budget format by dividing it into three sections:

• The “Cash from operations” section reports on the cash flows from operations for each month in the budget horizon. IMAX's management used the Cash from Operations subtotal as a measure of cash “profitability” resulting from the production and sales of the Highstepper Pentium. This subtotal answers the question, “Do each month's operations generate a positive cash flow?”

The second section lists nonoperational sources and uses of cash. The subtotal “Monthly Cash Flow” is used by IMAX management as a measure of the month's cash profitability. This subtotal answers the question, “Does the month as a whole generate a positive cash flow?” Hal obtained the information for this section from the capital budget and general ledger personnel in the Accounting Department. Sources are positive amounts as they will be deposited into IMAX's bank account. Uses are payments and, thus, are shown as negative amounts.

|

Exhibit 17-9 IMAX's Cash Budget for the Second Quarter |

||||

|

|

CASH BUDGET SECOND QUARTER, 2005 |

|

|

|

|

|

April |

May |

June |

Totals |

|

OPERATIONAL CASH INFLOWS: From product sales (Exhibit 17-3) |

$455,200 |

$440,320 |

$493,280 |

$1,388,800 |

|

OPERATIONAL CASH OUTFLOWS: Direct materials (Exhibit 17-5) |

$109,633 |

$117,900 |

$134,300 |

361,833 |

|

Direct labor (Exhibit 17-6) |

64,050 |

67,875 |

78,975 |

210,900 |

|

Manufacturing overhead (Exhibit 17-7) |

64,000 |

55,600 |

61,800 |

181,400 |

|

Selling & Admin. expenses (Exhibit 17-8) |

170,000 |

160,000 |

163,000 |

493,000 |

|

Income taxes (Exhibit 17-11) |

<450> |

3,844 |

4,536 |

7,930 |

|

TOTAL OPERATIONAL CASH OUTFLOWS |

<$407,233> |

<$405,219> |

<$442,611> |

<$1,255,063> |

|

CASH FROM OPERATIONS |

$47,967 |

$35,101 |

$50,669 |

$133,737 |

|

|

|

|

|

|

|

NONOPERATIONAL SOURCES & USES: Notes receivable collections |

7,000 |

-0- |

7,000 |

14,000 |

|

Equipment purchases |

<5,000> |

<10,000> |

<10,000> |

<25,000> |

|

Notes payable payments |

<40,000> |

<40,000> |

<40,000> |

<120,000> |

|

TOTAL NONOPERATIONAL CASH FLOWS |

<$38,000> |

<$50,000> |

<$43,000> |

<$131,000> |

|

MONTHLY CASH FLOW |

$9,967 |

<$14,899> |

$7,669 |

$2,737 |

|

Beginning cash balance |

20,000 |

24,917 |

20,000 |

20,000 |

|

CASH SURPLUS/<DEFICIT> |

$29,967 |

$10,018 |

$27,669 |

$22,737 |

|

FINANCING Beginning line-of-credit balance |

$5,000 |

$-0- |

$9,982 |

$5,000 |

|

Interest |

<50> |

-0- |

<100> |

<150> |

|

Borrowings |

-0- |

9,982 |

-0- |

9,982 |

|

Repayments |

<5,000> |

-0- |

<7,569> |

<12,569> |

|

Ending line-of-credit balance |

-0- |

9,982 |

2,413 |

2,413 |

|

ENDING CASH BALANCE |

$24,917 |

$20,000 |

$20,000 |

$20,000 |

• The last section “Financing” addresses the need for short-term financing. In some months, all businesses have surplus cash left over. In other months, there may not be sufficient deposits to cover the anticipated payments. In these months, a company needs a line-of-credit with its bank. A line-of-credit is analogous to an individual having overdraft protection. The bank temporarily deposits funds into IMAX's account to cover a projected deficit. This is a short-term, usually unsecured, loan. When a surplus balance is projected, the bank withdraws the surplus to pay the interest on the loan and then to pay off the principal balance. In this way, IMAX's bank is a stakeholder in the company. IMAX's bank requires that a cash budget, with a financing section, be updated quarterly and provided to the bank as a condition of maintaining the line-of-credit.

The Financing section really begins with the calculation of the monthly bank account balance (the “Cash Surplus/(Deficit)” subtotal). This is the sum of the Monthly Cash Flow subtotal plus the beginning cash balance for that month. On April 1, IMAX projects a $20,000 beginning cash balance, which is its minimum required balance according to the line-of-credit agreement with the bank. Whenever IMAX projects a balance less than $20,000, the bank will deposit enough money to bring the balance up to this amount. Whenever IMAX projects an ending balance greater than $20,000, the bank will use the surplus to repay the line-of-credit balance.

