Chapter 18 : Analyzing Cost-volume-profit Relationships

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1. Build a profit equation for an enterprise or product line.

2. Use cost-volume-profit (CVP) analysis to analyze different profit-making alternatives.

3. Apply CVP formulas to situations involving sales mixes and income taxes.

4. Describe how computer programs can assist in CVP

INTRODUCTION

Cost-volume-profit (CVP) analysis involves the study of the interrelationships among the following elements:

• Per-unit variable costs

• Total fixed costs

• Volume or level of activity

• Prices of products

• Mix of products sold

The goal of CVP analysis is to create an equation that can be used to predict a firm's profit. This profit equation can also be used to predict the change in profits, or in any element in the equation, for different alternatives a profit center manager may wish to consider. Expressing the relationships among sales prices, sales volume, variable costs, and fixed costs within an equation creates a powerful tool for the master budgeting process and for operational control decisions profit center managers make.

Strategic planning and master budgeting do not end when a cash budget and pro forma statements are created. The process is iterative in that once the results of the strategic plan are translated into a master budget, it may be revised many times before a final master budget is set. Throughout the process, the budget committee (or upper management) will consider many potential changes. In these committee meetings, the management accountant does not have the time to input changes and recreate a new master budget. Rather, management wants to know the answers to such questions as the following:

If we increase sales volume by cutting sales prices, will profits increase or decrease, and by how much?

• If variable or fixed costs can be changed, what effect will the change have on projected profits?

• If we undertake an advertising campaign that can increase sales volume, how will projected profits change?

To answer these questions, the management accountant must be able to calculate quickly and accurately what happens to projected profits for each alternative being considered. The profit equation and CVP analysis provide such a tool.

Profit center managers can use this same tool to help them analyze various opportunities during the course of day-to-day and month-to-month operations. From this perspective, CVP analysis is a bridging concept between profit center planning decisions and operational control decisions. It is useful in both decision-making functions.

This chapter introduces CVP analysis. Chapter 19 then applies this technique to specific types of operational control decisions. Next, Chapter 20 shows how the profit equation is used to develop an income statement format useful in the third decision-making function, profit center performance evaluation. Finally, CVP analysis is used in Chapter 21 to solve an increasingly perplexing problem faced by profit center managers in decentralized and multinational enterprises (i.e., transfer pricing).

COST-VOLUME-PROFIT BASICS

The best way to understand cost-volume-profit (CVP) analysis is to apply it. But before the profit equation is developed, the assumptions behind CVP analysis should be understood. These are the same basic assumptions used in building cost equations, first introduced in Chapter 7.

What Are the Basic CVP Assumptions?

Three assumptions are usually made when developing CVP relationships and profit equations, and when subjecting data to CVP analysis:

1. The behavior of both revenues and costs is linear throughout the relevant range. Linearity means that revenues and costs can be graphed as straight lines. For this to happen, sales prices must remain constant per unit, and all costs must be divisible into variable and fixed elements.1

2. Inventory quantities remain unchanged during the year. The number of units in beginning WIP and FGI equals the number of units in these ending inventories.

3. The sales mix is constant. The sales mix is the combination of products that make up total sales.

These assumptions simplify CVP relationships, and when the assumptions are valid, CVP analysis is very accurate in predicting profits. Normally, however, business operations do not match the assumptions exactly. In such cases, the resulting analysis is an approximation, but is still quite helpful in decision making.

Building the Profit Equation

The profit equation begins with the manufacturing cost equation. The Quick-Button case on the next page demonstrates how it is developed.

Both of the variable costs are manufacturing costs. The fixed manufacturing costs include the automated button-making machine and the work area costs for making buttons. Carrie developed the following manufacturing cost equation:

Annual manufacturing costs = $400 per year + $1.50 per button for Quick-Button

There are no variable selling and administrative costs, but there are fixed costs for the display kit (a selling expense) and the liability insurance (an administrative expense). Adding these costs to the manufacturing costs yields a total cost equation:

Total annual costs = $1,000 per year + $1.50 per button for Quick-Button

Revenues minus costs equals profit. By including the projected revenues in this equation, a profit equation can be developed. Revenues equal sales price multiplied by sales volume. Notice that no particular value is used for sales volume. As in the cost equation, volume is the independent variable.

Revenues - Total costs = Profit

= ($2.00 per button x Sales volume) - [$1,000 per year + ($1.50 per button x Sales volume)]

Reorganizing the equation:

(Revenues - Variable costs) - Fixed costs =

Profit {($2.00 per button x Sales volume) - ($1.50 per button x Sales volume)} - $1,000 per year = Profit

|

INSIGHTS & APPLICATIONS Applying CVP Analysis at Quick-Button Carrie Copolla is planning to start a business called Quick-Button. She will make and sell 2.5-inch plastic-coated, pin-back buttons. She plans to contract with schools, churches, political candidates, service organizations, and booster clubs to provide for their button needs.With an automated button-making machine, Carrie can prepare a button with a selected preprinted design in less than 30 seconds. She will have access to over 3,000 colorful, popular preprinted designs that are attached to the front of the button and covered with plastic. The button requires a button set, which is composed of a metal front, pin-back, and plastic cover. |

Based on a great deal of research, Carrie has prepared a schedule of estimated price and costs for her business plan:

QUICK-BUTTON ESTIMATED PRICE AND COSTS FOR 201x Sales price per button $2.00 Variable costs per button: Preprinted design $ .50 Button set $1.00 Total Variable costs $1.50 Fixed costs: Automated button-making machine $300 Display kit $400 Liability insurance $200 Work area $100 Total fixed costs $1,000 |

Revenues minus total variable costs equals contribution margin. Contribution margin is the total dollars available after covering variable costs that can be used to pay for fixed costs and to provide a target profit. Contribution margin is most useful, though, when it is expressed on a per-unit basis:

[(Sales price - Variable costs per unit) x Volume] - Fixed Costs = Profit [($2.00 per button - $1.50 per button) x Volume] - $1,000 per year = Profit

This version of the profit equation is very useful in analyzing profit-making decisions. Sales price minus variable costs per unit equals contribution margin per unit (CMU)2. CMU can be thought of as the incremental profit from one product available to pay for the fixed costs and to provide a profit. For Quick-Button, Carrie calculates a CMU of $0.50 ($2.00 sales price - $1.50 variable costs per unit). From a profit management point of view, a button is worth $0.50. Every time one more button is sold, Carrie will receive another $0.50. This $0.50 can be used to help pay for the fixed costs. If the fixed costs have been covered already, then this $0.50 becomes extra profit. Substituting CMU into the profit equation:

(CMU x Volume) - Fixed costs = Profit ($0.50 per button x Volume) - $1,000 per year = Profit

• Should Carrie go into the button-making business? To make this decision, Carrie needs to answer a number of questions, for example:

• How many buttons must be sold to cover fixed costs?

• What sales volume is necessary to realize a target profit?

• For any projected sales volume, is there much risk of not covering the fixed costs?

Break-even Analysis

To answer the first equation, the break-even point (BEP) must be calculated. This is the sales volume at which Quick-Button earns zero profit. BEP will give Carrie a benchmark to consider for her business. BEP is a key measurement in

CVP analysis and can be computed by two methods:

• The equation approach

• The contribution margin approach

THE EQUATION APPROACH. The equation approach uses the profit equation:

($0.50 per button x Volume) - $1,000 per year = Profit At the BEP, the profit goal is zero:

($0.50 per button x Volume) - $1,000 per year = $0 Solving for volume (BEP):

BEP = $1,000 per year x $0.50 per button = 2,000 buttons per year

In instances where the percentage relationship between variable costs and sales is known, but not the per-unit relationship, the following variation of the profit equation, using a contribution margin ratio (CM ratio), is appropriate. The CM ratio is created by dividing CMU by sales price or dividing the contribution margin by revenues.

