Chapter 13 : Cost Management For Logistics

LEARNING OBJECTIVES

Learning objective 1. Discuss how and EDI or other web-based payment system can support logistics and reduce costs.

Learning objective 2. Define procurement, and explain how procurement costs can be reduced.

Learning objective 3. Describe the transportation activity, and examine how productivity of this activity can be increased.

Learning objective 4. Explain how to manage inventory costs.

Learning objective 5. Describe the warehousing activity, and explore ways to manage warehouse costs.

INTRODUCTION

Just as management accountants, production people, and engineering personnel join forces in developing methods of costing products and services and managing production costs, so must management accountants and logistics personnel work together to manage logistics costs. The potential payoff of effective cost management for logistics is substantial, because logistics costs account for between 20 and 50 percent of total costs in most companies. Often, logistics costs exceed production costs.

Logistics systems consist of the integration of procurement, transportation, inventory management, and warehouse activities to provide the most cost-effective means of meeting internal and external customer requirements. Logistics costs are expenditures incurred for planning, implementing, controlling, and operating all logistics activities.1 This chapter is intended to assist management accountants in improving identification, measurement, and management of logistics costs.

USING ELECTRONIC DATA INTERCHANGE IN THE LOGISTICS SYSTEM

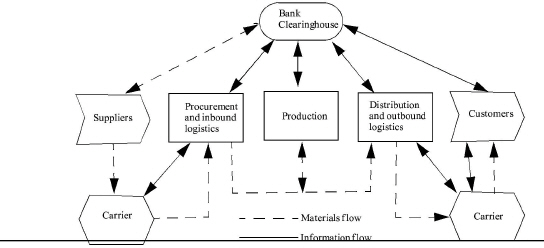

Electronic data interchange (EDI) was described in Chapter 3 as a set of standards and information technology that enable purchase orders, invoices, and payments, to be transferred electronically between participating companies. Many companies and industries are moving toward implementation of EDI technology. Besides interconnecting companies with suppliers, customers, and common carriers, EDI systems are used by commercial banks to handle electronic financial transactions (e.g., paying suppliers and common carriers and collecting from customers).

LEARNING OBJECTIVE 1

Discuss how an electronic data interchange (EDI) system can support logistics and reduce costs.

Improving Performance and Gaining Cost Savings with EDI

A customer order triggers the logistics system. The ability to capture all pertinent data immediately and ensure their timely flow to all users has direct impact on the effectiveness and efficiency of the entire logistics system. Mishandled customer orders and slow or erratic flow of information can lead to lost customers and excessive procurement, transportation, inventory, and warehousing costs, as well as disruptions in the production process. EDI provides the foundation for the logistics system and offers significant potential for improving logistics performance and increasing profits.

Significant cost savings can be realized with a fully integrated EDI system compared to nonelectronic communications. For example, Service Merchandise, Inc., a major catalogue discount retailer, has been able to cut the cost of a single purchase order transaction from $50 to $15 using EDI.2 This cost savings is due to:

• Reduced errors

• Reduced paperwork

• Increased order processing speed, which decreases costs throughout the logistics system

|

INSIGHTS & APPLICATIONS Not Just Bean Counters Any more Management accountants represent how companies convert activities into dollars, and hopefully, profits. Management accountants should, therefore, be walking the shop floor, talking to marketing, advertising, and logistics managers to find out what these departments need and then fulfilling those needs. |

Terry Zinsli, a management accountant and management team player at Coors' Shenandoah Brewery reports on logistics and customer service in addition to other activities throughout the enterprise. Zinsli's advice to management accountants is to look for opportunities. Learn everything about the internal customer in order to be a resource and business adviser.a |

|

aAdapted from Susan Jayson, “Playing on the Management Team,” Management Accounting, March 1993, p. 24. Reprinted from Management Accounting. Copyright by Institute of Management Accountants, Mont-vale, N.J. |

Designing an EDI System

The management accountant at Moparts, Inc., has proposed an EDI system to replace the company's present paper-based logistics systems. A commercial bank will be connected to the EDI technology to serve as a financial clearinghouse. The new EDI system design is illustrated in Exhibit 13-1

|

.

Key Elements of the EDI System

Chapter 3 described the EDI system from the viewpoint of computers and telecommunications. The EDI system also requires other key elements to make it workable for an organization, including the following:

|

INSIGHTS & APPLICATIONS Ford Is Building Tighter through EDI Ford is using electronic data interchange (EDI) to forge tighter links with its suppliers, trim the firm's operating expenses, increase worker productivity, and reduce inventory levels at plants. EDI is helping |

Ford not only reduce its costs but its suppliers are cutting costs as well. “We've really come to rely on the system,” says Ginny Cooper, materials coordinator for Cold Heading Company, a Detroit supplier of fasteners to Ford. “The system gives us instantaneous updated information so we can check how closely our production systems are running with Ford's.” “Basically, this is a win-win situation,” says Joseph Phelan, manager of supplier communications at Ford. “Our livelihoods depend on customer satisfaction, and by making our suppliers more integrated members of the Ford team, we can respond faster to customer needs and, ultimately, provide higher quality products”.a |

|

aJoanne Cummnings, “Another Bright Idea,” Network World, November 25, 1992, pp. 31-37. Copyright November 25, 1992 by Network World, Inc., Framingham, MA 01701. Reprinted from Network World. |

• Bar codes, QR codes, RFID tags, etc.

• Customer order model

• Picking and packing lists

• Portable terminals

• Flash reports

• Inventory control models

Bar Codes. All items in inventories use bar codes for identification and for product movement on computerized conveyor belts. As an item moves along the conveyor belt, it is scanned automatically, identified, and routed to the correct spur of the conveyor where it will be unloaded for production, loaded for shipment, or placed in a warehouse. All pertinent data relating to the item and its movement are also fed into the EDT system for producing various management reports, such as the order activity report in Exhibit 13-2.

|

Data |

DD/MM/YY |

|

Order Activity Report |

|

|

|

||

|

Purchase Order number |

Customer ID number |

Item number |

Date Ordered |

Quantity ordered |

Date shipped |

Quantity Shipped |

Quantity Backordered |

Quantity Canceled |

|

XXXXX |

XXXXX |

XXXXX |

dd/mm/yy |

XXXXX |

dd/mm/yy |

XXXXX |

XXXXX |

XXXXX |

|

XXXXX |

XXXXX |

XXXXX |

dd/mm/yy |

XXXXX |

dd/mm/yy |

XXXXX |

XXXXX |

XXXXX |

|

|

|

|

|

|

|

|

|

|

|

|

|

Control Totals |

|

|

|

|

|

|

|

|

Shipped Quantity Total |

XXXXX |

|

|

|

|

|

|

|

|

Backordered Quantity Total |

XXXXX |

|

|

|

|

|

|

|

|

Canceled Quantity Total |

XXXXX |

|

|

|

|

|

|

CUSTOMER ORDER MODEL. To make an EDI system functional, a number of software modules must be utilized. Structured English or pseudocode is used in designing these software modules. For example, Exhibit 13-3

|

ORDER ENTRY For each customer PURCH_ORDER GET CUSTOMER record IF CUST_NUMBER is valid SET INVOICE_HEADER record ENTER CUST_NAME, CUST_ADDR DATE_ORDER, and PO_NUMBER in INVOICE_RECORD WRITE INVOICE_HEADER record.... ..... |

illustrates a module of the customer order model designed in structured English. Other modules that check credit, process backorders, and so forth are designed in a similar manner. Once the design has been approved, it is automatically programmed in a computer language (e.g., COBOL or C) and integrated into the system using computer-aided software engineering (CASE) tools. All the integrated software modules that drive the customer order model automatically perform procedures necessary to service a customer order and run the EDI system.

AUTOMATICALLY GENERATING PICKING AND PACKING LISTS.

All customer orders automatically generate a picking and packing list, such as the list in Exhibit 13-4. The picking and packing list tells pickers in the warehouse which items have been ordered and must be picked, where they can be picked, and the most efficient sequence in which they should be picked. Bar codes are automatically prepared and attached to the picking and packing list.

Pickers retrieve ordered products, affix the proper shipping bar codes, and send the products down a conveyor belt in trays to a laser scanner. The laser scanner reads the bar codes, determines which order an item belongs to, and tips its tray down the appropriate packing chute.

|

|

|

|

|

MM/DD/YY |

|

|

|

|

|

Shipment Picking and Packing List |

|

|

||

|

Customer Number |

|

|

|

|||

|

Assigned Picker |

|

|

|

|||

|

Loading Dock Assigned |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Picking Sequence |

|

Product number |

Warehouse number |

Aisle number |

Shelf number |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weight |

|

|

|

Packing instructions: |

|

|

|

Carrier |

|

|

|

|||

|

Special Instructions: |

|

|

||||

At the bottom of the chute, packers, who also have a copy of the picking and packing list, assemble orders and pack them in boxes for shipping. Packers affix a second bar code to the outside of each box, and a second laser scanner ensures that each box is routed to the appropriate loading dock for shipment via a specific common carrier or company truck. At this point, the central EDI computer takes over and begins to prepare EDI data, such as bills of lading, shipment notices, and invoices. Also, all pertinent records in the database are updated automatically.