On April 1, IMAX expects to owe a $5,000 balance on its line-of-credit. For April, the bank will charge 1 percent simple interest and deduct this amount ($50) from the hank account. Therefore, the monthly interest charge is shown as a negative amount in the cash budget because it will be withdrawn from IMAX's bank account. In April, IMAX projects an ending bank account balance of $29,967 before line-of-credit financing (i.e., the “Cash Surplus/ <Deficit>”). It is in a position to pay back the entire balance on its line-of-credit. First, $50 will be deducted from the bank account for interest expense, then $5,000 for principal. This leaves a projected ending line-of-credit balance of zero and an ending bank account balance of $24,917.

The ending cash balance for April becomes the beginning cash balance for May. Once this is known, Hal can calculate May's cash surplus or deficit and determine whether any line-of-credit financing is needed. Because May's cash surplus is only projected to be $10,018, IMAX will need to borrow $9,982 on its line-of-credit so it can maintain its minimum required cash balance of $20,000.

In June, IMAX projects a cash surplus of $27,669. The bank will first use $100 of the surplus to pay one month's interest and then use the balance ($7,569) to partially repay the line-of-credit principal. At the end of June, IMAX will still owe $2,413 on its line-of-credit.

Considering the second quarter in total, IMAX operations will generate a positive cash flow of $133,737. Including nonoperational cash flows, the second quarter as a whole will generate a positive cash flow of only $2,737, however. The $2,737 will be used to pay $150 in line-of-credit interest and $2,587 of the beginning line-of-credit balance.

To prepare the “Totals” column in the cash budget, most lines can simply be added across. The beginning cash balance line should not be added across into the Totals column, though. The Totals column represents the entire second quarter-April 1, 201x, through June 30, 201x. Consequently, the beginning cash balance should be the beginning balance on April 1; that is, the $20,000. The cash surplus or deficit in the Totals column is then the sum of the quarter's cash flow plus the April 1st beginning balance.

Similarly, the beginning line-of-credit balance on April 1 is the beginning balance in the Totals column. The ending line-of-credit balance in the June column (the June 30th balance) becomes the ending balance for the quarter (which also ends on June 30th). The ending June cash balance is the ending cash balance for the second quarter. The cash surplus minus interest, plus borrowings, and minus repayments should sum to the ending cash balance for each month and for the quarter in the Totals column.

Step 3. Prepare supporting schedules and operating budgets as needed. The first line of the cash budget is cash deposits from the sales of Highstepper Pentiums. This information comes from Exhibit 17-3. Each line in the first section of the cash budget requires a supporting schedule (operating budget). As each operating budget is prepared, amounts needed for the pro formas are posted to them, as discussed in the next step.

Step 4. Complete the cash budget and pro formas. After individual amounts are posted to the cash budget, income statement, and balance sheet, the income statement is completed. The income tax liability is posted to the cash budget, and it is completed as described in step 2 above. Finally, the balance sheet is completed. Specific steps in posting amounts to the pro formas are discussed next.

THE PRO FORMA INCOME STATEMENT. Prior to completing the income statement, Hal Segiguchi obtained the standard cost card for the Highstepper Pentium from the MRP II LAN. It is presented in Exhibit 17-10. The pro forma income statement is shown in Exhibit 17-11. The sales budget (Exhibit 17-3) and the standard cost card (Exhibit 17-10) provide the information to project Gross Profit for each month11. Exhibit 17-8 provides the information on selling and administrative expenses. Note that the expenses are used and not the cash totals for each month. Expenses include depreciation even though it is not included in the cash outflows for the cash budget. Income taxes are projected to be 20 percent of pre-tax operating income less line-of-credit interest.