(CM ratio x Revenues) - Fixed costs = Profit

In an attempt to better understand this version of the profit equation, Carrie rotated it 90 degrees, creating a contribution margin-based income statement. She then created a spreadsheet program to perform CVP analysis. It is illustrated in Exhibit 18-1

|

Data Section |

|

|

|

|

|

|

Sales Price |

$ 2.00 |

|

|

|

|

|

Variable costs |

$ 1.50 |

|

|

|

|

|

Volume |

2,000 |

|

|

|

|

|

Fixed costs |

$ 1,000 |

|

|

|

|

|

Solution Section |

|

|

|

|

|

|

|

Quick-Button |

|

|

|

|

|

|

Pro Forma Income Statement |

|

|

|

|

|

|

for 20X5 |

|

|

|

|

|

|

|

Per Unit |

Percentage |

Totals @ 2000 units |

|

|

Sales Revenues |

|

$ 2.00 |

100% |

$ 4,000 |

|

|

Less: Variable Costs |

|

<$ 1.50> |

<75%> |

<$ 3,000> |

|

|

Contribution Margin |

|

$ 0.50 |

25% |

$ 1,000 |

|

|

Less: fixed costs |

|

|

|

<$ 1,000> |

|

|

Net Income |

|

|

|

$ 0 |

|

|

|

|

|

|

|

|

|

Profit Equation: |

|

|

|

|

|

|

Net Income = |

[(Sales price |

- Variable costs) |

x Volume] |

- Fixed costs |

|

|

= |

[( $ 2.00 |

- $ 1.50 |

x volume |

- $ 1,000 |

|

|

|

|

|

|

|

|

|

Break even revenues: |

|

|

|

|

|

|

BER = |

(Fixed costs |

+ Target profit) |

/ CM ratio |

= $ 4,000 per year |

|

|

BEP = |

(Fixed costs |

+ Target profit) |

/ CMU |

= 2,000 units per year |

|

. Her contribution margin-based income statement format organizes costs by behavior (variable versus fixed costs) and calculates the contribution margin as a subtotal3. She also added per-unit and percentage columns to the income statement format.

In creating this income statement format, Carrie did not calculate fixed costs on a per-unit or percentage basis. Fixed costs are constant in total, but change with volume when expressed as a per-unit or percentage amount4.

In the percentage column, Carrie calculated both variable costs and contribution margin as a percentage of sales. This can be done using either the total amounts or the per-unit amounts. Dividing variable costs by sales creates a variable cost ratio, while dividing CMU by sales price, or contribution margin by revenues, yields the CM ratio.

The CM ratio is most useful when dealing with multiple products, whereas CMU is most useful when analyzing individual product lines. For example, consider a large discount retailer such as Wal-Mart, Inc. In any store, there are literally thousands of products, and customers may purchase any number of products at any one time. Attempting to calculate a CMU for each product would be inefficient. A better way to analyze CVP relationships is to look at averages, expressed as percentages. Using the Quick-Button illustration in Exhibit 18-1, for every dollar of sales, on average, $0.25 (25% of revenues) will be available to contribute to paying the fixed costs and generating the profit goal. Substituting the CM ratio and fixed costs into the profit equation, Carrie calculated break-even revenues (BER) as:

(CM ratio x Revenues) - Fixed costs = Profit (25% x Rev.) - $1,000 per year = $0

To calculate BER:

BER = $1,000 per year - 25% = $4,000 per year

Notice that in Exhibit 18-1. Carrie used the BEP as her sales volume to verify the accuracy of the above calculations. Once the BEP is known, Carrie could also have calculated BER by multiplying BEP by sales price (2,000 buttons x $2.00 per button = $4,000).

THE CONTRIBUTION MARGIN APPROACH. The contribution margin approach to CVP analysis uses the profit equation in its factored form:

Target sales volume = (Fixed costs + Profit) - CMU To calculate BEP:

BEP = ($1,000 + $0) - $0.50 per button = 2,000 buttons per year

Carrie found this version of the profit equation easiest to explain to nonaccountants and the quickest way to perform CVP analysis. Simply interpreted, how many half-dollars are needed to cover $1,000? Obviously, 2,000 fifty-cent pieces are required to generate $1,000. Since each button contributes 50 cents, this is equivalent to asking how many buttons must be sold to generate $1,000 (the amount needed to just cover the fixed costs with nothing left over for profit).

Solving for sales revenues:

Target sales revenues = (Fixed costs + Profit) / CM ratio

To calculate BER:

BER = ($1,000 per year + $0) / 25% = $4,000 per year

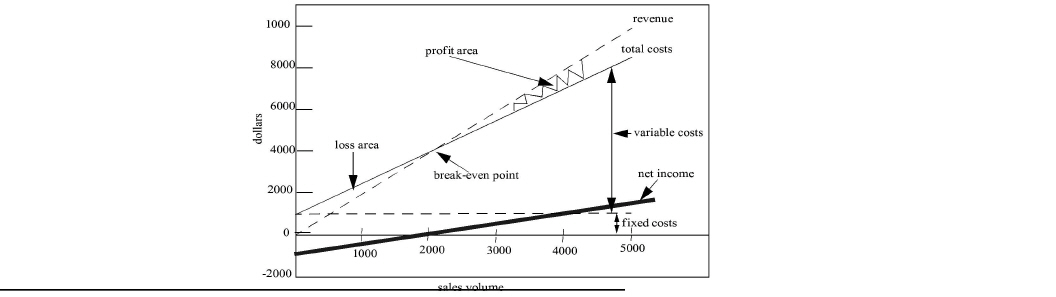

The CVP Chart

The CVP chart is a graphic presentation of the profit equation. Many decision makers prefer graphics instead of numbers because they can “see” a “picture” of the business. Moreover, a chart enables them to understand the relationship of cost, volume, and profit over a range of activity. Quick-Button's CVP chart is displayed in Exhibit 18-2. Carrie considered her relevant range to include sales volumes from zero to 5,000 buttons per year.

Sales volume is plotted on the horizontal axis and dollars on the vertical axis. The loss and profit areas are designated with arrows. To the left of the BEP, Carrie will suffer a loss because total costs are greater than revenues. To the right of the BEP, she will earn a profit because revenues are greater than total costs. In plotting the total costs line, she also included the fixed costs line to differentiate between total fixed and variable costs.

|

INCREMENTAL CVP ANALYSIS

The contribution margin approach, using the factored form of the profit equation, lends itself to incremental analysis. This type of CVP analysis often addresses “what-if” questions. For example, what if sales volume can be increased by 400 buttons? How much will profits increase? Or, what if Carrie sets a profit goal greater than zero (the BEP)? How many more buttons must she sell to obtain this target profit? This latter question is the second of the three questions Carrie is considering with respect to Quick-Button.

CVP Rules

Before demonstrating how CVP analysis is done incrementally, some mathematical relationships must be understood. These are called “CVP rules.”

1. A dollar change in contribution margin creates the same dollar change in profit (within the relevant range).

2. A unit change in volume multiplied by CMU equals the change in contribution margin.

3. A percentage change in volume multiplied by contribution margin equals the change in contribution margin.

4. A dollar change in revenues multiplied by the CM ratio equals the change in contribution margin. (Caution: This relationship is only true if the change in revenues is caused by a change in volume, not by a change in sales price.)

5. A dollar change in fixed costs creates the opposite change in profit (as fixed costs go up, profit goes down).

6. If there is a change in sales price or variable costs per unit (the elements of CMU), calculate the change in CMU first. Then multiply it by volume to obtain the change in contribution margin.

7. If there are simultaneous changes in one or both elements of CMU and in sales volume, calculate the new contribution margin and compare it to the old contribution margin to obtain the change in contribution margin.

These rules are summarized and demonstrated in Exhibit 18-3.

|

The purpose of these rules is to provide an efficient means of calculating the change in profit associated with an alternative course of action being considered by profit center managers. Rule 1 relates the change in profit to the change in contribution margin. If the change in contribution margin is known, then the change in profit is also known. Rules 2 through 7 are concerned with calculating the change in contribution margin. Each rule is illustrated using the Quick-Button data in Exhibit 18-1.