USING PORTABLE TERMINALS. Inventory counting and verification are handled by computer terminals hung from workers' belts. A laser-wand attachment is used to read the product identification bar code of every item in inventory. These data are then transmitted to the central EDI computer for update of the inventory database.

Every salesperson in the field has a laptop computer, which also has access to the EDI system. These laptops are used for electronic mail and paging as well as for facilitating a sale to a customer. The salesperson, sitting in a customer's office, can access a variety of models ranging from engineering specifications and design aids to economic analyses. Upon making a sale, the salesperson immediately transmits the sales data to the system to begin customer order processing.

USING FLASH REPORTS. Flash reports are generated automatically by the EDI system and displayed on terminal screens at strategic points throughout the company. Examples of flash reports include receiving orders, shipping orders, and rejected customer orders. Generally, flash reports require immediate action by some designated worker or manager. For example, warehouse workers receive a flash report notifying them what products will arrive, when, and by which carrier.

INVENTORY CONTROL MODELS. Inventory control models, like the customer order model, must be integrated into the EDI system. Inventory control deals with when to order or produce items and how much to order or produce. The when-to-order-or-produce question is answered by reorder points programmed into the system. The system monitors the depletion of inventory and automatically initiates an order to replenish the inventory when the reorder point is reached or exceeded. The how-much-to-order-or-produce question is usually answered by a mathematical model. These inventory control models, referred to as economic order quantity (EOQ) or economic batch quantity (EBQ) models, are described later in this chapter.

Other methods of controlling inventory are just-in-time (JIT) coupled with a kanban system, as described in Chapter 2. Material requirements planning (MRP) and manufacturing resource planning (MRP II) are software packages that can also be incorporated into EDI systems to aid inventory management, as described in Chapter 3.

MANAGING PROCUREMENT COSTS

LEARNING OBJECTIVE 2

Procurement includes the purchasing function and verification of inbound raw materials or products at the receiving dock. This logistics activity has the following goals:

• Select and evaluate suppliers (covered in Chapter 11)

• Provide an uninterrupted flow of materials and services to operate the enterprise

• Minimize inventory costs

• Acquire materials and services at the lowest cost and at the quality that best meets the company's needs

• Operate the procurement activity at the lowest possible cost

• Ensure that the correct product is received in the correct quantity and with acceptable quality

Managing the Procurement Activity

In addition to careful evaluation and selection of suppliers, the procurement activity itself should be managed properly. The following are selected performance measurements that will help accomplish this:

Purchase orders per buyer per week = # of POs per week / # of buyers

= 400 POs / 20 buyers = 20 POs/buyer/week

Administrative cost per PO = Administrative cost per week / # of POs per week

= $8000 / 400 POs = $20/PO

Service to production = # of complaints from production per week / # of orders released to production per week

= 4 complaints from production / 100 orders released to production

= 4% of orders released to production received complaints

Relationship of Just-in-Time to Procurement

The most effective approach to managing the costs of the procurement activity is to reduce the need for this activity. JIT procurement achieves this goal by developing long-term relationships with a few certified suppliers.

The characteristics of the JIT procurement activity are interrelated. They are grouped in Exhibit 13-5

|

Suppliers: Few and certified Long-term contracts Nearby Minimal paperwork Suppliers extend JIT procurement to their suppliers Quantities: Steady amount Frequent deliveries in small lots Quality: Close relationship among buyers, suppliers, and quality assurance people High reliability Ease of use |

under three general categories: suppliers, quantities, and quality.

WHAT ARE THE BUYER BENEFITS OF JIT PROCUREMENT? Exhibit 13-6

|

Material costs: Reduced inventory carrying costs Reduced transportation costs because of nearby suppliers Reduced prices because of long-term agreements and cost savings Administrative costs: Overall reduction of procurement activities Less paperwork Less labor Less Supervision Less contract negotiation Design costs: Fast response to engineering changes Participation of supplier in design innovations, functional analysis, target costing, and quality specifications Productivity: Reduced scrap and rework Reduced inspection Reduced production delays |

summarizes the benefits of JIT procurement to the buyer. All the benefits result in substantial cost savings for the buying company.

WHAT ARE THE SUPPLIER BENEFITS OF JIT PROCUREMENT? Exhibit 13-7

|

Materials costs: Reduced finished and work-in-process inventory carrying costs Reduced purchased inventories it JIT is used with the company's own suppliers Administrative costs: Increased control of finished goods inventory because outgoing shipments are steady and predictable Less paperwork Less labor Less supervision Reduced long-term risk of doing business Design costs: Participates with buying company's new product development teams Ability to plan ahead for design changes Productivity: Ability to predict resource and capacity needs Assists in the retention of a trained labor force |

summarizes the certified supplier benefits of JIT procurement. The certified supplier or vendor receives a long-term purchase agreement from the buyer. This provides the supplier with the opportunity to reduce nonvalue-added activities, reduce capacity and resources, retain a trained labor force, reduce inventories, and implement JIT procurement systems with its own suppliers.3

MANAGING TRANSPORTATION COSTS

LEARNING OBJECTIVE 3

Transportation involves the movement of products (raw materials, parts, supplies, subassemblies, work-in-process, finished goods) from point-of-origin to point-of-consumption. Transportation creates place utility by delivering the product to where it is needed. Transportation also provides time utility according to how quickly the product is moved; that is, how long the time-in-transit is.4

Transportation can account for 50 percent or more of the cost of basic raw materials, such as iron ore, coal, and cement. Transportation costs for such items as computers or jewelry may be less than 1 percent.

Any one or more of five transportation modes—motor, rail, air, water, or pipeline-may be selected— in addition, modal combinations are available, such as rail—motor (piggybacking), motor—air, and so forth.

Costing the Transportation Activity

Costs for private carriage, such as a fleet of trucks, provide a good example of costing the transportation activity. Transportation costs are normally assigned to one or more of the following cost objects:

• Loads

• Shipments

• Products

ASSIGNING TRANSPORTATION COSTS TO THE LOAD. The cost drivers used are hours, loads, and miles. Exhibit 13-8

|

Exhibit 13-8 Assigning Transportation Costs to the Load |

|

|

Load: Mixed Origin: Memphis Destination: Dallas Loaded Miles: 500 Empty Miles: 500 Load Ratio: 50% Driving Hours: 16 Unloading Hours: 2 Loading Hours: 2 |

|

|

Assignment of costs by hours: |

|

|

Driver wages and fringe benefits ($10 x 20hours) |

$200 |

|

Tractor depreciation ($5 x 20 hours) |

100 |

|

Trailer depreciation ($2 x 20 hours) |

40 |

|

Terminal facilities ($8 x 20 hours) |

160 |

|

Costs by hours |

$500 |

|

Assignment of costs by load: |

|

|

Dispatching ($20 x 1 load) |

$ 20 |

|

Administration ($100 x 1 load) |

100 |

|

Other operating costs ($40 x 1 load) |

40 |

|

Costs by load |

$160 |

|

Assignment of costs by miles: |

|

|

Fuel and oil ($0.30 x 1,000 miles) |

$300 |

|

Tractor maintenance ($0.10 x 1,000 miles) |

100 |

|

Trailer maintenance ($0.02 x 1,000 miles) |

20 |

|

Tires and tubes ($0.08 x 1,000 miles) |

80 |

|

Insurance ($0.04 x 1,000 miles) |

40 |

|

Accidents ($0.02 x 1,000 miles) |

20 |

|

Costs by miles |

$560 |

|

Total transportation costs for the load |

$1,220 |

, shows how these costs are assigned, using one load from Memphis to Dallas as an example. The truck did not carry a load on its return trip to Memphis, its home terminal, so this is referred to as “empty backhaul miles.”

Certain time-related costs are assigned according to hours of use. For example, in Exhibit 13-8 drivers are paid on an hourly basis, so driver wages and fringe benefits are assigned using hours. Depreciation is time-dependent in that depreciation expense is usually computed as a fixed charge per month regardless of business activity. The total hours should be used to assign depreciation and terminal facilities expense.

Certain costs are best assigned on a fixed charge per load. Dispatching costs are often assigned on a per-load basis. To avoid seasonal fluctuations, dispatching costs can be calculated by dividing a 12-month total of this cost element by the total number of loads handled during that period. Administration and other operating costs (e.g., labor for preparing paperwork for each load) are also assigned on a per-load basis.