|

Data Section: Standard Costs |

|

|

|

|

Manufacturing inputs |

Price |

Output Quantity |

Loss % |

|

PC Boards |

$100.00 |

5.00 |

0.00% |

|

Direct Labour |

$15.00 |

16.00 |

20.00% |

|

Variable Overhead |

$10.00/DLH |

|

|

|

Fixed overhead |

$7.50/DLH |

|

|

|

Normal production volume (in units) |

3200 |

|

|

|

|

|

|

|

|

Solution section: Standard Cost Card and Manufacturing cost equation |

|||

|

IMAX Computers Highstepper Pentium Standard Cost Card |

|

|

|

|

Manufacturing inputs |

Standard Prices |

Standard Quantities |

Standard Costs |

|

PC Boards |

$100.00 |

5 boards/computer |

$500/computer |

|

Direct Labour |

$15.00 |

20 DLH/computer |

$300/computer |

|

Variable Overhead |

$10.00/DLH |

20 DLH/computer |

$200/computer |

|

Fixed overhead |

$7.50/DLH |

20 DLH/computer |

$150/computer |

|

|

Standard Absorptive Manufacturing Cost |

$1,150/computer |

|

|

Monthly production cost = |

$40,000/month + $1,000/computer |

|

|

|

Note: the 20DLH standard quantity is 16 DLH / (1-20%). The $1,000/computer is the sum of the variable standard costs. Refer to Chapter 7. |

|||

THE PRO FORMA BALANCE SHEET. The pro forma balance sheet is presented in Exhibit 17-12. Most of the amounts are posted to it as the operating budgets are prepared. Some amounts require special calculations not reflected on the operating budgets. For example, the accounts receivable balance can be computed upon completion of the sales budget, as shown in note 1 to the balance sheet. The current portion of the notes receivable represents three more bimonthly collections in 2005 (in August, October, and December according to the cash budget).

|

IMAX COMPUTERS Pro Forma Income Statement Second Quarter, 2005 |

||||

|

|

April |

May |

June |

Totals |

|

Sales revenues (Exhibit 17-3) |

$460,000 |

$400,000 |

$540,000 |

$1,400,000 |

|

Less sales discounts |

<3,200> |

<3,680> |

<4,320> |

<11,200> |

|

Less bad debts |

<4,000> |

<4,600> |

<5,400> |

<14,000> |

|

Net sales |

$392,800 |

$451,720 |

$530,280 |

$1,374,800 |

|

Less cost of goods sold (Exhibit 17-10) |

<230,000> |

<264,500> |

<310,500> |

<805,000> |

|

Gross profit |

$162,800 |

$187,220 |

$219,780 |

$569,800 |

|

Less selling and administrative expenses (Exhibit 17-8): |

|

|

|

|

|

Variable selling expenses |

20,000 |

23,000 |

27,000 |

70,000 |

|

Fixed selling expenses |

25,000 |

20,000 |

20,000 |

65,000 |

|

Fixed administrative expenses |

120,000 |

125,000 |

150,000 |

395,000 |

|

Total selling & admin. expenses |

<165,000> |

<168,000> |

<197,000> |

<$530,000> |

|

Net pre-tax operating income |

<$2,200> |

$19,220 |

$22,780 |

$39,800 |

|

Less line-of-credit interest (Exhibit 17-9) |

<50> |

-0- |

<100> |

<150> |

|

Less income taxes -20% |

450 |

<3,844> |

<4,536> |

<7,930> |

|

Net operating income |

<$1,800> |

$15,376 |

$18,144 |

$31,720 |

|

Note: COGS is calculated by multiplying the standard absorptive manufacturing cost by the monthly sales forecast. |

||||

The beginning property, plant, and equipment account balance ($2,500,000) comes from the projected March 30th balance, as does the accumulated depreciation balance ($450,000). The current liability balances come directly from the operating budgets referenced in the “Exhibit” column. As Hal Segiguchi calculated each amount, he noted his calculations below the balance sheet. Based on his past experiences with the budget committee, he knew he would need to explain where these amounts came from. The notes provide him with the necessary “audit trail.”

Master Budgeting Differences in Nonmanufacturing Enterprises

The foregoing budgeting steps can also be used in preparing the operating budget in merchandising and service firms. The operating budgets are much simpler in nonmanufacturing enterprises because these firms do not make products.

In a merchandising organization, a merchandise purchases budget replaces the production budget and its associated direct materials, direct labor, and manufacturing overhead budgets as illustrated in Exhibit 17-2. A merchandise purchases budget is a statement showing the cost of merchandise to be purchased to meet estimated sales and ending merchandise inventory needs. A typical budget is illustrated in Exhibit 17-13.