1. $ If CM increased by $200, profit will increase by $200. 2. If 400 more buttons can be sold, each generating another 50 cents in CMU, CM will increase by $200. 3. % If volume increases by 20% (400 buttons), CM will increase by $200 (20% of the $1,000 CM). 4. $ If revenues increase by $800, contribution margin will increase by $200 (25% of revenues). Caution: This relationship is only true if the change in revenues is caused by a change in volume, not by a change in sales price. See rule 6 for calculating the effect of a change in sales price. 5. +$ If fixed costs go up $100, profit will go down $100. 6. If sales price increases by 15 cents and variable costs per unit increase by 10 cents, CMU will increase by 5 cents, and CM will increase by $100 ($.05 x 2,000 buttons). 7. If CMU increases 10 cents to $0.60 per button, but volume decreases to 1,500 buttons, the new CM = $900 ($0.60 x 1,500 buttons), which is a decrease in CM of $100 from the original amount in Exhibit 18-1. |

|

Legend:

CM = contribution margin $ = dollars CMU = contribution margin per unit percentage |

“What-If” Analysis

“What-if” questions are asked in master budgeting meetings as well as during day-to-day operations of the profit center manager. Using the factored form (the contribution margin approach) of the profit equation and thinking incrementally will allow modern management accountants to answer these questions immediately without returning to their desks for more calculations. Profit center managers are not likely to be pleased when a management accountant says, “I'll have to get back to you later on that.” They need quick and accurate answers within the meeting. To illustrate, consider the following scenario based on the Quick-Button example found on the next page:

Wouldn't it have been better if Carrie had responded, “Let's see. If sales volume increases 300 buttons with a CMU of 50 cents each, then contribution margin will increase $150. This will cover the incremental advertising costs of $100 and leave an extra $50 in profits.” If Carrie had been proficient in incremental CVP analysis, the meeting could have continued without having to be rescheduled sometime in the future!

|

INSIGHTS & APPLICATIONS Obtaining a Bank Loan for Quick-Button Carrie Copolla decided she should make and sell quick-buttons. Since she does not have sufficient capital to start up her business, she set up an appointment with her banker, hoping to obtain a short-term, unsecured line-of-credit until Quick-Button starts to make sufficient profits and cash flows to cover her costs. Her banker, John Enterest, reviewed her master budget, in particular, her cash budget for the upcoming year. |

He was concerned that the sales forecast will not be sufficient for her to repay a loan. So, they began considering various alternatives to increase sales. “Well, Carrie, what if you bought and distributed some advertising brochures promoting your buttons? If an expenditure of $100 could increase sales volume by 300 buttons, would this generate any extra profits?” Carrie responded, “Gee, I don't know. I'll work up the numbers, but it will take me a while.” John was a little perturbed. “O.K., but I can't make a loan decision until I know the answer. It looks like we will have to schedule another meeting to go over your figures. I'm going on vacation next week, so we'll have to set up a meeting again in three weeks or so, depending on my work load when I return.” |

WHAT IF I CAN INCREASE SALES VOLUME? At her meeting with John Enterest, Carrie forecast a sales volume of 2,400 buttons, as shown in Exhibit 18-4. She now knows this is 400 buttons above her BEP. Because of her inability to answer John's question, Carrie realized the need to become more competent in incremental CVP analysis for solving what-if questions. While John was on vacation, Carrie separated his question into two parts: (1) What is the effect on profits if sales volume increases by 300 buttons? and (2) What is the effect on profits from spending $100 on advertising?

Target sales vol. =

Target sales vol. =  (Fixed costs + Profit) - CMU + 300 buttons =

(Fixed costs + Profit) - CMU + 300 buttons =  (0 + Profit) x $0.50

(0 + Profit) x $0.50

Solving for the change in profit:

Profit = + 300 buttons x $0.50 = + $150

Profit = + 300 buttons x $0.50 = + $150

Alternatively, Carrie can use CVP rule 2:

Volume x CMU = + 300 buttons x $0.50 per button = + $150

Volume x CMU = + 300 buttons x $0.50 per button = + $150

If 300 more buttons can be sold, each generating another 50 cents in CMU, then contribution margin will increase by $150. Applying rule 1, a change in contribution margin will yield the same change in profit. This is true only over the relevant range in which total fixed costs do not change if volume changes. Carrie can also solve for the change in profits by using the profit equation approach. The equation, though taking longer to solve, will always work.

Profit = (CMU x Volume) - Fixed costs = ($0.50 per button x 2,700 buttons) - $1,000 per year = $350

Carrie's original base case projection (2,400 buttons per year in Exhibit 18-4) showed a profit of $200. Thus, profit will increase $150 to $350

|

Data Section |

|

|

|

|

|

|

Sales Price |

$ 2.00 |

|

|

|

|

|

Variable costs |

$ 1.50 |

|

|

|

|

|

Volume |

2400 |

|

|

|

|

|

Fixed costs |

$ 1000 |

|

|

|

|

|

Solution Section |

|

|

|

|

|

|

|

Quick-Button |

|

|

||

|

|

Pro Forma Income Statement |

|

|

||

|

|

for 20X5 |

|

|

||

|

|

|

|

|

|

|

|

|

|

Per Unit |

Percentage |

Totals @ 2500 units |

|

|

Sales Revenues |

|

$ 2.00 |

100% |

$ 4,800 |

|

|

Less: Variable Costs |

|

<$ 1.50> |

<75%> |

<$ 3,600> |

|

|

Contribution Margin |

|

$ 0.50 |

25% |

$ 1,200 |

|

|

Less: fixed costs |

|

|

|

<$ 1,000> |

|

|

Net Income |

|

|

|

$ 2000 |

|

|

|

|

|

|

|

|

|

Profit Equation: |

|

|

|

|

|

|

Net Income = |

[(Sales price |

- Variable costs) |

x Volume] |

- Fixed costs |

|

|

|

[( $ 2.00 |

- $ 1.50 |

x volume |

- $ 1,000 |

|

|

|

|

|

|

|

|

|

Break even revenues: |

|

|

|

|

|

|

BER = |

(Fixed costs |

+ Target profit) |

/ CM ratio |

|

|

|

|

$ 4,000 |

|

|

|

|

|

BEP = |

(Fixed costs |

+ Target profit) |

/ CMU |

|

|

|

|

2,000 units |

|

|

|

|

To finish this example, the increase in contribution margin results from an increase in fixed costs (the $100 expenditure for advertising). CVP rule 5 states that a change in fixed costs causes the opposite change in profit. In other words, if fixed costs go up $100, then profit goes down $100. Subtracting the change in fixed costs from the change in contribution margin produces the net $50 increase in profit.

WHAT IF I SET A TARGET PROFIT GOAL? Originally, Carrie also wanted to know, “What sales volume is necessary to realize a target profit?” Assume Carrie sets a profit goal of $200 for 2005. As Exhibit 18-4 shows, she will have to sell 2,400 buttons. She can solve for this incrementally:

Target sales volume = (Fixed costs + Profit) / CMU = (0 + $200) - $0.50 per button = +400 buttons

Carrie will have to sell 400 buttons above the BEP (2,000 buttons). But What if she wants another $300 in profits? If Carrie wants $300 more in profits, regardless of the level of profits she already has, she will have to sell another 600 buttons.

In this illustration, Carrie set an absolute dollar amount of profit. Conceptually, this is just another fixed cost—the payment to the owner. But, what if she stated her profit goal as a percentage of sales revenues? For example, Carrie sets a profit goal of 5 percent of sales. Exhibit 18-5 shows the sales revenues necessary to achieve a 5 percent profit. The projected profit of $250 is 5 percent of the $5,000 sales revenues.

|

Data Section |

|

|

|

|

|

|

Sales Price |

$ 2.00 |

|

|

|

|

|

Variable costs |

$ 1.50 |

|

|

|

|

|

Volume |

2500 |

|

|

|

|

|

Fixed costs |

$ 1000 |

|

|

|

|

|

|

|

|

|

|

|

|

Solution Section |

|

|

|

|

|

|

|

Quick-Button |

|

|

||

|

|

Pro Forma Income Statement |

|

|

||

|

|

for 20X5 |

|

|

||

|

|

|

|

|

|

|

|

|

|

Per Unit |

Percentage |

Totals @ 2500 units |

|

|

Sales Revenues |

|

$ 2.00 |

100% |

$ 5,000 |

|

|

Less: Variable Costs |

|

<$ 1.50> |

<75%> |

<$ 3,750> |

|

|

Contribution Margin |

|

$ 0.50 |

25% |

$ 1,250 |

|

|

Less: fixed costs |

|

|

|

<$ 1,000> |

|

|

Net Income |

|

|

|

$25 0 |

|

|

|

|

|

|

|

|

|

Profit Equation: |

|

|

|

|

|

|

Net Income = |

[(Sales price |

- Variable costs) |

x Volume] |

- Fixed costs |

|

|

|

[( $ 2.00 |

- $ 1.50 |

x volume |

- $ 1,000 |

|

|

|

|

|

|

|

|

|

Break even revenues: |

|

|

|

|

|

|

BER = |

(Fixed costs |

+ Target profit) |

/ CM ratio |

= $ 4,000 per year |

|

|

|

|

|

|

|

|

|

BEP = |

(Fixed costs |

+ Target profit ) |

/ CMU |

= 2,000 units per year |

|

In this situation, conceptually speaking, a profit goal stated as a percentage of revenues is just another variable cost. Therefore, profit will not be in the numerator of the profit equation because it is not an absolute amount (a fixed cost). Instead, it will now be in the denominator:

Target sales revenues = Fixed costs / (CM ratio - Profit percentage)

= $1,000 / (25% - 5%)

= $5,000 per year

Many different types of what-if questions can be asked:

• What if a special order is possible? What is the lowest sales price Carrie can bid?