Certain costs are a function of miles operated. For such costs, both loaded and empty miles are used. The per-mile charge is determined by using averages. For example, the trailer maintenance cost per mile is calculated by determining the cost of maintaining trailers over a 12-month period and dividing by the miles operated.

ASSIGNING LOAD COSTS TO SHIPMENTS. The second stage of costing the transportation activity involves assigning costs to specific shipments. A load may be composed of one or more shipments. For example, one load may contain shipment 1 for customer A, shipment 2 for customer B, and shipment 3 for customer C, or all three shipments may be consigned to customer A. In some instances, one load may represent one shipment. In this case, the total transportation costs for the load are the same as the total transportation costs for the shipment.

The most commonly used basis for assigning load costs to shipments is cwt-miles. Cwt stands for hundredweight. Cwt-miles for each shipment on the load are calculated by multiplying the shipment weight in cwt by the miles travelled. For example, assume that a truck leaves the terminal facilities with three shipments of four different products, weighing a total of 50,000 pounds (500 cwt). The truck makes two intermediate stops before reaching the final delivery point, a distance of 500 miles, and returns empty to the point of origin. Further, assume that it is management's policy to assign empty backhaul miles to the original outbound load5. The total cost of the load, as previously calculated, is $1,220. The assignment of miles, weight, and costs to each shipment is illustrated in Exhibit 13-9.

|

Exhibit 13-9 Assigning Load Costs to Each Shipment |

|

||||

|

Shipment Number |

Miles: Origin to Destination |

Weight (in cwt) per Shipment |

Shipment Cwt-Miles |

Percentage of Total Cwt-Miles |

Assigning Shipment Costs |

|

1 2 3 |

100 300 500 |

100 150 250 |

10,000 45,000 125,000 |

5.6% 25.0% 69.4% |

67.78 305.00 847.22 |

|

Totals |

|

500 |

180,000 |

100.0% |

$1,220.00 |

ASSIGNING LOAD COSTS TO PRODUCTS. Assigning load costs to products is similar to assigning load costs to shipments. In both cases, the costs of transporting the load are assigned on the basis of cwt-miles, as illustrated in Exhibit 13-10

|

Exhibit 13-10 |

||||

|

(a) Distribution of weight and miles by product |

|

|

||

|

Shipment Number |

Product Code |

Product Weight (in cwt) by Shipment |

Miles |

Cwt-Miles |

|

1 |

A |

40 |

100 |

4,000 |

|

|

C |

60 |

100 |

6,000 |

|

2 |

A |

50 |

300 |

15,000 |

|

|

B |

40 |

300 |

12,000 |

|

|

C |

60 |

300 |

18,000 |

|

3 |

A |

80 |

500 |

40,000 |

|

|

B |

60 |

500 |

30,000 |

|

|

C |

40 |

500 |

20,000 |

|

|

D |

70 |

500 |

35,000 |

|

Totals |

|

500 |

|

180,000 |

. The major difference is that the assignment of costs to products requires determining the total cwt-miles by product, calculated in panel (a) of Exhibit 13-10 Once cwt-miles by product are calculated, the load costs are assigned to each product based on the percentage of total cwt-miles, as summarized in panel (b).6

|

(b) Product cost assignment |

|

|

|

|

|

|

Product |

|

Percentage |

Cost |

|

Product |

Weight |

|

of Total |

Assigned to |

|

Code |

(in cwt) |

Cwt-Miles |

Cwt-Miles |

Products |

|

A |

170 |

59,000 |

32.8% |

$ 400.16 |

|

B |

100 |

42,000 |

23.3% |

284.26 |

|

C |

160 |

44,000 |

24.4% |

297.68 |

|

D |

70 |

35,000 |

19.5% |

237.90 |

|

Totals |

500 |

180,000 |

100.0% |

$1,220.00 |

Reporting Transportation Costs

The preceding costing methods can provide cost information by load, by shipment, and by product. Modifications can be made to provide cost information by customer, by sales region, by plant, and so forth. Also, cost-per-mile reports can he prepared, similar to the one presented in Exhibit 13-11

|

Exhibit 13-11 Transportation Cost-per-Mile Report |

||||||||

|

|

|

|

|

Total |

Total Loaded |

|

Total |

Cost |

|

Origin |

Destination |

Loads |

Weight (in Pounds) |

Miles Operated |

Miles Operated |

Load Ratio |

Variable Costs |

per Mile |

|

Memphis |

El Paso |

4 |

200,000 |

8,000 |

6,400 |

80% |

$8,400 |

$1.05 |

|

Cleveland |

Chicago |

5 |

220,000 |

2,000 |

1,000 |

50% |

$2,600 |

$1.30 |

.

Monthly (or weekly) driver cost analysis reports, as illustrated in Exhibit 13-12

|

Exhibit 13-12 Monthly Driver Cost Analysis Report |

||||||

|

|

Total |

Tractor |

Trailer |

Wages and |

Fuel and |

Miles per |

|

Driver |

Miles |

Cost |

Cost |

Benefits |

Oil Costs |

Gallon |

|

Name |

Operated |

per Mile |

per Mile |

per Mile |

per Mile |

of Fuel |

|

Brown |

10,000 |

$0.20 |

$0.05 |

$0.35 |

$0.24 |

5.3. |

|

Jones |

12,000 |

0.21 |

0.06 |

0.33 |

0.60 |

1.9 |

, are also appropriate for transportation cost management. Such reports provide detailed operating cost information by driver and are used by management for driver performance analysis. Although Jones drove 12,000 miles for the month, which is high performance, the cost for fuel and oil, at $0.60 per mile, was exorbitant. The 1.9 miles per gallon of fuel reflect this exorbitant cost. Management should examine such unusual performance costs immediately.

Using Individual Performance Measurements for Reporting Transportation Costs

Transportation activity improvements are vital to the success of the logistics system. Following are sonic of the more popular performance measurements that indicate the effectiveness and efficiency of the transportation activity:

Customer complaints = # of customer complaints per week / # of shipments per week

= (5 customer complaints) / (100 shipments)

= 5 % of the shipments had customer complaints

Damage claims = # of damage claims per week / # of shipments per week

= 2 damage claims / 100 shipments

= 2 % of the shipments had damage claims

Late delivery = # of late deliveries per week / of shipments per week

= 10 late deliveries / 100 shipments

= 10% of the shipments were late

Cost per ton-mile = Total transportation costs per week / (Total miles x Total tons shipped) per week

= $400,000 transportation costs/week / (20,000 miles/week x 500 tons/week)

= $0.04 per ton-mile

Cost of fuel per mile for Truck =

= Total cost of fuel for Truck X per week / Total miles for Truck X

= $650 cost of fuel Truck X / 2,500 miles Truck X

= $0.26 cost of fuel per mile

Miles per gallon of fuel for Truck X =

= Total miles for Truck X per week / Gallons of fuel used by Truck X per week

= 2,500 miles Truck X / 500 gallons Truck X

= 5 miles per gallon

Percentage of loaded miles for Truck X =

= Loaded miles per week / (Loaded miles per week + Empty backhaul miles per week)

= 2,000 loaded miles per week / (2,000 loaded miles per week + 500 empty backhaul miles per week)

= 80% loaded miles

MANAGING INVENTORY COSTS

LEARNING OBJECTIVE 4

Inventory represents the largest single investment in assets for most distributors, retailers, wholesalers, and some manufacturers. Managing inventory costs revolves around two decisions:

• How much to order or produce

• When to order or produce

The availability of the right item at the right time at the right place is necessary for satisfying customers and operating the production process. Too much inventory, however, can reduce profitability and impinge on management's ability to implement an effective and efficient logistics system. Proper inventory management requires an optimum balance between understocking and overstocking. The following are three popular approaches to inventory management:

• Economic Order Quantity (EOQ) model, reorder point, and safety stock approach

• Material Requirements Planning (MRP) approach

• Just-In-Time (JIT) approach

Why Do Enterprises Need Inventories?

As a general statement, the function of inventory is to meet demands of customers and production and to ensure a smooth, efficient operation. Only under the following ideal conditions would inventories not be needed:

• Market and production demand is known with certainty.

• Raw materials are delivered just in time.

• There are zero setup and lead times.

• Interruptions do not occur in transportation or production.

• Quantity discounts on unit costs are not available.

• Procurement costs are insignificant.7

Many companies generally do not experience these conditions. Thus, a large number of enterprises need to carry some level of inventory.

What Are Inventory Costs?

While inventories help balance supply and demand and protect the business from uncertainties, they also incur costs. The following groups of inventory costs should be managed:

PROCUREMENT COSTS. Procurement costs include costs incurred for placing purchase orders with suppliers, receiving inventory, preparing work orders for ordering a production lot, and setting up production systems. When inventory is purchased, costs are incurred for preparing requisitions and purchase orders, receiving and inspecting shipments, placing materials in storage, and processing invoices. When production orders are generated, costs are incurred for paperwork activities, materials handling, and production setups. Of course, with the implementation of certified vendor programs, JIT, and EDI, most of these costs can be eliminated.