Note the similarities between this budget and the direct materials budget in Exhibit 17-5. The only difference is that instead of calculating the number of computers to manufacture as the basis for direct material purchases, in this budget, sales revenues are used to project merchandise purchases. Assume that IMAX purchases Highstepper Pentiums and Cost of Goods Sold equals 60 percent of sales revenues12. Sales revenues are calculated using retail sales prices. Merchandise is purchased at cost, however, not at retail sales price. Thus, revenues first have to be converted into their corresponding cost of the computers sold.

|

Exhibit 17-12 IMAX's Pro Forma Balance Sheet |

|||

|

IMAX COMPUTERS Pro Forma Balance Sheet June 30, 2005 |

|

|

|

|

Assets: |

Exhibit |

Balance |

Totals |

|

Current: Cash |

17-9 |

$20,000 |

|

|

Accounts receivable |

note 1 |

263,200 |

|

|

Notes receivable |

note 2 |

21,000 |

|

|

Raw materials inventory |

17-5 |

48,700 |

|

|

Work-in-process inventory |

none |

-0- |

|

|

Finished goods inventory |

17-4 |

34,500 |

$387,400 |

|

Noncurrent: Notes receivable |

note 3 |

$84,000 |

|

|

Property, plant, & equipment |

note 4 |

2,525,000 |

|

|

Less accumulated depreciation |

note 4 |

<540,000> |

2,069,000 |

|

Total Assets |

|

|

$2,456,400 |

|

|

|

|

|

|

Liabilities: |

|

|

|

|

Current: Accounts payable |

17-5 |

$46,567 |

|

|

Wages payable |

17-6 |

20,475 |

|

|

Overhead payable |

17-7 |

69,600 |

|

|

Selling & Admin. expenses payable |

17-8 |

192,000 |

|

|

Line-of-credit payable |

17-9 |

2,413 |

|

|

Notes payable |

note 5 |

240,000 |

$571,055 |

|

Noncurrent: Notes payable |

note 6 |

|

1,600,000 |

|

Total Liabilities |

|

|

$2,171,055 |

|

Owners' Equity: |

|

|

|

|

Beginning balance |

note 7 |

$253,625 |

|

|

Plus second quarter net income |

17-11 |

31,720 |

285,345 |

|

Total Liabilities And Owners' Equity |

|

$2,456,400 |

|

|

Notes: 1. Accounts receivable (Exhibit 17-3): May revenues x 80% x 14%; June revenues x 80% x (35% + 14%). 2. Notes receivable-current (Exhibit 17-9): $7,000 is collected every other month. 3. Notes receivable-long run: two years remaining after 2005 at $7,000 every other month. 4. Property, plant & equipment: purchased $25,000 (Exhibit 17-9); depreciation of $75,000 (Exhibit 17-7 FOH) plus $15,000 (Exhibit 17-8 S & A Expenses). 5. Notes payable-current: $40,000 per month from Exhibit 17-9. 6. Notes payable-long term: 40 months remaining after 2005 at $40,000 per month (Exhibit 17-9). 7. Owners' equity: there is no drawing account as owners are paid salaries included in S & A expenses. |

|||

|

Exhibit 17-13 IMAX'S Merchandise Purchases Budget |

||||||

|

Item: |

Formula: |

March |

April |

May |

June |

July |

|

Sales |

|

$500,000 |

$400,000 |

$460,000 |

$540,000 |

$600,000 |

|

COGS |

60.00% |

$300,000 |

$240,000 |

$276,000 |

$324,000 |

$360,000 |

|

+Ending inventory(10-day supply) |

113 |

80,000 |

92,000 |

108,000 |

120,000 |

|

|

<Beginning inventory> |

113 |

<100,000> |

<80,000> |

<92,000> |

<108,000> |

|

|

Gross Purchases |

|

$280,000 |

$252,000 |

$292,000 |

$336,000 |

|

|

Net Purchases |

98.00% |

$274,400 |

$246,960 |

$286,160 |

$329,280 |

|

|

Accounts Payable Payment Schedule: |

|

|

|

|

|

|

|

To pay this month (1st two monthly shipments) |

2/3 |

|

$164,640 |

$190,773 |

$219,520 |

|

|

Owed from last month |

1/3 |

|

91,467 |

82,320 |

95,387 |

$109,760 |

|

Cash outflow for accounts payable payments |

|

$256,107 |

$273,093 |

$314,907 |

|

|

|

Manual Calculations Procedures: |

|

|

|

|

|

|

|

1. Write down sales revenues. (Double underline so revenues are not added into gross purchases totals.) 2. Convert revenues into cost of goods sold. (Sales are purchased at cost, not at retail sales prices. Use COGS ratio.) 3. Calculate beginning and ending FGI requirements. (Use COGS, not revenues, in calculating beginning and ending FGL) 4. Adjust gross purchases to net purchases. (Always take purchase discounts.) 5. “Flow out” net purchases into the months they are really paid. (Just as was done in Exhibit 17-5 for direct materials purchases.) |

||||||

The beginning and ending merchandise inventories also have to be calculated at cost, using projected COGS in the second line of the budget.