• What if a firm has an opportunity to buy a part instead of making it? Will buying increase profits?

• What if a part can be sold instead of processed further into a final product?

• Will selling it now increase profits?

• What if a firm does not have enough materials or labor to make all the different types of products it usually sells? Which products should be made?

These kinds of profit management questions are considered in the next chapter. Incremental CVP analysis provides a powerful tool for the management accountant to use in efficiently answering such questions.

Margin of Safety

The third question Carrie originally considered involves the risk of not covering fixed costs (i.e., not breaking even). Measuring this risk involves the calculation of the margin of safety. This is the difference between the sales forecast and the break-even point and can be expressed by the following equation:

Margin of safety = (Sales forecast - BEP) / Sales forecast

= (2,400 buttons - 2,000 buttons) / 2,400 buttons

= l6%5

Quick-Button's sales can decrease by 400 buttons, or 16 percent of the sales forecast, before Carrie suffers a loss. If actual sales are below the forecast by more than 16 percent, then Carrie will not break even. These computations can be a useful guide. If the marketing and cost data that Carrie has collected are fairly accurate, then she and John Enterest can consider this a high margin of safety, which indicates low risk. They do not expect that her sales forecast will be off by more than 16 percent. If, on the other hand, her margin of safety was 5 percent, then even a small decline in sales would result in a loss. Consequently, a low margin of safety indicates a high risk of not breaking even.

MULTIPLE PRODUCTS AND INCOME TAX CONSIDERATIONS

The Quick-Button case involved just one product, but many enterprises sell multiple products. Furthermore, all profit-making enterprises are subject to income taxes. These extensions to CVP analysis are considered next.

Sales Mix

Sales mix is the relative distribution of sales among the various products sold by a business. Suppose that Tommy Telford is preparing a business plan to launch his venture, New-Wave Designs. He plans to make and market designer caps and T-shirts. Tommy has prepared a projected sales mix for the first fiscal year as follows:

|

|

|

Estimated |

|

|---|---|---|---|

|

|

Product |

Unit Sales |

Sales Mix |

|

|

Caps |

15,600 |

60% |

|

|

T-shirts |

10,400 |

40% |

|

|

|

26,000 |

100% |

The sales mix for caps and T-shirts can be expressed as relative percentages (as here) or as the ratio of 60 percent to 40 percent (60:40). If this sales mix remains constant over the budget horizon, both the BEP and the sales necessary to achieve a target profit can be calculated using the CVP and break-even equations presented earlier in this chapter.

To illustrate the calculation of the BEP for New-Wave Designs, assume that fixed costs are $24,000. In addition, assume that the unit sales price and variable costs are as follows:

|

|

Product |

Unit Sales Price |

Unit Variable Cost |

|---|---|---|---|

|

|

Caps |

$2.00 |

$1.40 |

|

|

T-shirts |

$5.00 |

$3.50 |

In computing the BEP, each product is considered as a component of an overall New-Wave product called the “package.”6 To calculate the BEP, a weighted-average sales price, variable cost per package, and CMU are needed:

|

Weighted-average package sales price: |

($2.00 x .60) + ($5.00 x .40) = |

$3.20 |

|

Less weighted-average package variable cost: |

($1.40 x .60) + ($3.50 x .40) = |

<$2.24> |

|

|

Weighted-average CMU = |

$0.96 |

The package's variable cost ratio is 70 percent of sales ($2.24 / $3.20), and the CM ratio is 30 percent ($0.96 - $3.20). The overall BEP is computed using the profit equation in its factored format:

BEP = Fixed costs of $24,000 - CMU of $0.96 per package = 25,000 packages

Because the sales mix is 60 percent for caps and 40 percent for T-shirts, the BEP is 15,000 caps (25,000 packages x .60) and 10,000 T-shirts (25,000 packages x .40). The foregoing analysis is summarized in the following contribution margin income statement:

|

|

New-Wave Designs Contribution Margin Income Statement For Year Ended December 31, 2005 |

|||

|

|

|

CAPS |

T-SHIRTS |

TOTAL |

|

|

Sales: |

|

|

|

|

|

15,000 units x $2.00 |

$30,000 |

|

$30,000 |

|

|

10,000 units x $5.00 |

|

$50,000 |

50,000 |

|

|

Total sales |

$30,000 |

$50,000 |

$80,000 |

|

|

Less variable costs: |

|

|

|

|

|

15,000 units x $1.40 |

21,000 |

|

21,000 |

|

|

10,000 units x $3.50 |

|

35,000 |

35,000 |

|

|

Total variable costs |

<$21,000> |

<$35,000> |

<$56,000> |

|

|

Contribution margin |

$9,000 |

$15,000 |

$24,000 |

|

|

Less fixed costs |

|

|

< 24,000> |

|

|

Profit |

|

|

$ -0- |

If Tommy wants to earn a target profit of $20,400:

Target sales volume = (Fixed costs + Profit) / CMU

= ($24,000 + $20,400) / $0.96

= 46,250 packages

The sales quota for caps is 27,750 (60 percent of 46,250), and for T-shirts it is 18,500 (40 percent of 46,250). This can also be solved incrementally. The profit goal changes from zero (BEP) to $20,400:

Target sales volume = (Fixed costs + Profit) / CMU

= ($0 + $20,400)/ $0.96 per package

= 21,250 packages

Sales volume of caps will have to increase 12,750 (60 percent of 21,250) from the BEP of 15,000 caps to 27,750 caps. Sales volume of T-shirts will have to increase 8,500 (40 percent of 21,250) from its BEP of 10,000 to 18,500 T-shirts.

Income Tax Considerations

If Tommy realizes a profit of $20,400, he will have to pay income taxes and self-employment taxes. Assume these two taxes amount to 40 percent.

|

After-tax profit = Pretax profit - Taxes |

= $20,400 - ($20,400 x 40%) |

|

|

= $12,240 |

This profit amount is not acceptable to Tommy because he wants $20,400 after taxes. The aftertax profit is 60 percent (1 - Tax rate) of the pretax profit. Solving for the pretax profit needed:

Pretax profit = Aftertax profit - (1 - Tax rate) Substituting this into the profit equation: = 60,417 packages per year7

|

|

Fixed costs + |

Aftertax profit |

|

Target sales volume = |

(1 - Tax rate) |

|

|

CMU |

||

|

|

|

|

|

|

$24,000 + |

$20,400 |

|

Target sales volume = |

(1 - 40%) |

|

|

|

$0.96 per package |

|

What if Tommy's target profit is not an absolute dollar amount, but rather is 5 percent of sales revenues after taxes?

Target sales revenues = Fixed costs / [CM ratio / (Profit percentage / (1 - Tax rate))

= $24,000 / [30% - (5% / (1 -40%))]

= $110,770 per year (rounded up)

SENSITIVITY ANALYSIS AND FINANCIAL PLANNING SOFTWARE

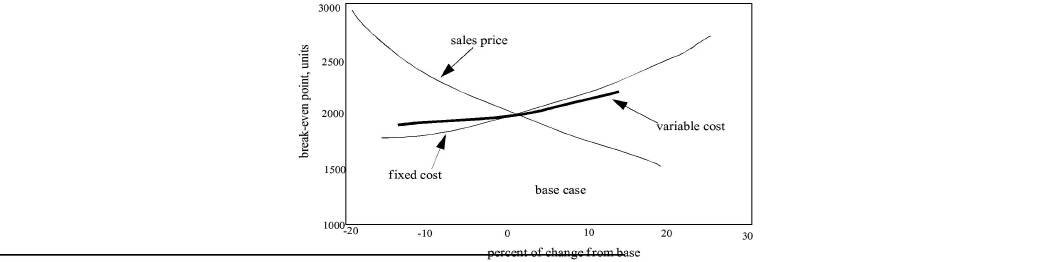

In addition to the preceding analysis, modern profit management also involves sensitivity analysis, which shows how the profit equation responds to changes in the CVP parameters. Sensitivity analysis is a helpful tool for showing the results of different assumptions about the CVP elements. It involves examining the impact of reasonable changes in “base case” assumptions. For example, management accountants might make calculations using several different estimates of variable costs, fixed costs, and sales prices. The effect of these changing parameters on the break-even point can then be studied relative to a most likely scenario.