INVENTORY CARRYING COSTS. Inventory carrying costs, the costs associated with the quantity of inventory stored, include a number of different cost components and generally represent one of the highest costs of the logistics system. These costs are usually estimated as a percentage of the cost of inventory and can be categorized into the following groups:

Capital costs. Money invested in inventory is usually a major cost component. Carrying inventory ties up money that could be used for other types of investments. Therefore, the company's opportunity cost of capital, which is the rate of return that could be realized from some other investment, should be used to reflect the true capital costs.

Inventory service costs. These costs include ad valorem (personal property) taxes and fire and theft insurance, an expense of carrying inventory. Taxes vary depending on the state in which inventories are held and, in general, directly with inventory levels. Insurance rates are not strictly proportional to inventory levels, since insurance is usually purchased to cover a certain value of product for a specified time period. Insurance rates also depend on the construction of the warehouse; its age, security measures, and fire prevention equipment.

Storage space costs. Storing inventory results in warehousing costs. Also, work-in-process inventory takes up valuable floor space and acts as a bottleneck that interrupts a smooth synchronized manufacturing process.

Inventory risk costs. These costs include the following:

• Obsolescence

• Damage

• Shrinkage

• Relocation of inventory

The cost of obsolescence is the cost of each unit that must be disposed of at a loss because it can no longer be sold at regular price. This cost is the difference between the original cost of the unit and its disposal value. Damaged inventory cost is also the difference between the original cost of the unit and its disposal value. Shrinkage involves theft of inventory. It also results from poor record keeping or shipping wrong products or quantities to customers. Relocation costs are incurred when inventory is shipped from one warehouse location to another to avoid obsolescence.

STOCKOUT COSTS. Stockout costs arise when an inventory item is demanded but is not readily available to the customer or the production process. When finished goods are unavailable to deliver to a customer, sales are lost or backorder costs are incurred. If sales are lost, the stockout costs equal the forgone contribution margin plus a loss in goodwill. If the stockout is backordered, costs are incurred to prepare and process related paperwork and possibly to pay high freight premiums. When materials needed for production are not in stock, costs of interruption, such as machine downtime and idle capacity occur.8

In general, the correct level of inventory is the level that will minimize the total of these three cost categories. Such minimization is difficult to achieve, however, because some of these costs are in direct conflict with one another. For example, high levels of inventory increase carrying costs but decrease stock-out costs. Purchasing raw materials more often will increase procurement costs but decrease carrying costs. The minimization cost problem therefore has two dimensions: how much to order or produce during a production run and how often to order. The how-much-to-order decision involves a trade-off between procurement costs and carrying costs. The when-to-order decision involves a trade-off between carrying costs and stockout costs.

Calculating the Economic Order Quantity for a Merchandising Firm

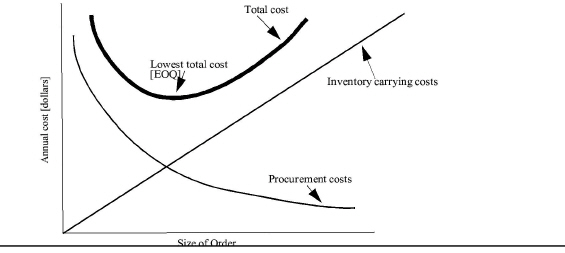

There are many different methods of determining how much inventory merchandising firms (e.g., distributors, wholesalers, and retailers) should order. The best-known model used in this area is the classic economic order quantity (EOQ) model, which reveals how much to procure when a reorder point is reached. The goal of the EOQ model is to minimize the opposing costs of procuring and carrying inventory, as shown graphically in Exhibit 13-13

|

. The EOQ model assumes no stockout costs will be incurred because demand is assumed to be known and constant throughout the year.

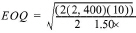

The EOQ model is particularly applicable for independent demand items, which are free from influence of other items. For example, the demand for snow skis does not depend on the demand for refrigerators. Independent demand is fairly stable, once allowances are made for seasonal variation. Generally, independent demand items are carried on a continual basis. The EOQ in units can be calculated using the following formula:

where:

D = Annual demand in units

P = Cost of procuring one order

C = Annual inventory carrying costs (as a percentage of product cost)

V = Average cost or value of one unit of inventory

The EOQ formula states that the economic order quantity varies directly with demand and procurement costs and varies inversely with carrying costs. Due to the square rooting, a quadrupling of demand results only in a doubling of the EOQ.

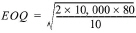

Assume the following data: The annual demand (D) for product X is 2,400 units, and the cost of procuring (P) one order is $10. Further assume that annual carrying costs (C) are 20 percent of product cost, and the average cost or value (V) of one unit of product X is $1.50. These data are substituted in the EOQ formula as follows:

EOQ = 400 units per order, which requires six purchase orders per year to meet annual demand of 2,400 units

If the annual carrying costs per unit are known, the formula becomes:

where C is the annual carrying costs per unit in absolute terms. The EOQ model is based on the following assumptions:

• Only one product is involved, and it is independent of other inventory items

• A constant and known rate of demand

• A constant and known replenishment or lead time

• A stable purchase price that is independent of the order quantity or time

• A stable transportation cost that is independent of the order quantity or time

• A constant unit carrying cost

• No stockouts occur

One, however, rarely finds a situation where both demand and lead time are constant, both are known with certainty, and costs are known precisely. Fortunately, the EOQ model is relatively insensitive to small changes in the input data. Referring to the graph in Exhibit 13-13, one can see that the EOQ curve is relatively flat around the solution point. Although the calculated EOQ was 400 units, an EOQ variation of, say, 100 units might not change the total cost significantly. Knowing this relationship is helpful. For example, if a shipping container holds five pallets, with each pallet containing 100 units, then increasing the order to 500 units would probably be the logical decision.9

Adjusting the Economic Order Quantity for Volume Discounts

By ordering quantities larger than the minimum, sales quantity price discounts and transportation volume rate discounts may be available. To illustrate, refer to the EOQ calculated for product X, which was 400 units. No sales quantity price discount was available. Now assume the availability of the following sales quantity price discounts:

|

Order Size (Units) |

Sales Quantity Discount |

|

|

2,400 |

|

10% |

|

1,200 |

|

8 |

|

800 |

|

6 |

|

600 |

|

4 |

|

480 |

|

2 |

|

400 |

|

2 |

With sales quantity price discounts, the purchase price of inventory is not constant but is affected by the change in prices due to the varying discount percentages. The objective, therefore, is to identify an EOQ that minimizes not only the sum of procurement and carrying costs, but also the purchase price of inventory.

Exhibit 13-14

|

Exhibit 13-14 Cost Trade-offs to Determine the Most Economic Order Quantity with Sales Quantity Price Discounts Included |

||||||

|

|

|

Number of Orders Annually |

|

|||

|

|

1 order |

2 orders |

3 orders |

4 orders |

5 orders |

6 orders |

|

List price per unit |

$1.50 |

$1.50 |

$1.50 |

$1.50 |

$1.50 |

$1.50 |

|

Quantity discount |

10% |

8% |

6% |

4% |

2% |

2% |

|

Discount price per unit |

$1.35 |

$1.38 |

$1.41 |

$1.44 |

$1.47 |

$1.47 |

|

Size of order in units |

2,400 |

1,200 |

800 |

600 |

480 |

400 |

|

Average inventory in units |

1,200 |

600 |

400 |

300 |

240 |

200 |

|

Cost of average inventory |

$1,620.00 |

$828.00 |

$564.00 |

$432.00 |

$352.80 |

$294.00 |

|

Cost of total inventory (a)* |

$3,240.00 |

$3,312.00 |

$3,384.00 |

$3,456.00 |

$3,528.00 |

$3,528.00 |

|

Carrying cost(20% of average) (b) |

324.00 |

165.60 |

112.80 |

86.40 |

70.56 |

58.80 |

|

Cost to order (c) |

10.00 |

20.00 |

30.00 |

40.00 |

50.00 |

60.00 |

|

Total cost per year: (a) + (b) + (c) |

$3,574.00 |

$3,497.60 |

$3,526.80 |

$3,582.40 |

$3,648.56 |

$3,646.80 |

|

*Cost of total inventory = Discount price per unit x Total units ordered annually. |

||||||

shows the effect of sales quantity price discounts. Notice that the order quantity that minimizes total cost (1,200 units per order) differs from the EOQ computed earlier (400 units per order) when no sales quantity price discount was available. The procurement of 400 units per order would require six orders per year. This option is not as attractive as making two orders per year at 1200 units per order. A similar analysis can be made to take advantage of transportation volume rate discounts.