Essentially, sensitivity analysis is an approach for dealing with uncertain data and other decision risks. Decisions always involve inputs, such as assumptions, estimates, and simplifications, all of which are prone to errors of varying degrees.8 Sensitivity analysis can be used to:

• Identify those variables that are most/least sensitive to changes in assumptions.

• Make better profit decisions.

• Decide which data estimates should be refined.

• Focus managerial attention on the most critical elements of a scenario.9

This analysis may consider only a few variables, or it may systematically consider all. It may analyze only one variable at a time (known as relative sensitivity), multiple variables, or scenarios of plausible sets of changes. These sensitivities may then be presented through words, tables, or graphs.

Rapid advances in desktop computer technology have removed the barrier of burdensome calculations from sensitivity analysis. Data points are easily obtained through multiple runs of a simple spreadsheet model. Hard-copy output can then be automatically generated to summarize the results. This output usually takes the form of a line graph, bar chart, or break-even graph (CVP chart), all with varying axes and notations.

A sensitivity analysis can be done using any measure, for example, injuries per year, net sales revenue, internal rate of return, present worth, or profit. No matter what form the output takes, it will always show how the chosen measure varies as decision parameters are changed within reasonable limits.

Using Graphical Sensitivities with CVP Analysis

The Quick-Button case can be used to illustrate sensitivity analysis. Based on new sales and cost data and incremental CVP analyses that Carrie Copolla performed for various alternatives, she now estimates the following;

• Sales price per button. $1.30

• Variable cost per button: $0.52

• Fixed costs (one year): $1,560

This will be the base case for her sensitivity analysis. The break-even point is still 2,000 buttons annually.

Carrie has also determined what she considers to be limits of reasonable change for her price and cost data. To be competitive, she feels her button sales price can vary plus or minus 19 percent from her $1.30 estimate. Her variable cost estimate could change by as much as 15 percent. Finally, fixed costs could be 10 percent less than estimated, but they could be as much as 30 percent higher. Carrie uses this information with her profit equation to create a spreadsheet generating three tables.

Exhibit 18-6 holds variable cost and fixed costs at their base case values while varying sales price over the 19 percent range. The table also shows the percentage change from the base case for each sales price. The goal of her three tables is to calculate the break-even point under each condition, as shown in the last column.

|

Exhibit 18 -6 Spreadsheet Analysis of Sales Price Sensitivity for Quick-Button |

|||||

|

Sensitivity of BEP to Sales Price |

|

|

|

|

|

|

Sales price |

$1.30 |

+/- 19% |

|

|

|

|

Variable cost |

$0.52 |

|

|

|

|

|

Fixed cost |

$1,560 |

|

|

|

|

|

BEP |

2,000 |

|

|

|

|

|

Percentage change from base |

New sales price |

New CMU |

New BEP |

Change in BEP |

% change in BEP |

|

-19% |

$1.05 |

$0.53 |

2,944 |

944 |

47% |

|

-15 |

1.11 |

0.59 |

2,645 |

645 |

32% |

|

-12 |

1.14 |

0.62 |

2,517 |

517 |

26% |

|

-8 |

1.20 |

0.68 |

2,295 |

295 |

15% |

|

-4 |

1.25 |

0.73 |

2,137 |

137 |

7% |

|

0 |

1.30 |

0.78 |

2,000 |

0 |

0% |

|

4 |

1.35 |

0.63 |

1,880 |

(120) |

-6% |

|

8 |

1.40 |

0.88 |

1,773 |

(227) |

-11% |

|

12 |

1.46 |

0.94 |

1,660 |

(340) |

-17% |

|

15 |

1.50 |

0.98 |

1,592 |

(408) |

-20% |

|

19 |

1.55 |

1.03 |

1,515 |

(485) |

-24% |

Exhibit 18-7 holds sales price and fixed costs at their base case values while changing the variable cost per unit. Similarly, Exhibit 18-8 varies only the fixed costs over its range.

|

Exhibit 18 -7 Spreadsheet Analysis of Variable Cost Sensitivity for Quick-Button |

||||||

|

|

|

|

|

|

|

|

|

Sales price |

$ .30 |

|

|

|

|

|

|

|

Variable cost |

$0.52 |

+/-15% |

|

|

|

|

|

Fixed cost |

$1,560 |

|

|

|

|

|

|

BEP |

2,000 |

|

|

|

|

|

|

Percentage change from base |

New variable cost per unit |

New CMU |

New BEP |

Change in BEP |

% change in BEP |

|

|

-15% |

$0.44 |

$0.86 |

1,814 |

(186) |

-9% |

|

|

-12 |

0.46 |

0.84 |

1,858 |

(142) |

-7% |

|

|

-8 |

0.48 |

0.82 |

1,903 |

(97) |

-5% |

|

|

-4 |

0.50 |

0.80 |

1,950 |

(50) |

-3% |

|

|

0 |

0.52 |

0.78 |

2 000 |

0 |

0% |

|

|

4 |

0.54 |

0.76 |

2,053 |

53 |

3% |

|

|

8 |

0.56 |

0.74 |

2,109 |

109 |

5% |

|

|

12 |

0.58 |

0.72 |

2,167 |

167 |

8% |

|

|

15 |

0.60 |

0.70 |

2,229 |

229 |

11% |

The percentage change from the base case, and the BEP from the three spreadsheet tables are plotted in Exhibit 18-9. Each of the three plots represents the relative sensitivity of the BEP to a particular parameter. The plots intersect at the base case. From this graph, Carrie can see that the break-even point, in units sold, for her Quick-Button business is most sensitive to the price she charges for her buttons since that curve has the greatest slope. Therefore, if she wants to decrease the number of units needed to break even, the most effective way to do so is to raise her price. Decreasing either variable or fixed costs is not nearly as effective since these trend lines are flatter.10

|

Exhibit 18 -8 Spreadsheet Analysis of Fixed Cost Sensitivity for Quick-Button |

|||||

|

Sensitivity of BEP to Fixed Cost |

|

|

|

||

|

Sale price |

$1.30 |

|

|

|

|

|

Variable cost |

$0.52 |

|

|

|

|

|

Fixed cost |

$1,560 |

+ 30% -10% |

|

|

|

|

BEP |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

% change from base |

New fixed cost |

CMU |

New BEP |

Change in BEP |

% change in BEP |

|

-10% |

$ 1,404 |

$0.78 |

1,800 |

(200) - |

10% |

|

-6 |

1,466 |

0.78 |

1,880 |

(120) |

-6% |

|

-2 |

1,529 |

0.78 |

1,961 |

(39) |

-2% |

|

-0 |

1,560 |

0.78 |

2,000 |

0 |

0% |

|

4 |

1,622 |

0.78 |

2,080 |

80 |

4% |

|

8 |

1,685 |

0.78 |

2,161 |

161 |

8% |

|

12 |

1,747 |

0.78 |

2,240 |

240 |

12% |

|

16 |

1,810 |

0.78 |

2,321 |

321 |

16% |

|

20 |

1,872 |

0.78 |

2,400 |

400 |

20% |

|

24 |

1,934 |

0.78 |

2 480 |

480 |

24% |

|

28 |

1,997 |

0.78 |

2,561 |

561 |

28% |

|

30 |

2,028 |

0.78 |

2,600 |

600 |

30% |

|

A more typical planning and forecasting situation will very likely involve a great many more inputs than just price and costs. In such cases, sensitivity analysis can assist profit managers in making the most effective use of planning resources by allocating them to researching the most critical of the inputs.

Using Graphical Sensitivity Analysis for Decision Making

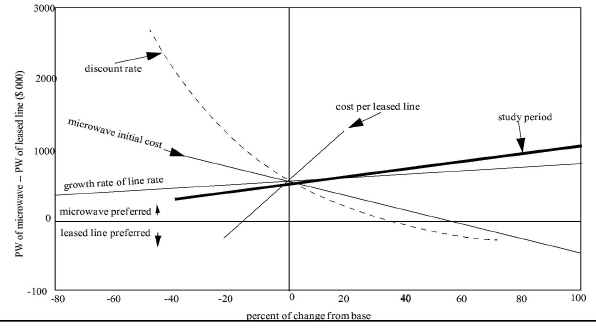

Sensitivity analysis provides knowledge to managers to help them explore how certain changes may affect a decision. In the accompanying NPV Corporation case (see p. 852), sensitivity analysis gives management a chance to experiment with different assumptions before making a final decision.

Besides the uncertainty in the demand's growth rate, other base case assumptions can be challenged. For example, the problem horizon (study period) and the discount rate are somewhat arbitrary selections, and the initial cost of microwave installations is often higher than expected. Top management insists that the effects of these uncertainties on the present value of the project be analyzed before a decision is made. The chief variables to be analyzed and their limits of reasonable change are as follows:

Microwave. Initial cost (-40%, +100%), operating costs (-40%, +60%), capacity (-10%, +20%), and life (-40%, +100%).

Leased lines. Cost per line, including amortization of company-supplied interfaces (-20%, +20%), and growth rate of line rates (-80%, +300%).

General. Demand's growth rate (-100%, +50%) and discount rate (-50%, +70%).

|

INSIGHTS & APPLICATIONS Upgrading Data Communications at NPV Corporation NPV Corporation, a regional commercial lending firm with its home office in Phoenix, has been operating a single branch office in Tucson for the last eight years.

About one hundred miles and two mountain ranges separate these offices. Since the Tucson branch office opened, its information system has been linked with that of the home office by low-speed data communication over ordinary telephone lines, and most recently dedicated high-speed leased lines. |

An extended period of growth in the company's Tucson lending activity has stretched the capacity of this communication medium to the point that lending officers are highly frustrated with the response time of the system and are demanding improvements.

Management is considering two alternatives for upgrading data communications at NPV. If anticipated growth occurs, then a large investment in private microwave transmission equipment will be cheaper over the company's anticipated 20-year strategic planning horizon. If the growth is slower, however, then leasing high-speed dedicated data transmission lines from the phone company will be cheaper, because lines can be incrementally added to match increases in user demand. Thus, the company must decide between the microwave medium and the leased line medium. |

The relative sensitivity of the alternatives' present worth (PW) to each variable is shown in Exhibit 18-10. Note that the vertical axis represents the difference in present worth (PW) between the two alternatives, and the horizontal line at zero is a line of indifference. Above this line, microwave is preferred. Below this line, the leased lines is preferred. Management has already determined a single most likely scenario for the project, and this is taken as the base case. In the exhibit, the base case clearly favors the microwave alternative because it occurs above the line of indifference.

|

It's important to realize that the natural units for the analyzed variables may be different from each other. For instance, the discount rate is in percent, while the microwave initial cost is in dollars, and the demand's growth rate is in megabits per second per year. For this reason, to readily compare the graphs a common metric must be identified. In Exhibit 18-10, this is the percentage change from the base case, which is shown as the horizontal axis. Of course, lines representing the variables all intersect at the base case point.

Financial Planning Software

Although spreadsheet programs can perform many types of profit planning analyses, financial planning software is often more efficient. It also provides many more sophisticated calculations than can be done with a spreadsheet program, as shown in the Amherst Company case.

BUILDING A WHAT-IF SCREEN. With these data, a what-if screen produced by a financial planning software program11 can be set up to reveal the results of changing conditions. The initial what-if screen and its results are displayed in Exhibit 18-11. At the bottom of the screen are the equations and data used by the program to generate the values at the top of the screen. This initial screen becomes the base case. When a variable receives a new definition (i.e., is changed), this definition replaces the one in the base case. The base case, however, is still stored in memory and can be recalled at any time.

|

|

1 |

2 |

3 |

4 |

5 |

|

Sales |

100.00 |

125.00 |

156.25 |

195.31 |

244.14 |

|

Variable Costs |

75.00 |

100.00 |

125.00 |

150.00 |

175.00 |

|

Contribution Margin |

25.00 |

25.00 |

31.25 |

45.31 |

69.14 |

|

CM Ratio |

.25 |

.20 |

.20 |

.23 |

.28 |

|

|

|

|

|

|

|

|

Sales increases by 1.25 |

Each scenario |

|

|

||

|

|

|

|

|

|

|

Suppose that management wants to see the results it dollar sales grow by 15 percent rather than 25 percent per period, while variable costs remain the same as in the base case. All the management accountant has to do is change the multiplier to 1.15 instead of 1.25. The results are computed instantly and displayed on the screen as presented in Exhibit 18-12.

|

INSIGHTS & APPLICATIONS Amherst Company's Master Budgeting Assume that management at Amherst Company wants to project CVP data for five periods. Marketing has estimated that dollar sales for the first period will be $100,000 and will increase by 25 percent each period. Cost accounting projects the variable costs at $75,000 for the first period, $100,000 for the second period, $125,000 for the third period, $150,000 for the fourth period, and $175,000 for the fifth period. |

The management accountant has just installed an interactive financial planning system for PCs. What-if and goal-seek are two features that allow managers to ask questions and receive an answer in real-time. The what-if feature permits managers to change the definition of one or more variables temporarily to see what the change implies. The base case remains in memory and can be recalled whenever the management accountant needs it. The goal-seek feature enables the management accountant to determine the value a particular variable has to have to achieve a desired level of performance. Managers can specify their goal either as: Performance at a single point in time or, - Performance over the entire time horizon |

The management accountant can also change several variables, not just one, when creating a what-if screen. For example, the management accountant may want to determine the effect of simultaneous changes in both dollar sales and variable costs:

Sales = 100, Previous x 1.12

Variable costs = 70, Previous + 20

The program will immediately compute new values based on these new variables.

In many what-if analyses, the management accountant may want to change a variable in one or more periods from its value in the base case. The what-if feature can be used for all periods, as in the preceding examples, or for selected periods. To illustrate, if management expects no change in dollar sales for two periods but wants to give new values thereafter:

Sales = Prior 2, Previous x 1.20

The user can also update the base case if new assumptions lead to better results than the initial base case assumptions. In other words, the user has created a new base case against which other what-if cases are to be judged. If desired, the user can keep the initial base case and save the new base case under another name. In this way, both the initial and the updated models are available for use.

|

|

1 |

2 |

3 |

4 |

5 |

|

Sales |

100.00 |

115.00 |

132.25 |

152.09 |

174.90 |

|

Variable Costs |

75.00 |

100.00 |

125.00 |

150.00 |

175.00 |

|

Contribution Margin |

25.00 |

15.00 |

7.25 |

2.09 |

-0.10 |

|

CM Ratio |

.25 |

.13 |

.05 |

.01 |

-0.00 |

|

|

|

|

|

|

|

|

Sales increases by 1.415 |

Each scenario |

|

|

||

|

|

|

|

|

|

|

USING THE GOAL-SEEK FEATURE. Another powerful feature is goal-seek. Through goal-seek, the program calculates the value a particular variable has to have to achieve a desired level of performance. For example, the management accountant might type the goal as:

Goal: Contribution margin = 25, Previous + 20

This goal states that the contribution margin is to start at $25,000 and to increase by $20,000 each period. Once the goal is established, the program asks for the variable to be adjusted:

Adjust: Variable costs

The program then solves the model and displays the results as shown in Exhibit 18-13.

|

|

1 |

2 |

3 |

4 |

5 |

|

Sales |

100.00 |

125.00 |

156.25 |

195.31 |

244.14 |

|

Variable Costs |

75.00 |

80.00 |

91.25 |

110.31 |

139.14 |

|

Contribution Margin |

25.00 |

45.00 |

65.00 |

85.00 |

105.00 |

|

CM Ratio |

.25 |

.36 |

.42 |

.44 |

.43 |

|

|

|

|

|

|

|

|

Sales increases by 1.25 |

Each scenario |

|

|

||

|

Goal: |

CM increases by |

1.20 |

Adjust: |

Variable Costs |

|

The results of the goal-seek screen indicate that variable costs must be reduced to the amounts shown for each period if the company is to realize a contribution margin increase of $20,000 in each period beginning with a contribution margin of $25,000 in period 1.

Goal-seek can also be used in just one period, say, period 4. For example, the user might specify:

Goal: Contribution margin [4] = 60 Adjust: Sales [4]

In the base case (Exhibit 18-11), sales of $195,310 in period 4 produce a contribution margin of $45,310. If management can control variable costs at $150,000 and increase sales to $210,000, then the company will achieve a contribution margin of $60,000.

ANALYZING TARGET PROFITS. Assume that the Amherst Company is planning to expand its operations and is considering three alternatives with target profits set at $100,000, $150,000, and $200,000, respectively. To round out the scenario, the management accountant estimates fixed costs at $200,000, $300,000, and $400,000, respectively, for the three alternative expansion plans. The contribution margin (CM) ratio can range from .40 to .60 for each alternative.