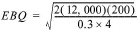

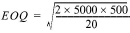

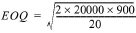

Calculating the Economic Order Quantity for a Manufacturing Firm

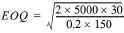

The preceding EOQ formula is equally appropriate for calculating the optimum size of a production order or production run, sometimes called an economic batch quantity (EBQ) or economic production run (EPR). For production, V is the variable manufacturing cost per unit, and P represents an estimate of the setup cost. To illustrate, assume that stock item XYZ-8 is manufactured rather than purchased. The pertinent input data are:

= 12,000 units

= $200 C = 30%

= $4 per unit

The optimum size of a production run is calculated as follows:

=

= 2,000 units per production order, which requires six production runs per year to meet annual demand of 12,000 units

Managing inventory under Uncertainty

Rarely are lead times and demand known with certainty. Consequently, management has the option of either maintaining additional inventory in the form of safety stock or incurring stockout costs. Safety stock is an amount of inventory held in excess of cycle stock (one-half of the HOQ) because of uncertainty in demand and lead time. This situation leads to an additional cost trade-off; that is, inventory carrying costs versus stockout costs. Two methods are used for managing inventory under conditions of uncertainty:

• Fixed quantity, variable period method

• Variable quantity, fixed period method10

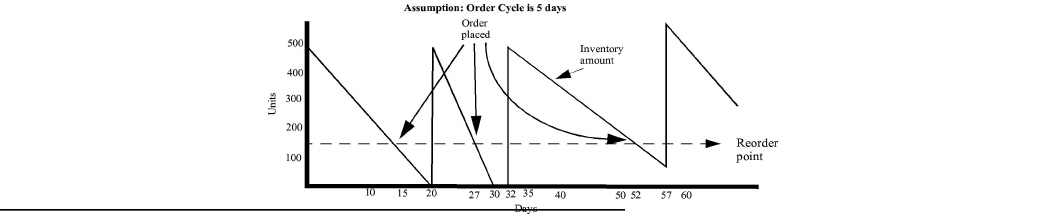

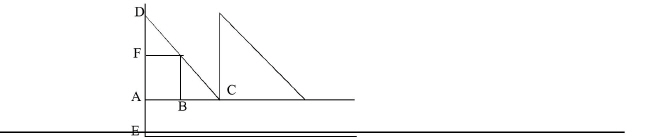

FIXED QUANTITY, VARIABLE PERIOD METHOD. Under the fixed quantity, variable period method, illustrated in Exhibit 13-15

|

|

aSource: James R. Stock and Douglas M. Lambert, Strategic Logistics Management, 2d ed. (Homewood, Ill.: Irwin, 1987), p. 411. With permission. |

, the order size is a fixed quantity that is placed at variable time intervals (the quantity may be determined by the EOQ formula). Inventory is monitored continuously, and when on-hand inventory falls to a reorder point, a fixed quantity is ordered.

The reorder point is a predetermined minimum level required to satisfy demand during the order cycle, which is five days in the example. The order cycle includes all of the time that elapses from the placement of the order until the product is received and ready for sale or usage. Order cycle is also referred to as lead time or replenishment cycle.

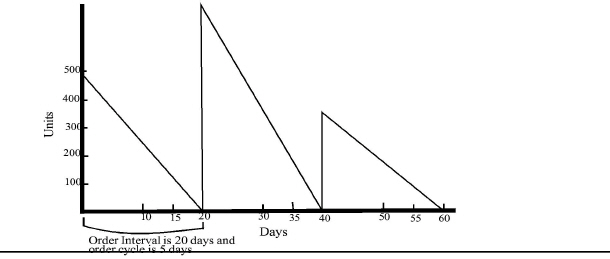

VARIABLE QUANTITY, FIXED PERIOD METHOD. Under the variable quantity, fixed period method, illustrated in Exhibit 13-16

|

|

a.Source: James R. Stock and Douglas M. Lambert, Strategic Logistics Management, 2d ed. (Homewood, Ill.: Irwin, 1987), p. 411. |

, the order size is a variable quantity that is placed at fixed time intervals. Inventory is reviewed periodically, and orders are placed to bring the inventory up to some predetermined level.

While the two methods are mutually exclusive, it is possible to use one method with one group of inventory items and the other method with other groups or classes of inventory items. In general, the fixed quantity, variable period method is well suited for situations where items are ordered infrequently in large quantities compared to usage, such as with low-value items. This method works well when controlled by a computer system that monitors usage and automatically generates an order when the reorder point is reached.

The variable quantity, fixed period method is well suited for situations where groups of items are ordered for replenishment relatively frequently from one source and the inventory items are high-value items that require tight control through periodic physical checks. In this situation, more human intervention is necessary.11

Material Requirements Planning

As described in Chapter 3, material requirements planning (MRP) is a computer-based inventory management system that focuses first on the amount and timing of finished products demanded and then computes the demand for raw materials, parts, and subassemblies at each preceding stage of production and from the vendor. Once management makes a forecast of demand for the final product, the quantities required for all components that make up that finished product can be computed based on dependent demand. All these components are dependent on the finished product. For example, an automaker's demand for four tires and a transmission depends on the production of autos. Conversely, the demand for a car is independent in the sense that a car is not a component of another product. Whereas the EOQ model focuses on inventory management under conditions of independent demand, MRP focuses on inventory management under conditions of dependent demand.

Dependent Demand And Time-phased Procurement. The essential concepts of MRP are dependent demand and time-phased procurement (a planned amount to be ordered in each time period). Dependent demand is based on the master production schedule, which initiates and drives procurement and manufacturing activities. Once the raw materials, parts, and subassemblies necessary to support a specific production schedule are identified, MRP provides a time-phased logic to manage their timely arrival (rather than using the reorder point described earlier in the discussion of the EOQ model).

The logic behind dependent demand is that safety stocks are not needed to support a time-phased procurement program such as MRP. The basic notion of time phasing is that raw materials, parts, and subassemblies need not be carried in inventory as long as they are available when needed. Since this assumption is not always realistic, some MRP systems do allow for small safety stocks.

To gain some level of safety stocks, a common practice is to build safety time into the material requirements plan. For example, a part may be ordered a week earlier than necessary to ensure timely arrival. Another popular approach is to increase the quantity of components by some arbitrary percentage (e.g., 5 percent) to serve as a safety stock, or cushion.

Objectives Of MRP. MRP has two primary objectives:

• Eliminate or minimize safety stocks

• Deliver raw materials, parts, and subassemblies at exactly the right time, place, and quantity needed (i.e., the JIT concept)

Because of these objectives, some companies have combined MRP with JIT.

When To Employ MRP. MRP systems are normally employed when one or more of the following conditions exist:

• Demand-dependent components need to be stocked only just prior to the time they will be needed in the production process.

• Large quantities of inventories are demanded at specific points in time with little or no usage at other times, such as in a job order operation as opposed to a continuous processing or mass-production operation.

• All needed components can be delivered on a timely basis.

• Effective employment of the MRP system requires knowledge of the following:

• What to produce, how much, and when, as spelled out in the master production schedule

• Quantity and type of raw materials, parts, and subassemblies needed to make the finished product, as specified in the bill of materials (BOM)

• The amount of inventory in stock, as recorded in the inventory records file

• What items are on order, as listed in purchase orders outstanding

• How long it takes to get various components, as indicated by lead times compiled in the inventory records file

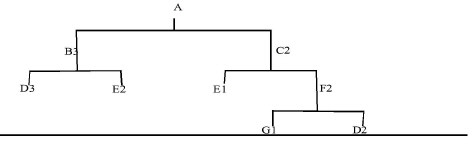

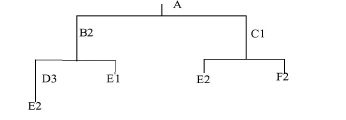

An MRP Example. A simplified version of a master production schedule is shown in Exhibit 13-17

|

Exhibit 13-17 Master Production Schedule for Product A |

||||||||

|

|

Week (number) |

|||||||

|

Product A |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

Quantity |

|

|

|

|

|

|

|

100 |

. It shows planned output for finished product A. The schedule indicates that 100 units of product A will be needed for shipment to customers at the start of week 8. The master production schedule is based on what is needed, not what is possible.

The bill of materials (BOM) contains a listing of all the raw materials, parts, and subassemblies that are needed to produce one unit of product A, as illustrated in Exhibit 13-18

|

. The quantity of each component that goes into the production of product A is included in parentheses. It can be readily seen that product A is composed of three B's and two C's. In addition, each B consists of three D's and two E's. Similarly, each C requires one E and two F's. Each F is made up of one G and two D's.