Management wants to know the dollar sales level that the enterprise must generate to earn the target profits. The program accesses the fixed costs, target profit, and CM ratio at each level, inputs them in the profit equation, and computes the 27 sales revenues shown on the CVP analysis screen in Exhibit 18-14.

|

Sales required to generate target profits of: |

|

|

||

|

Fixed costs |

CM ratio |

100 |

150 |

200 |

|

200 |

.40 |

750 |

875 |

1000 |

|

|

.50 |

600 |

700 |

800 |

|

|

.60 |

500 |

582 |

667 |

|

300 |

.40 |

1000 |

1125 |

1250 |

|

|

.50 |

800 |

900 |

1000 |

|

|

.60 |

667 |

750 |

833 |

|

400 |

.40 |

1250 |

1375 |

1500 |

|

|

.50 |

1000 |

1100 |

1200 |

|

|

.60 |

833 |

917 |

1000 |

Managers can input new values for target profits, fixed costs, and CM ratios to see the effect of changing these variables and to gain a clearer perspective by viewing a wide range of cost, volume, and profit patterns. The objective of such analyses is to enhance management's decision-making acumen. The use of spreadsheet programs and financial planning software can contribute to improving profit management, resulting in a high-quality profit management accounting system.

SUMMARY OF LEARNING OBJECTIVES

The major goals of this chapter were to enable you to achieve four learning objectives:

Learning objective 1. Build a profit equation for an enterprise or product line.

The profit equation provides a means of expressing the relationships among variable and fixed costs, sales volume, and their effects on profit. Within a specified relevant range, a linear equation is usually created. It is assumed that sales price and variable costs are constant per unit, fixed costs are constant in total, beginning and ending inventory levels do not change, and sales mix is constant when dealing with multiple products.

The profit equation, especially in its factored form, allows the management accountant to quickly and accurately calculate the profit for any level of sales volume within the relevant range. It also promotes incremental analysis by measuring the change in any variable within the equation, given target values for the other variables. The profit equation and its most useful factored forms are summarized in Exhibit 18-15.

|

(CMU x Volume) - Fixed costs = Profit |

|

|

|

|

Solved for: |

|||

|

|

Target Sales Volume |

|

Target Sales Revenues |

|

Profit goal is a fixed amount: |

|

|

|

|

Pretax profit goal:= |

(Fixed costs + Profit) |

|

(Fixed costs + Profit) |

|

|

CMU |

|

CM ratio |

|

|

|

|

|

|

|

Fixed costs + Aftertax profit /(1 - Tax rate) |

|

Fixed costs + Aftertax profit / (1 - Tax rate) |

|

Aftertax profit goal:= |

CMU |

|

CM ratio |

|

|

|

|

|

|

|

|

|

|

|

Zero-profit goal (break-even): = |

Fixed costs |

|

Fixed costs |

|

|

CMU |

|

CM ratio |

|

|

|

|

|

|

Profit goal is a variable amount: |

|

|

|

|

Pretax profit goal:= |

Fixed costs |

|

Fixed costs |

|

|

CMU - Profit per unit |

|

CM ratio - Profit percentage |

|

|

|

|

|

|

|

Fixed costs |

|

Fixed costs |

|

Aftertax profit goal:= |

CMU - Profit per unit / (1 - Tax rate) |

|

CM ratio - Profit percentage / (1 - Tax rate) |

|

|

|

|

|

|

Incremental analyses:

Target sales revenues = (See also Exhibit 18-3 for CVP rules.) |

|||

Learning objective 2. Use cost-volume-profit (CVP) analysis to analyze different profit-making alternatives.

The break-even point (BEP) is a critical measurement in CVP analysis. It is at this point that total costs equal total sales and the profit is zero. CVP and break-even analysis can be performed by using the equation approach or the contribution margin approach. Regardless of the method used, the results will be the same.

The equation approach is based on the profit equation:

(CMU x Volume) - Fixed costs = Profit

The contribution margin approach is based on the contribution margin, which is sales revenues less variable costs. The contribution margin is most useful when stated as contribution margin per unit (CMU) or as a contribution margin (CM) ratio. The contribution margin approach uses the profit equation in one of its factored forms (see Exhibit 18-15).

The following data apply to Pizza King:

• Unit sales price: $10

• Unit variable cost: $6

• Fixed costs: $2,000/period

To calculate the BEP:

BEP = Fixed costs / CMU = (2000 $/period) / (4 $/pizza) = 500 pizzas/period

A contribution margin-based income statement proves this computation:

|

Sales ($10 x 500) |

$5,000 |

|

<Variable costs ($6 x 500)> |

<3,000> |

|

Contribution margin |

$2,000 |

|

<Fixed costs> |

<2,000> |

|

Profit |

$ -0- |

CMU is the amount that each pizza contributes to covering fixed costs and to profit. If CMU is $4 per unit, each pizza sold will provide $4 to cover fixed costs and contribute to profit. If Pizza King sells 600 pizzas, the first 500 will cover the $2,000 in fixed costs ($4 x 500 pizzas), and the last 100 pizzas will contribute $400 to profit ($4 x 100 pizzas).

The CM ratio is computed as follows:

CM ratio = Sales price $10 = 40%

Using the CM ratio, the break-even revenue (BER) is computed as follows:

BER = $2,000 / .40 = $5,000

If the target profit for Pizza King is $800, then the sales revenue necessary to achieve this target profit is computed as follows:

Revenue goal = ($2,000 + $800) / .40 = $7,000

The sales volume necessary to meet the target profit of $800 is 700 pizzas ($7,000 / $10 sales price per pizza). This can also be computed as follows:

Sales quota = ($2.000 + $800) / $4

= 700 pizzas

Working incrementally, the additional sales volume and revenues needed to generate an additional $800 in profit can be calculated as:

Target sales volume =

Target sales volume =  (Fixed costs + Profit) / CMU

(Fixed costs + Profit) / CMU

= + $800 - $4 per pizza

= +200 pizzas (above BEP)

Target sales revenues =

Target sales revenues =  (Fixed costs + Profit) / CM ratio

(Fixed costs + Profit) / CM ratio

= +$800 / 40%

= +$2,000 (above BER)

The margin of safety is the excess of budgeted sales over break-even sales. As a percentage, the margin of safety is computed as follows:

Margin of safety (%) =

= (Budgeted sales - Break-even sales) / (Budgeted sales)

= (700 pizzas - 500 pizzas) / 700 pizzas = 28% (rounded down)

Managers use the margin of safety to evaluate budgeted operations for the forthcoming period or to determine the degree of risk in launching a new business venture. A high margin of safety serves as a cushion and means low risk. A low margin of safety means high risk.

Learning objective 3. Apply CVP formulas to situations involving sales mixes and income taxes.

Sales mix, also termed product mix, is the relative distribution of sales among multiple products. Assume that Sierra Sid sells two products, A and B.

|

|

Product A |

Product B |

|

Sales price |

$20 |

$15 |

|

Variable costs |

<10> |

<6> |

|

Contribution margin |

$10 |

$ 9 |

The sales mix is 25 percent product A and 75 percent product B. Product C, which is the overall product, is composed of products A and B. Total fixed costs are $7,400. How many units of each must Sierra Sid sell to break even? The following calculations are used to answer this question:

Weighted-average sales price = ($20.00 x .25) + ($15.00 x .75) = $16.25 per product C

Weighted-average variable costs = ($10.00 x .25) + ($6.00 x .75) = $7.00 per product C

Fixed costs

Product C BEP = FC / CMU

= $7,400 / ($16.25 - $7.00)

= 800 units of product C

Product A BEP = 800 units x .25

= 200 units of product A

Product B BEP = 800 units x .75

= 600 units of product B

Proof of the preceding calculations is illustrated in the following contribution margin income statement:

|

Sierra Sid contribution Margin Income Statement |

|

||

|

For Year Ended December 31, 2005 |

|

||

|

|

Product A |

Product B |

Totals |

|

Sales: |

|

|

|

|

200 units x $20 |

$4,000 |

|

$ 4,000 |

|

600 units x $15 |

|

$9,000 |

9,000 |

|

Total sales |

$4,000 |

$9,000 |

$13,000 |

|

Less variable costs:200 units x $10 |

$2,000 |

|

$ 2,000 |

|

600 units x $6 |

|

$3,600 |

3,600 |

|

Total variable costs |

<$2,000> |

<$3,600> |

<$ 5,600> |

|

Contribution margin |

$2,000 |

$5,400 |

$ 7,400 |

|

Less fixed costs |

|

|

< 7,400> |

|

Profit |

|

|

$ -0- |

Assume Sierra Sid sets an after-tax profit goal of $15,000 and anticipates an income tax rate of 20 percent. How many total products (Product C) will have to be sold to obtain this target profit?