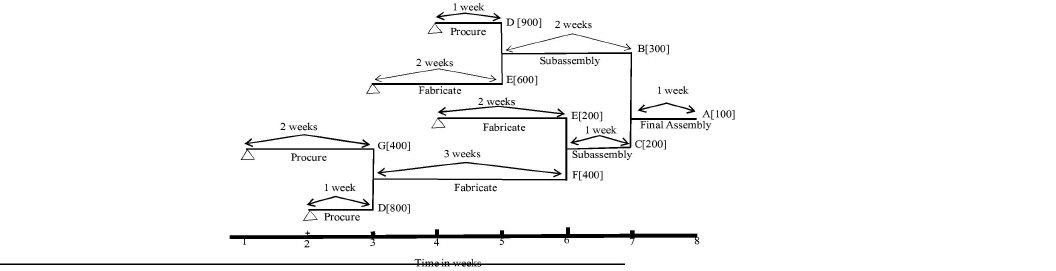

When the items are needed must be determined next. This task requires knowing the lead times, which, in turn, indicate when procuring or making the items must begin to meet the production of product A eight weeks from now. When the bill of materials is turned on its side and lead times are included, as illustrated in Exhibit 13-19

|

, a time-phased product structure is created.

The time-phased requirements can be readily seen in the exhibit. For example, raw material G must be ordered at the start of week 1, D at the start of week 2 and week 4. Fabrication of E and F must begin at the start of week 3, and so forth.

The quantities that were previously generated from the BOM are for gross requirements. They did not take into account any inventory that is currently on hand or due to be received. The quantities of raw materials, parts, and subassemblies that must be acquired to meet the demand generated by the master production schedule are the net requirements. Net requirements are calculated by subtracting from gross requirements, the sum of inventory on hand and any scheduled receipts, and then adding in safety stock, if applicable, as shown by the following formula:

Net requirements = Gross requirements- (On hand + Scheduled receipts + Safety stock)

In the preceding example, only item G has 100 units on hand. None of the other items are on hand or on order. The net requirements for G are:

Net requirements = 400 - (100 + 0 + 0 ) = 300 units of G

As discussed in Chapter 2, the objective of JIT, a demand-pull approach, is to reduce all inventories (raw materials, work-in-process, and finished goods) to zero or insignificant levels. JIT proponents regard inventory as a liability rather than an asset; they consider inventory a means of covering up problems. They further believe that the amount of inventory is a measure of how the organization is managed; that is, the higher the inventory amounts, the worse management's performance.

HOW JIT WORKS. If a company has eliminated its nonvalue-added activities and is practicing synchronized manufacturing, it can fill an order from a customer almost immediately even though there are zero inventories. The kanban at the end of the process pulls upstream activities into action, all the way back to the supplier. Because delivery from the vendor is just-in-time and the activities, such as setup, are near zero, the company becomes a high-velocity, synchronized manufacturer (a manufacturer with very short lead times) that can meet customer demands easily. High velocity is achieved by reducing setup costs, quality costs; procurement costs, and carrying costs to very low levels.

JIT AND ITS KANBAN SYSTEM. The kanban system, described in Chapter 2, is the heart of the JIT inventory management system. The kanban system PULLS the raw materials from the vendor through production and to the customer.

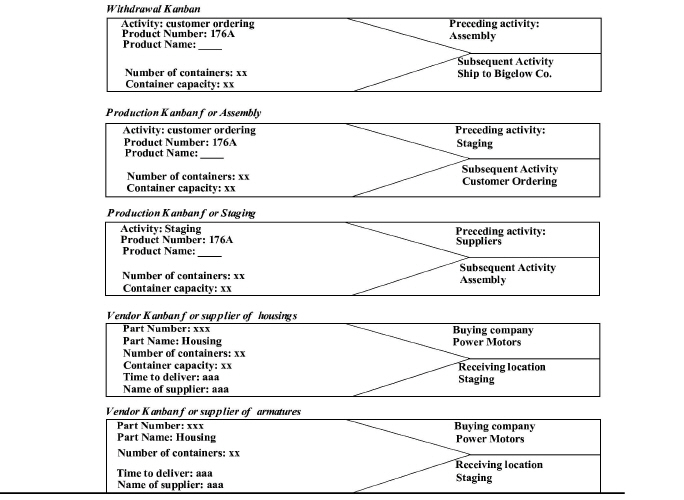

A kanban system uses cards that are normally inserted in a plastic envelope that is attached to a container holding the needed inventory. The kanban card is the authorization to work on or move parts. Withdrawals and replenishments occur all the way up and down the line from finished goods to vendors. The kanban system uses three cards:

• Withdrawal kanban

• Production kanban

• Vendor kanban

A withdrawal kanban specifies the quantity that a subsequent activity should withdraw from the preceding activity. A production kanban states the quantity that the preceding activity should produce. A vendor kanban specifies how many raw materials the supplier should deliver. Also stated on the vendor kanban card are the time and place of delivery.

|

INSIGHTS & APPLICATIONS JIT versus Traditional Manufacturing Time is a strategic resource. Fast-response manufacturing has therefore become an important competitive tool. With JIT manufacturing, most suppliers are clustered around automakers' assembly plants, making timely delivery cheaper and more reliable. |

Some traditional U.S. assembly plants and suppliers are scattered around the country. Some parts take weeks to be shipped, which increases both the amount of inventory in transit and the supplies needed to guard against interrupted production. Some authorities estimate that with the traditional way of ordering and delivering inventory, at anytime more than half of the company's inventory is on trucks and trains. |

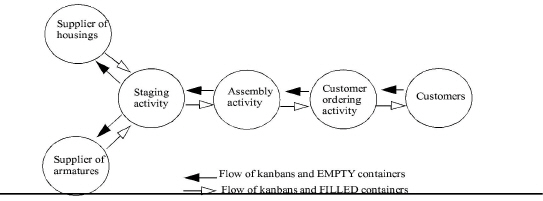

A JIT EXAMPLE. Exhibit 13-20

|

presents examples of the three types of kanbans for Power Motors. Exhibit 13-21

|

shows the flow and linkage through-out the kanban system at Power Motors. Because JIT is a demand-pull system, the only thing that will start the production process is a customer order. The Bigelow Company sends an order for ten electric motors to the customer ordering activity of Power Motors. When the order is received, customer ordering prepares a withdrawal kanban and keeps it there for reference and control. Customer ordering also prepares a production kanban and attaches it to two empty containers that are transported to the assembly activity. This kanban signals the assembly activity to begin production. To do so, a production kanban must be prepared for the staging activity. This production kanban is attached to the two empty containers and moved to staging. Next, the staging activity prepares two vendor kanbans for delivery of ten housings and ten armatures that will be staged and assembled to make the ten electric motors ordered by Bigelow. When the parts are delivered to staging at 8:00 A.M., this first activity begins. When the first container is completed with five electric motors, the production kanban is attached to it, and it is moved to the assembly activity. When the assembly activity is completed, the container and the attached production kanban are moved to the ordering activity where the electric motors are made ready for shipment to Bigelow as soon as the second container arrives with the other five motors.

The use of kanbans ensures that a subsequent activity withdraws (or pulls) the product from the preceding activity in the required quantity at the necessary time. The kanban system, including the kanban containers and cards, controls the preceding activity by permitting it to produce only the quantities withdrawn by the subsequent activity. This way, inventories are kept at a minimum and the parts arrive just-in-time to be used.

A simple kanban system can be found in any restaurant. The customer places an order with a waiter who, in turn, gives the order to the kitchen. The meal is prepared and transferred to the waiter who checks it and gives it to the customer who ordered it. The only difference between this system and Power Motors' kanban system is that the waiter does not transfer a container to the kitchen. Also, suppliers for the restaurant usually deliver daily rather than at several intervals during the day.

It should be pointed out that although the goals of JIT are laudable, not all enterprises can fully implement these goals. For example, a cabinet manufacturer in Missouri cannot achieve JIT delivery from a lumber supplier located in Oregon. More than likely, the deliveries will be weekly or monthly with the size of the truckload being the most economical size to order at one time.

On the other hand, JIT is the only way some companies can operate. For example, a fish market, because of the perishability of its product, must operate according to JIT principles.

Measuring Inventory Management Effectiveness and Efficiency

No matter which inventory management approach is used (i.e., EOQ, reorder point, and safety stock; MRP; or JIT), almost every enterprise, at one time or another, is faced with the problems of surplus, short, incorrect, and obsolete inventory and inadequate attention to high-value items. Whatever the reasons for such conditions, the management accountant must provide information that will help management take corrective action to manage inventory more effectively and efficiently. Two methods can be used to provide such information:

• Contribution-by-value analysis

• Turnover ratios

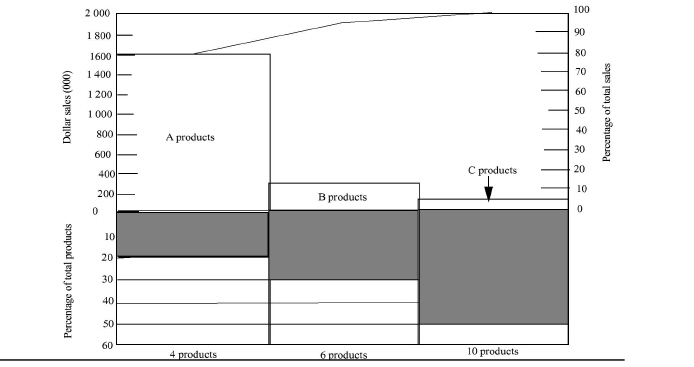

USING THE CONTRIBUTION-BY-VALUE ANALYSIS METHOD. One of the simplest and most effective ways to manage inventories efficiently is the contribution-by-value analysis method (also called the ABC analysis method), which is based on Pareto's principle, as presented in Chapter 12. This law states that in most situations a relatively small percentage of certain objects contributes a relatively high percentage of output.

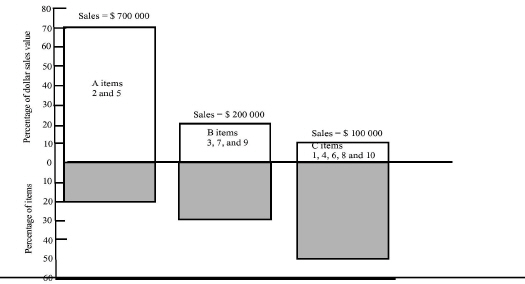

For example, review the contribution-by-value analysis report in Exhibit 13-22

|

Exhibit 13-22 Contribution-by-Value Analysis Report Showing the Relative Contributions of Products A, B, and C |

||||||

|

Product item |

Product Count |

Cumulative Percentage of Total Product Items |

Annual Dollar Sales |

Cumulative Dollar Sales |

Cumulative Percentage of Total Contribution |

Product Classification |

|

A600 |

1 |

5.0% |

$600,000 |

$ 600,000 |

30.0% |

A |

|

Z412C |

2 |

10.0 |

400,000 |

1,000,000 |

50.0 |

A |

|

B784 |

3 |

150 |

300,000 |

1,300,000 |

65.0 |

A |

|

Q445 |

4 |

20.0 |

300,000 |

1,600,000 |

80.0 |

A |

|

B797 |

5 |

25.0 |

90,000 |

1,690,000 |

84.5 |

B |

|

C984Q |

6 |

30.0 |

60,000 |

1,750,000 |

87.5 |

B |

|

C776A |

7 |

35.0 |

50,000 |

1,800,000 |

90.0 |

B |

|

A4440 |

8 |

40.0 |

40,000 |

1,840,000 |

92.0 |

B |

|

M121 |

9 |

45.0 |

30,000 |

1,870,000 |

93.5 |

B |

|

M14R |

10 |

50.0 |

30,000 |

1,900,000 |

95.0 |

B |

|

D122 |

11 |

55.0 |

15,000 |

1,915,000 |

95.8 |

C |

|

D127C |

12 |

60.0 |

14,000 |

1,929,000 |

96.5 |

C |

|

E951 |

13 |

65.0 |

12,000 |

1,941,000 |

97.1 |

C |

|

E962 |

14 |

70.0 |

12,000 |

1,953,000 |

97.7 |

C |

|

R4805 |

15 |

75.0 |

11,000 |

1,964,000 |

98.2 |

C |

|

RS77 |

16 |

80.0 |

10,000 |

1,974,000 |

98.7 |

C |

|

RS201 |

17 |

85.0 |

9,000 |

1,983,000 |

99.2 |

C |

|

T12R |

18 |

90.0 |

8,000 |

1,991,000 |

99.6 |

C |

|

T17C |

19 |

95.0 |

7,000 |

1,998,000 |

99.9 |

C |

|

S776 |

20 |

100.0 |

2,000 |

2,000,000 |

100.0 |

C |

. This report reveals that A items account for 20 percent of the products in inventory but contribute 80 percent of sales. The B items account for 30 percent of the products and add an additional 15 percent of sales. The C items account for 50 percent of the products but add only 5 percent of sales. The Pareto chart in Exhibit 13-23

|

presents a visual interpretation of the information in the contribution-by-value analysis report.

For the A items, management should provide sufficient safety stocks and high levels of service. B items should receive less attention and probably lower or zero safety stocks. As for the C items, management may actually consider eliminating some of the products from inventory because their contribution to sales revenue is minimal.

USING TURNOVER RATIOS. Ratios are one of the most common methods for measuring inventory management effectiveness and efficiency. The following are typical turnover ratios:

Raw materials = Cost of raw materials used / Average raw materials inventory

Work-in-process = Cost of goods manufactured / Average work-in-process inventory

Finished goods = Cost of goods sold / Average finished goods inventory

The data for these turnover ratios are derived from financial accounting data. Thus, they are influenced by the financial accounting procedures used for measuring periodic income. For example, a writedown of inventory will usually be charged against cost of goods sold so that the writedown, which may be an indicator of inventory inefficiency, will actually increase inventory turnover. Also, the various inventory costing procedures (e.g., FIFO, LIFO) make interpretation of inventory turnovers very complex. For example, how does one interpret the turnover ratio of the current cost of goods sold to the average inventory costed by the LIFO inventory costing procedure when LIFO inventory may be costed at prices that occurred many years ago? Moreover, there is a problem of aggregating data. For instance, a moderately rapid turnover ratio for the inventory may obscure the fact that half of the inventory is turning very slowly and the other half very rapidly.12

Calculating turnover ratios on a unit basis helps minimize the preceding problems and makes the ratios more meaningful. For an individual product, the inventory turnover is the ratio of the number of units sold or issued to the average number of units on hand, such as:

Product X Turnover Ratio =

= # of units of product X sold during the month / Average # of units of product X on hand during the month

Assume 1,200 units of product X were sold during March. At the beginning of March, 500 units were on hand, and at the end of March, 300 units were on hand, giving an average number of units on hand during March of 400 [(500 + 300) = 2]. Thus, the turnover ratio of product X is 3, calculated as follows:

Product X Turnover Ratio = 1,200 units of product X / 400 average units on hand

= 3 turns during March

Turnover ratios should be used only as indicators. Using them as a sole measure of inventory management effectiveness and efficiency can backfire. For example, the traditional assumption is that the higher the turnover, the better. A better goal may be to carry zero inventory. In a JIT environment, this is the goal. In other environments that depend on some amount of inventory on hand, a zero-inventory policy would cause problems, such as stockouts and excessive procurement costs. Any meaningful application of turnover ratios must, therefore, implicitly assume that high turnovers are only desirable to the extent that they are compatible with effective and efficient operations. Inventory turnovers are worth improving only if there is no substantial increase in procurement costs or significant loss of sales resulting from excessive stockouts. Turnover ratios are only useful if they can be related in some way to inventory management costs and the optimum decisions of how much and when to order.13

MANAGING WAREHOUSING COSTS

LEARNING OBJECTIVE 5

Warehousing is the link between the producer and the customer. It is the activity in the logistics system that stores products (raw materials, parts, supplies, subassemblies, work-in-process, finished goods) at and between the point-of-origin and point-of-consumption.

What Are the Reasons for Warehousing?

In general, the warehousing of inventories is necessary for the following reasons:

• To achieve transportation economies

• To achieve production economics

• To maintain a source of supply

• To meet changing market conditions (e.g., seasonality and demand fluctuations)

• To achieve a desired level of customer service14

Costing and Budgeting Warehousing Activities

Warehousing is a major activity in many logistics systems. The warehousing activity itself consists of specific activities, such as receiving; storing; order picking, packing, and staging; and shipping.

A management accounting system should produce a variety of performance measurements to help managers examine warehousing productivity. For instance, financial performance measurements include the following:

Receiving and storage cost per unit =

= Total receiving and storage costs per week / Avg # of units stored per week

= $2,400 receiving and storage costs / 8,000 units stored

= 0.30 $/unit

Picking costs per unit =

= Total picking costs per week / Number of units picked per week

= $1,200 picking costs / 6,000 units picked

= 0.20 $/unit

Packing costs per unit

= Total packing costs per week / Number of units packed per week

= $6,000 packing costs / 6,000 units packed

= 1.00 $/unit

Staging costs per shipment

= Total staging costs per week / Number of shipments staged per week

= $80,000 staging costs / 4,000 shipments staged

= 20.00 $/shipment

Loading costs per shipment =

= Total loading costs per week / Number of loads per week

= $200,000 loading costs / 2,000 loads

= 100 $/load

Demurrage costs (i.e., the costs for detaining a transportation vehicle) are also important. Increasing demurrage costs indicate poor dock scheduling for inbound and outbound shipments. Performance measurements for inbound and outbound shipments can be calculated in the following manner:

Inbound demurrage costs per load =

= Total inbound demurrage costs per week / # of loads rec’d in the week

= $20,000 inbound demurrage costs / 100 inbound loads

= 200 $/inbound load

Outbound demurrage costs per load =

= Total outbound demurrage costs per week / # of loads shipped in the week

= $30,000 outbound demurrage costs / 200 outbound loads

= 150 $/outbound load

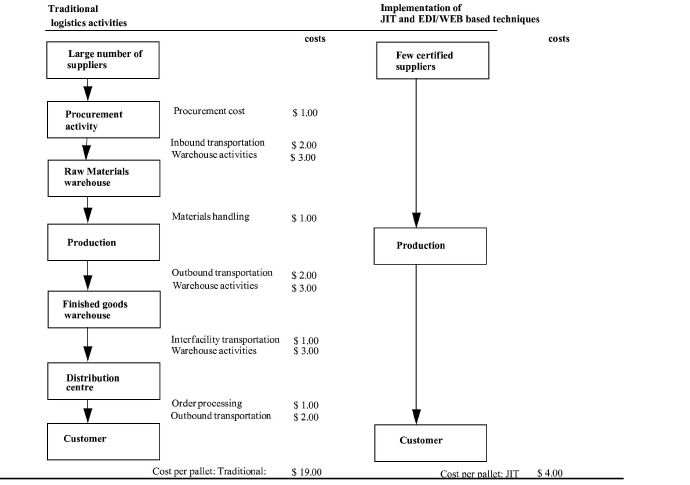

Can the Procurement and Warehouse Activities Be Eliminated?

Clearly, procurement and warehouse activities add costs incrementally to products. By applying JIT and EDI techniques, these activities can be reduced or eliminated, as illustrated in Exhibit 13-24.

|

By using JIT and EDI techniques, the procurement activity can be eliminated, along with the $1.00 per pallet cost. Direct delivery of raw materials to production eliminates the warehouse activities cost of $3.00 per pallet and the materials handling cost of $1.00 per pallet. Similarly, transportation to the finished goods warehouse, finished goods warehouse activities, interfacility transportation, distribution center warehouse activities, and order processing activities, which incur a combined cost of $10.00 per pallet, can be eliminated with JIT and EDI. In fact, JIT and EDI techniques help reduce overall costs by $15.00 per pallet ($19.00 - $4.00).

Not all companies can take full advantage of JIT and EDI techniques, however, especially those that experience marked seasonality in production or sales patterns. In fact, some companies such as food processors must stockpile raw materials and run production full-time during a two- or three-month period immediately after the crop is harvested. After the products are packed, food processing companies must store the products in warehouses throughout the year until they are sold.

Similarly, the seasonal requirements for toys and clothing usually cannot he supplied by current production capacity. Therefore, many companies use warehousing to store products in advance of heavy selling seasons in order to facilitate smooth production throughout the year.

SUMMARY OF LEARNING OBJECTIVES

The major goals of this chapter were to enable you to achieve five learning objectives:

Learning objective 1. Discuss how an electronic data interchange (EDI) system can support logistics and reduce costs.

An EDI system embedded in the integrated computer-based information system (ICBIS) acts as a nerve center for the logistics system. Information from the ICBIS helps to coordinate all the logistics activities. Implementing EDI into the ICBIS provides the potential to increase logistics productivity and thereby reduce total costs.

A high-quality, last information flow facilitates the integration of all logistics activities. Conversely, a poor flow of information, which can allow lost orders, bottlenecks, and errors to go undetected, can create confusion and inefficiencies within the logistics system.

The cost associated with achieving a rapid flow of error-free information is more than offset by cost savings realized throughout the logistics system. For example, assume that servicing a customer requires four days for order transmittal and processing, two days for warehouse processing, and one day for air freight transportation. An investment in an EDT system could reduce transmittal and processing time to one day. With the five extra days gained from this efficiency, the company can choose a less expensive transportation mode or improve customer service, thus differentiating itself from its competitors.

Learning objective 2. Define procurement, and explain how procurement costs can be reduced.

Procurement costs are incurred to get the right product to the right place at the right price and at the right time. Because procurement costs represent a substantial cost of doing business, this activity's performance should be measured. Implementing JIT techniques can help reduce procurement costs. Traditionally, the buying company has assumed the role of monitoring the quality of purchased materials, inspecting and counting materials for quality and quantity, and returning poor-quality materials to the supplier for rework and adjustments. The ultimate goal of the buying company is to be able to certify suppliers as sources of high-quality materials and thus eliminate all the preceding nonvalue-added activities associated with procurement.

Learning objective 3. Describe the transportation activity, and examine how productivity of this activity can be increased.

Transportation, together with warehousing, adds time and place utility to products. The five basic modes of transportation-motor, rail, air, water, and pipeline-provide movement of products between where they are produced and where they are consumed. Each mode has different cost and service characteristics.

Typically, transportation costs are assigned to loads, shipments, and products for costing purposes. Also, a variety of performance reports and measurements help management increase transportation productivity.

Learning objective 4. Explain how to manage inventory costs.

The objective of managing inventory costs is to maintain the lowest possible inventory consistent with customer service and production goals. This objective revolves around two decisions:

• How much to order or produce

• When to order or produce

Three inventory management approaches help deal with these decisions:

• EOQ, reorder point, and safety stock

• MRP

• JIT

Inventory costs include:

• Procurement (or setup) costs

• Carrying costs

• Stockout costs

The EOQ model minimizes the total of carrying costs and procurement (or setup) costs. Managing inventory under uncertainty entails minimizing the trade-off between carrying costs and stockout costs. Two methods are used to do this:

• Fixed quantity, variable period method

• Variable quantity, fixed period method

The MRP and JIT approaches to inventory management seek to overcome assumptions regarding stable usage and independent demand that are required for EOQ calculations. Whereas EOQ calculations result in a uniform order quantity that may be ordered in a fixed or variable time interval, the order sizes generated by MRP and JIT are more flexible to accommodate irregular usage.

MRP and JIT approaches are used primarily by manufacturers that make products that are dependent on other components. For example, the production of a leaf blower requires a motor and various parts that must be procured or made. All of this inventory that is, the leaf blower (the finished product) and its various components (raw materials, parts, and subassemblies)—is not made or ordered until needed. Thus, the MRP and JIT approaches are based on demand-pull and just-in-time concepts that minimize or eliminate all inventories.

For MRP and JIT to work, all activities of the logistics system must be fully integrated and efficient. A weak link in the logistics chain can spell disaster for either inventory management approach. For example, transportation becomes an even more critical activity under MRP and JIT. Although warehousing is reduced under MRP and JIT, a relatively small facility may be needed to consolidate and stage raw materials for input to production and output finished goods for shipping to external customers.

Two key methods are used to measure inventory management effectiveness and efficiency:

• Contribution-by-value analysis method

• Turnover ratios

Learning objective 5. Describe the warehousing activity, and explore ways to manage warehouse costs.

The purpose of warehousing is to provide place and time utility for inventory management. The relative importance of warehousing, however, varies among companies.

A number of performance measurements should be prepared to help manage specific warehousing activities effectively and efficiently. In companies where JIT and EDI techniques are implemented, procurement and warehousing activities can be reduced, if not eliminated, thus reducing a substantial amount of logistics costs while increasing the effectiveness and efficiency of the logistics system.

IMPORTANT TERMS

Contribution-by-value analysis method (ABC analysis method) A method based on Pareto's principle, which states that a relatively small percentage of certain objects contributes a relatively high percentage of output.

Cycle stock An amount of inventory equal to half the economic order quantity.

Dependent demand A situation where the demand for raw materials, parts, and subassemblies is derived from plans to make certain finished products.

Economic order quantity (EOQ) model A formula for minimizing inventory carrying and procurement costs. The EOQ model can also be used to calculate the optimum size of a production order.

independent demand A situation where inventory items are not connected or related to each other.

Inventory carrying costs Expenditures incurred for holding inventory.

Logistics costs Expenditures incurred for planning, implementing, controlling, and operating all logistics activities.

Logistics systems Represent the integration of procurement, transportation, inventory management, and warehouse activities to provide the most cost-effective means of meeting internal and external customer requirements.

Order cycle (lead time or replenishment cycle) Includes all the elapsed time from placement of an order until the product is received and ready for sale or usage.

Procurement A logistics activity that includes purchasing and receiving verification of inbound raw materials or products.

Procurement costs Expenditures incurred either for placing purchase orders with suppliers and receiving inventory or for preparing work orders for ordering a production lot and setting up for production.

Production kanban States the quantity that the preceding activity should produce.

Reorder point A predetermined minimum level required to satisfy demand during the order cycle.

Safety Stock An amount held to protect against demand and order cycle (lead time) variabilities.

Stockout costs Expenditures incurred for not having inventory available when needed.

Time-phased procurement A planned amount of raw materials, parts, and subassemblies to be ordered or fabricated in each time period.

Transportation A logistics activity that involves movement of materials and products from origin to destination.

Vendor kanban Specifies how many raw materials the supplier should deliver.