Sales quota = [Fixed costs + (Aftertax profit / (1 - Tax rate)] / CMU

[$7,400 + [$15,000 = (1 - 20%)] / $9.25 = 2,828 total products (rounded up)

Learning objective 4. Describe how computer programs can assist in CVP analysis.

Electronic spreadsheets and various financial planning software packages provide an efficient way for management accountants and managers to work directly with the computer, taking advantage of its computational speed and its ability to store massive amounts of data. These software packages provide a simple, natural way of communicating with the computer. Moreover, most of these packages are interactive; they permit the user to sit at the workstation or PC and receive instant feedback. Thus, the user can easily create new CVP models, ask what-if questions, and obtain answers quickly and at a low cost. The results are less drudgery for management accountants and increased quality of decision making in profit management.

IMPORTANT TERMS

Break-even point (BEP) The sales volume at which revenues equal total costs, and there is zero profit.

Contribution margin Sales revenues minus variable costs. It is the amount that contributes toward covering fixed costs and then toward profits.

Contribution margin approach A method of CVP analysis that focuses on the contribution margin, using the profit equation in one of its factored forms.

Contribution margin-based income statement An income statement format in which total variable costs are subtracted from sales revenues, creating the contribution margin subtotal, from which fixed costs are then subtracted to yield net income. It differs from a traditional financial accounting format in that costs are organized by behavior rather than by function.

Contribution margin per unit (CMU) Sales price minus variable costs per unit. It is the incremental money available from selling one more product that is used to cover fixed costs and contribute to profits.

Contribution margin ratio (CM ratio) The contribution margin per unit expressed as a percentage of the selling price.

Cost-volume-profit (CVP) analysis The determination and study of the relation-ships among cost, volume or level of activity, and profit. CVP analysis involves the creation and use of the profit equation.

Equation approach A CVP analysis method that uses the profit equation in its unfactored format: (CMU x Volume) - Fixed costs = Profit.

Margin of safety The sales volume in excess of the break-even point. It is usually expressed as a percentage of the sales forecast and is used as a measure of break-even riskiness.

Profit equation Usually, a linear equation used to summarize CVP relationships. It is: (CMU x Volume) - Fixed costs = Profit.

Sales mix The relative combination in which an organization's products are sold. Sales mix is calculated by expressing the sales of each product as a percentage of total sales.

Sensitivity analysis A type of profit management analysis, usually using software programs, that measures the riskiness of the amounts used in the profit equation. It shows how profit and volume change as other amounts change by certain percentages or absolute amounts.

Variable cost ratio The percentage relationship between variable costs and sales revenues.

DEMONSTRATION PROBLEMS

DEMONSTRATION PROBLEM 1 Break-even calculations.

Quickround manufactures golf carts. The following data pertain to this product:

|

Unit sales price |

$800 |

|

Unit variable costs |

$300 |

|

Total fixed costs |

$100,000 |

|

Required: |

|

a. Compute the BEP and BER using the equation approach.

b. Compute the BEP and BER using the contribution margin approach.

c. The expected (or budgeted) sales for the next period are 300 golf carts. Compute the margin of safety.

SOLUTION TO DEMONSTRATION PROBLEM 1

a.

(CMU x Volume) - Fixed costs = Profit

($500 per cart x Volume) - $100,000 = $0

BEP = 200 golf carts

BER can be calculated by multiplying BEP by the sales price:

BER = 200 golf carts x $800 per cart = $160,000

b. The contribution margin approach simply uses the profit equation in one of its factored forms. To calculate how many units must be sold to break even, total fixed cost is divided by CMU:

BEP = Fixed costs / CMU

= $100,000/ ($800-$300)

$100,000 / $500

= 200 golf carts

BER = Fixed costs / CM ratio

= $100,000 / (($800 - $300) / $800)

$100,000 / .625

= $160,0 00

c. Margin of safety = Sales forecast - BEP / Sales forecast

= (300 carts - 200 carts) / 300 carts = 33.33%

DEMONSTRATION PROBLEM 2 Sales mix.

Landscape Products is a two-product company making square-pointed shovels and yard rakes. The following budget is developed for the next period:

|

|

Shovel |

Rake |

Totals |

|

Sales in units |

18,200 |

7,800 |

26,000 |

|

Sales revenues @ $20 and $14 |

$364,000 |

$109,200 |

$473,200 |

|

<Variable costs> @ $12 and $9 |

<218,400> |

<70,200> |

<288,600> |

|

Contribution margin @ $8 and $5 |

$145,600 |

$ 39,000 |

$184,600 |

|

Fixed costs |

|

|

<106,500> |

|

Net income |

|

|

$ 78,100 |

Note: Total sales in units are made up of 70% shovels and 30% rakes.

Required: Compute the BEP for both products

SOLUTION TO DEMONSTRATION PROBLEM 2.

|

The weighted-average CMU is computed as follows: |

||

|

|

Weighted-average sales price = ($20 x .70) + ($14 x .30) = |

$18.20 |

|

|

Weighted-average variable costs = ($12 x .70) + ($9 x .30) = |

$11.10 |

|

|

Weighted-average CMU = $18.20 - $11.10 = |

$ 7.10 |

BEP = Fixed costs of $106,500 / $7.10

= 15,000 units

BEP (shovels) = 15,000 units x .70 = 10,500 shovels

BEP (rakes) = 15,000 units x .30 = 4,500 rakes

Assuming that the sales mix will not change, Landscape must sell 10,500 shovels and 4,500 rakes next period to break even.

DEMONSTRATION PROBLEM 3 Break-even calculation considering income taxes.

Gladstone Company's projected data are as follows:

|

Sales ($100 x 2,000 units) |

|

$200,000 |

|

Variable costs ($60 x 2,000 units) |

$120,000 |

|

|

Fixed costs |

60,000 |

<180,000> |

|

Net income before taxes |

|

$ 20,000 |

|

Income taxes (40%) |

|

<8,000> |

|

Net income after taxes |

|

$ 12,000 |

Required: How many units will Gladstone have to sell to earn $30,000 in net income after taxes?

SOLUTION TO DEMONSTRATION PROBLEM 3

Unit sales = Fixed costs + [Target profit (1 - Tax rate)] / CMU

= $60,000 + [$30,000 - (1 - .40)] / $40

= 2,750 units

|

Sales ($100 x 2,750 units) |

|

$275,000 |

|

Variable costs ($60 x 2,750 units) |

$165,000 |

|

|

Fixed costs |

60,000 |

<225,000> |

|

Net income before taxes |

|

$ 50,000 |

|

Income taxes (40%) |

|

<20,000> |

|

Net income after taxes |

|

$ 30,000 |

REVIEW QUESTIONS

18.1 List and briefly define the elements involved in cost-volume-profit (CVP) analysis.

18.2 What are the two goals (purposes) of a profit equation?

18.3 Why is the master budgeting process iterative?

18.4 What is the role of CVP analysis in the master budgeting process?

18.5 How can CVP analysis help profit center managers in their operational control role?

18.6 What are the three basic CVP assumptions?

18.7 Which assumptions also apply to cost equations?

18.8 What is the relationship between a cost equation and a profit equation?

18.9 How are sales revenues and sales prices related?

18.10 What is the independent variable in the profit equation? Why is it the same as in the manufacturing cost equation?

18.11 Define contribution margin and contribution margin per unit. How are they related?

18.12 Write out the profit equation used in the equation approach to CVP analysis.

18.13 Define the break-even point.

18.14 Describe and distinguish between the equation approach and the contribution margin approach.

18.15 How can the profit equation be written as a function of revenues?

18.16 What is the format for the contribution margin-based income statement? How does it differ from the traditional format used in financial reporting?

18.17 Why are fixed costs and profit included only in the totals column and not expressed on a per-unit basis?

18.18 What is the purpose of expressing contribution margin on a per-unit and a percentage basis?

18.19 Compare and contrast the variable cost ratio and the contribution margin ratio.

18.20 How is the CM ratio useful in multiple product CVP analysis?

18.21 Interpret how CMU and fixed costs are related in break-even analysis.

18.22 What is a CVP chart?

18.23 How is incremental CVP analysis useful in profit management decisions?

18.24 Using the data in Exhibit 18-1, make up simple numeric examples to illustrate each of the CVP rules for incremental analysis.

18.25 Describe “what-if” analysis.

18.26 Why can a profit goal, stated as an absolute dollar amount, be considered as just another fixed cost of the business?

18.27 How does the profit equation change if the profit goal is stated as a variable amount?

18.28 Define, illustrate, and interpret the margin of safety.

18.29 Define sales mix.